DXY is hanging in there.

AUD is not.

As lead boots turn to concrete shoes.

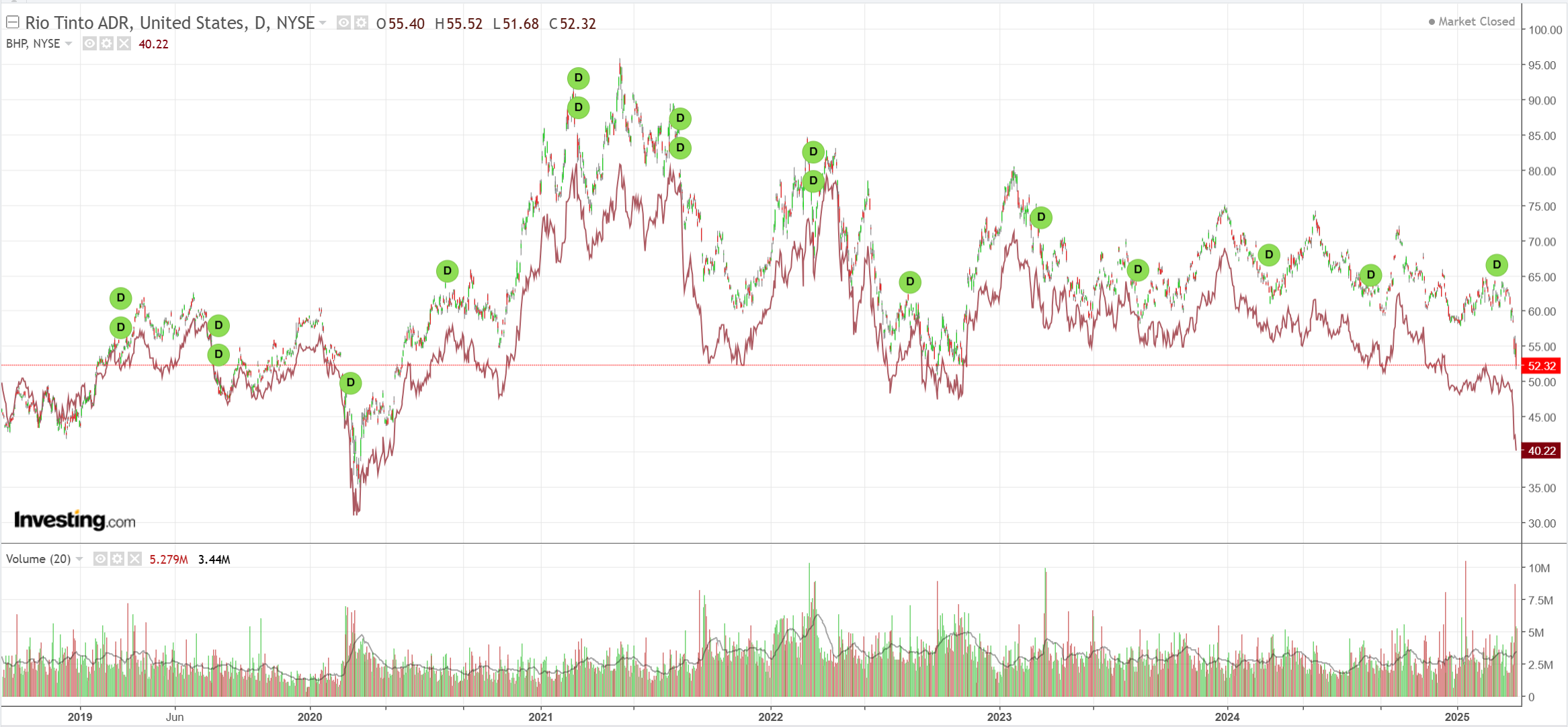

Commodities are the screaming meteor of death.

Landing on big miners.

EM lol.

The junk skunk!

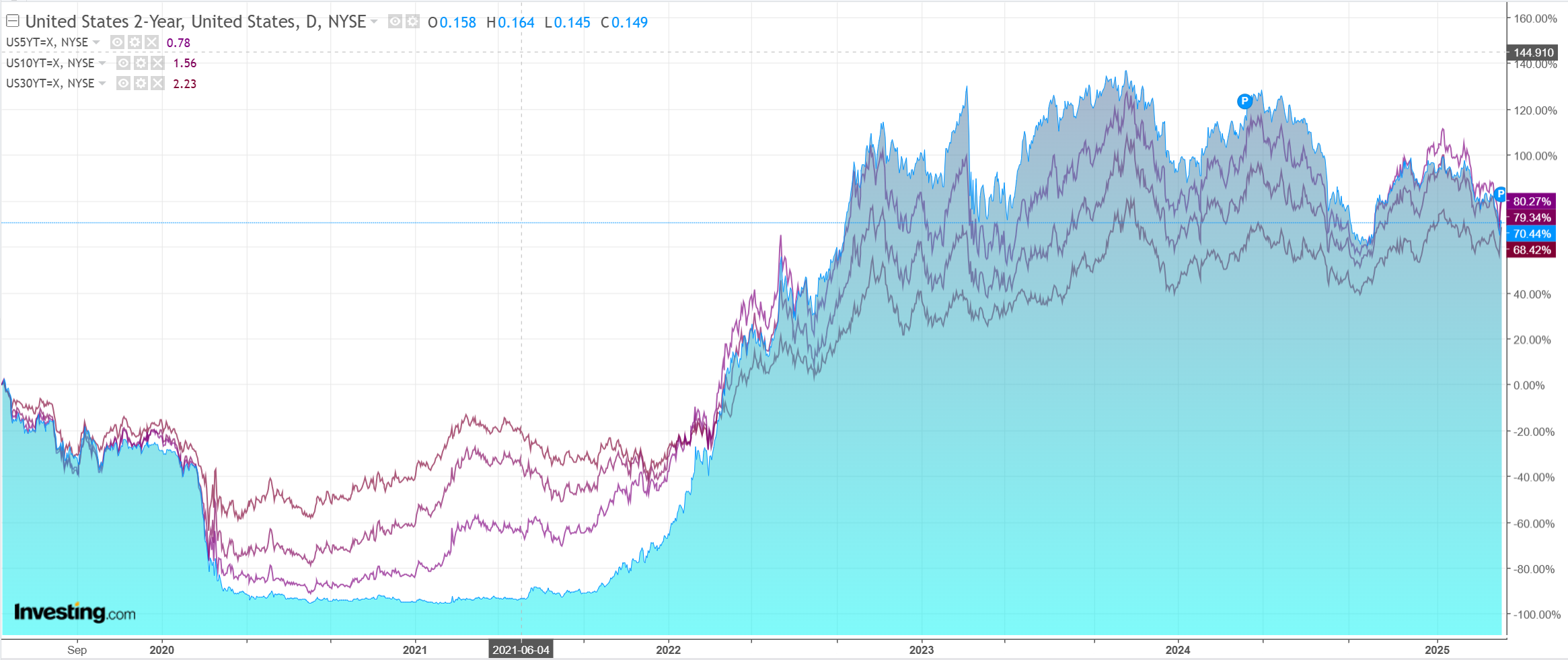

Uh oh, Treasuries are selling with everything else…hello, Liz Truss moment.

Stocks whoa.

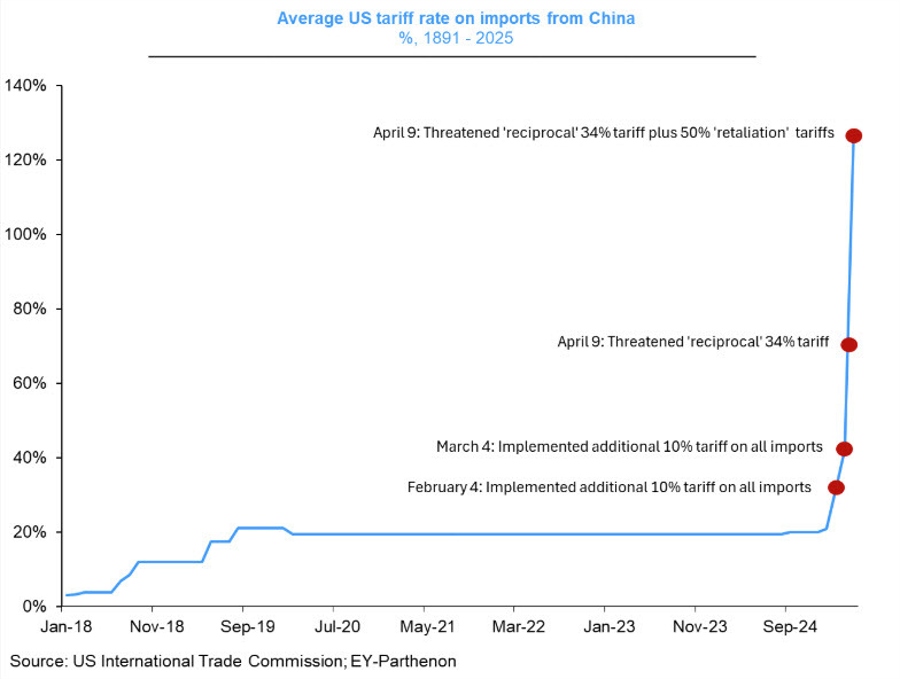

Here is your new world order chart with Trump’s 50% increase in Chinese tariffs scheduled for tonight!

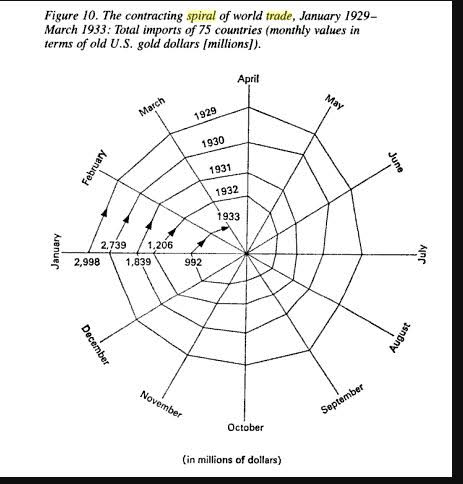

Or maybe a more apposite chart is Charles Kindleberger’s spider web of collapsing trade after Smoot-Hawley in his seminal Manias, Panics, and Crashes.

The US/China trade relationship is asymmetric.

On the China side, it is nearly all raw material imports and a not very large $238bn. On the US side, it is a much larger and more dangerous $732bn in goods.

If those goods and commodities suddenly swamp the world, the deflationary shock will be immense.

Making matters even worse, the RMB is about to break lows not seen since the GFC, and if it devalues at a rapid pace, then all bets are off on a US and China decoupling completed in days rather than years.

That has a sub-50 cents AUD written all over it.