DXY is a falling comet aiming for an extinction-level event.

But for what? Not AUD!

Nor CNY.

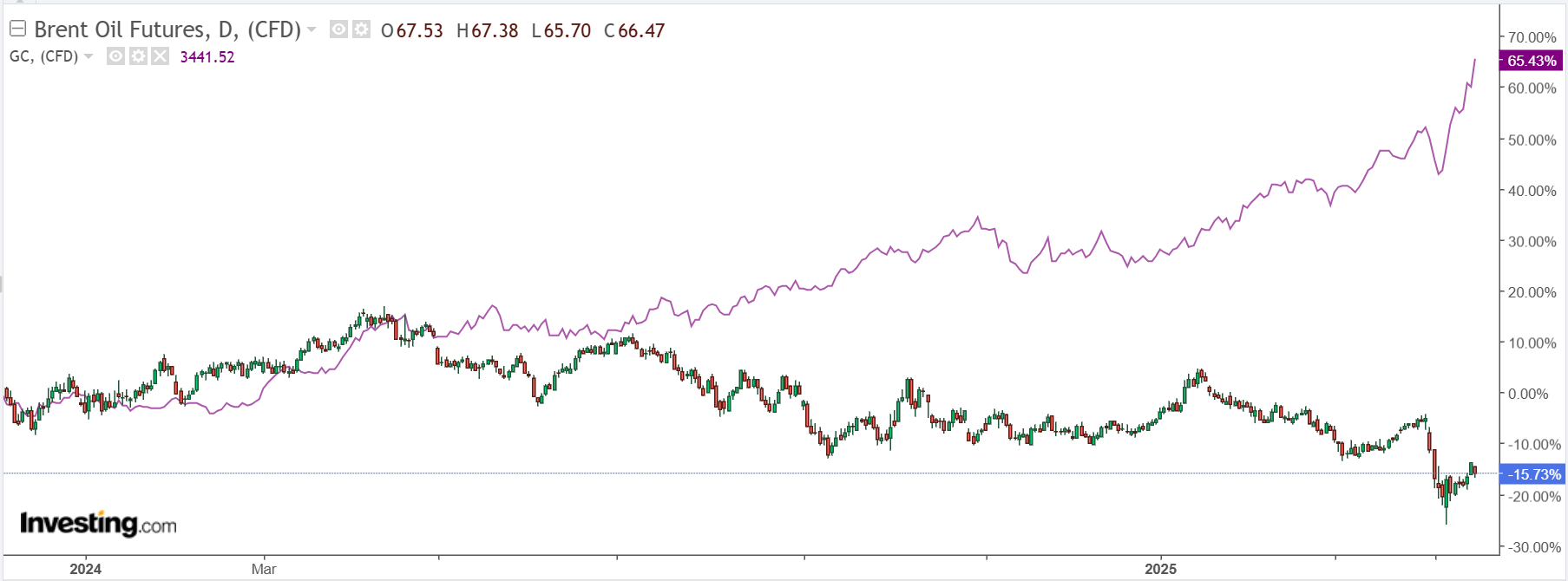

Gold is the forever currency now.

Metals are confused by monetary versus fundamentals clash.

Bg miners = big bear.

EM yawn.

Junk stress.

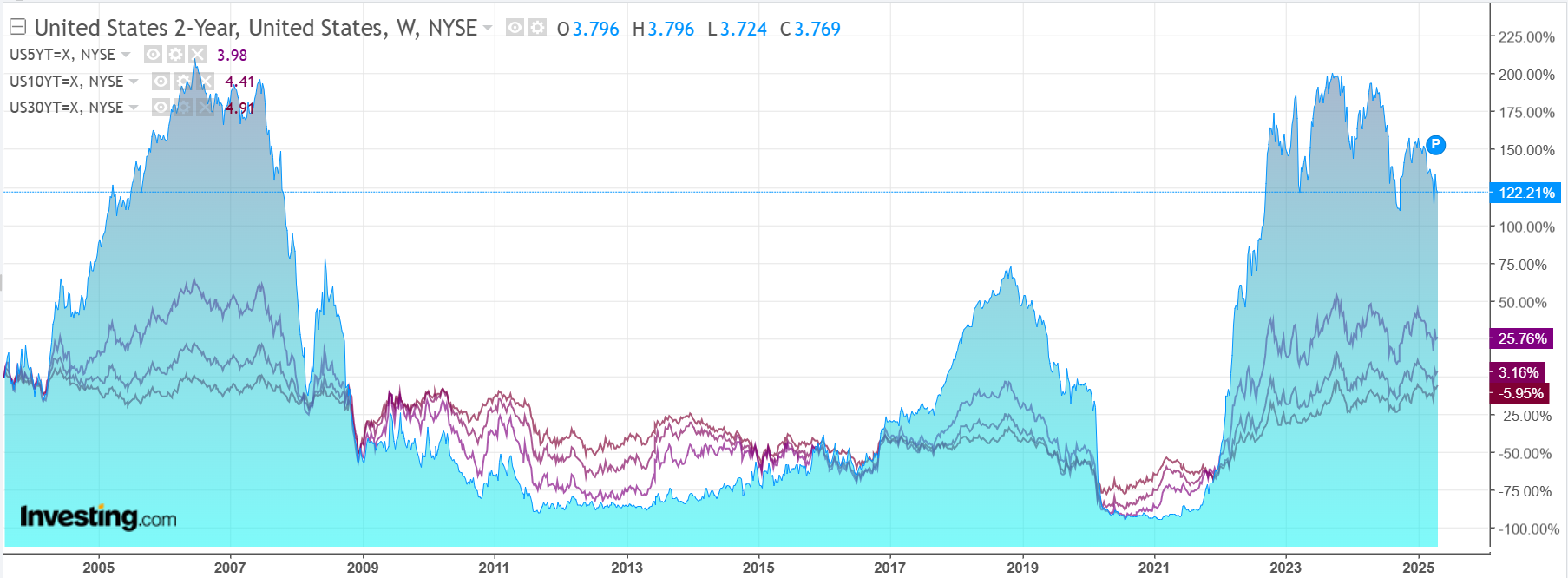

Curve steepener going nuts as Treasury loses control of the long end.

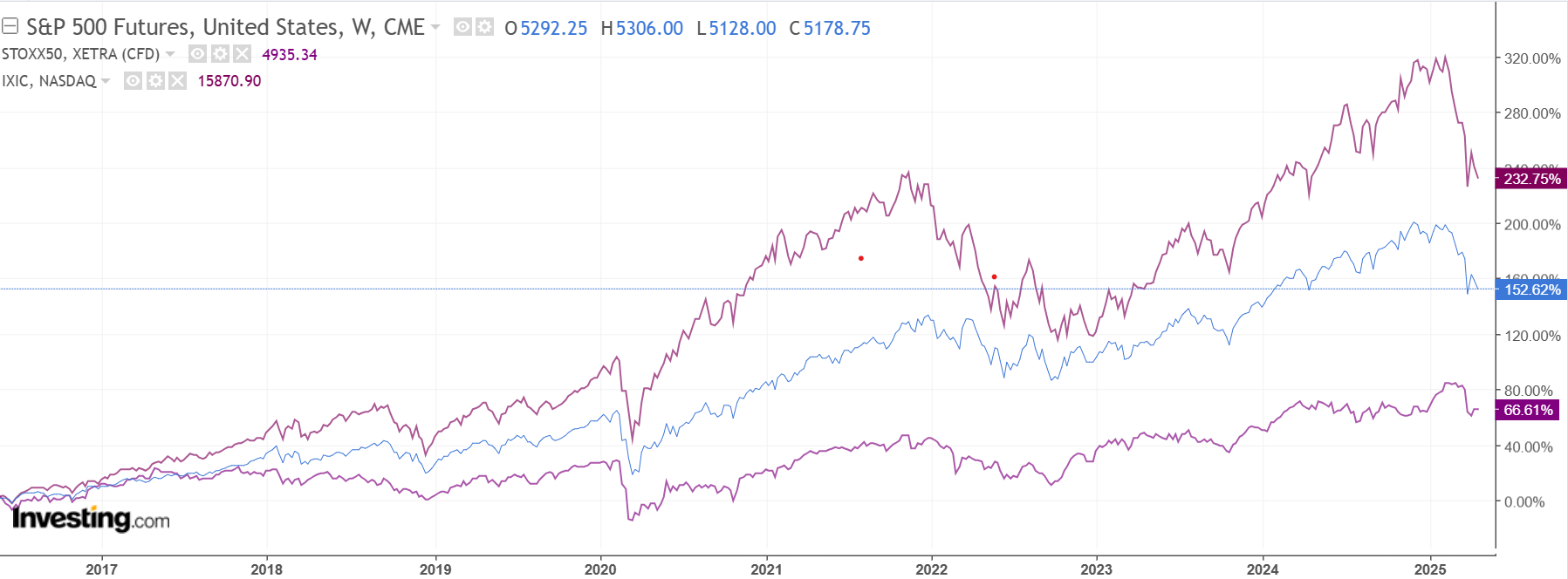

Stocks no likee.

Welcome to the United of Turkey and its reserve currency lira. Credit Agricole.

When a country’s FX and sovereign bond yields are going in opposite directions, it necessarily implies foreign capital outflows, a usual EM pattern that erupted in the US last week following the massive ratcheting up of Donald Trump’s trade war.

Recent, “PBoC selling USTs” and “Treasury Basis trade unwind” narratives hide a more systemic issue: balance-of-payment (BoP) strains, just like in EMs. When this setting applies to the US, this is both highly unusual and can quickly turn ugly for the rest of the world.

So what’s next? Usually, BoP strains can end in two ways: (1) some necessary internal adjustment to reduce the external financing requirement of a nation and/or rebuild foreign confidence (eg, Liz Truss in 2022 or François Mitterrand in 1983) or (2) a currency crisis (this is when EM countries call the IMF).

In the current US case, BoP strains remain largely manageable and some backpedalling from the Trump administration already suggests the first option is significantly more likely. That said, the mere idea of questioning the external solvency of the US is deeply worrisome.

If at some point countries that are often the target of tariffs force a US BoP adjustment (ie, more of last week’s moves until the US government is forced to reduce its public deficit so as to contract imports), it would be significantly more painful than even the most violent trade war for both the US and the rest of the world.

Add Trumpian attacks on the integrity of the Federal Reserve, and the unlikely becomes eminently plausible.

This is the playbook of Emperor Erdoğan of Turkey, who has so bastardised its central bank that the lira has become something of a global market joke in which it crashes, injecting politically untenable inflation surges, then surges as Erdoğan relents.

To describe this as reckless by the child president really doesn’t say it.

If it continues, then a global recession is inevitable as three decades of imbalances try to unwind in a few short months.

I can only guess what happens to the AUD in this scenario. Probably it rises so long as DXY falls are somewhat orderly.

But as the damage to US credibility outstrips market capacity to absorb the adjustments, AUD will probably reverse downwards as economies buckle.

Belt up.