DXY is up some more. EUR down.

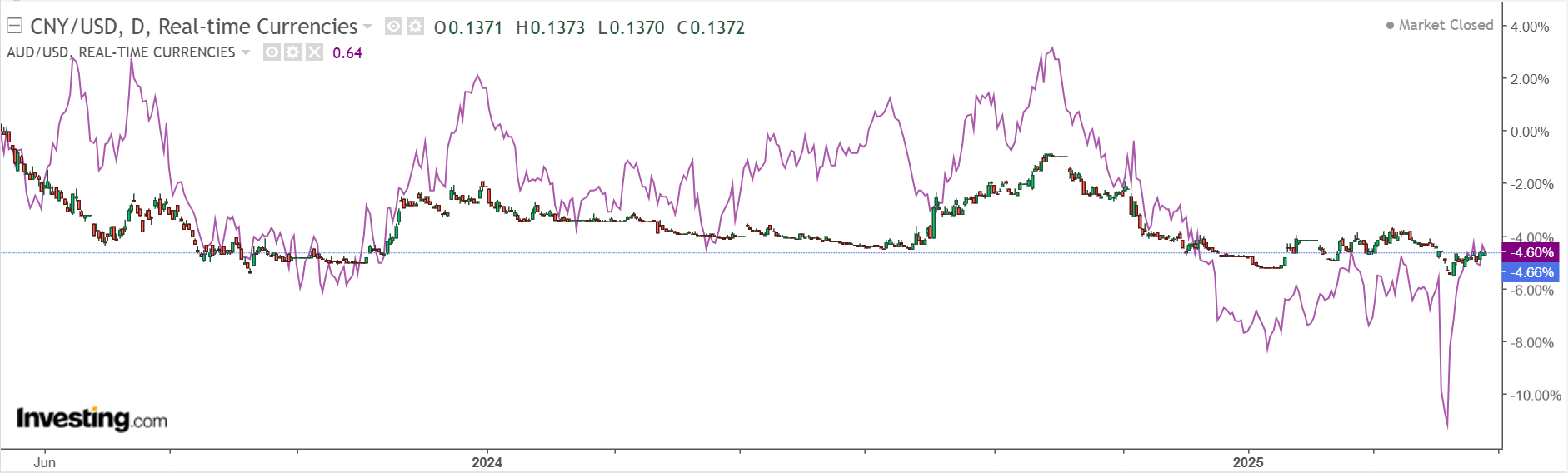

AUD looks like it’s sitting on resistance turned support.

Led boots stuck fast.

Gold and oil pulling back.

Metals flaming out.

Miners too.

EM yawn.

Junk has nearly priced out recession. Bad idea!

Yields down.

Stocks up.

The base case is a reversal of risk before long and another round of DXY selling.

USD: Further to fall. Even after a swift move in recent weeks, we believe that the Dollar has further to fall. Less exceptional US asset returns will compress the Dollar’s high valuation as global allocators move to a more diversified portfolio.

Within this framework, we think investors are too worried about positioning—while tactical Dollar shorts have increased and moves have outstripped our short-term GSBEER models, the whole point is that structural positioning is still very long—and too focused on flows and repatriation calculations.

While this matters, we do not view it as a “stock” of unhedged Dollar assets that needs to be corrected.

Instead, we are more focused on the likely shift in future allocations.

We view the evidence that some investors have sold or hedged a portion of their Dollar assets largely as confirmation that they are unlikely to be adding to those positions with the same enthusiasm as before.

Historically, these types of changes in investor appetite led to large, persistent changes in exchange rates.

If you are in unhedged international assets on the presumption that AUD will protect you in the event of a global sell-down, there is a much higher chance than usual that AUD will instead exacerbate your losses.