DXY struggles on.

AUD is holding support.

Lead boots plod on.

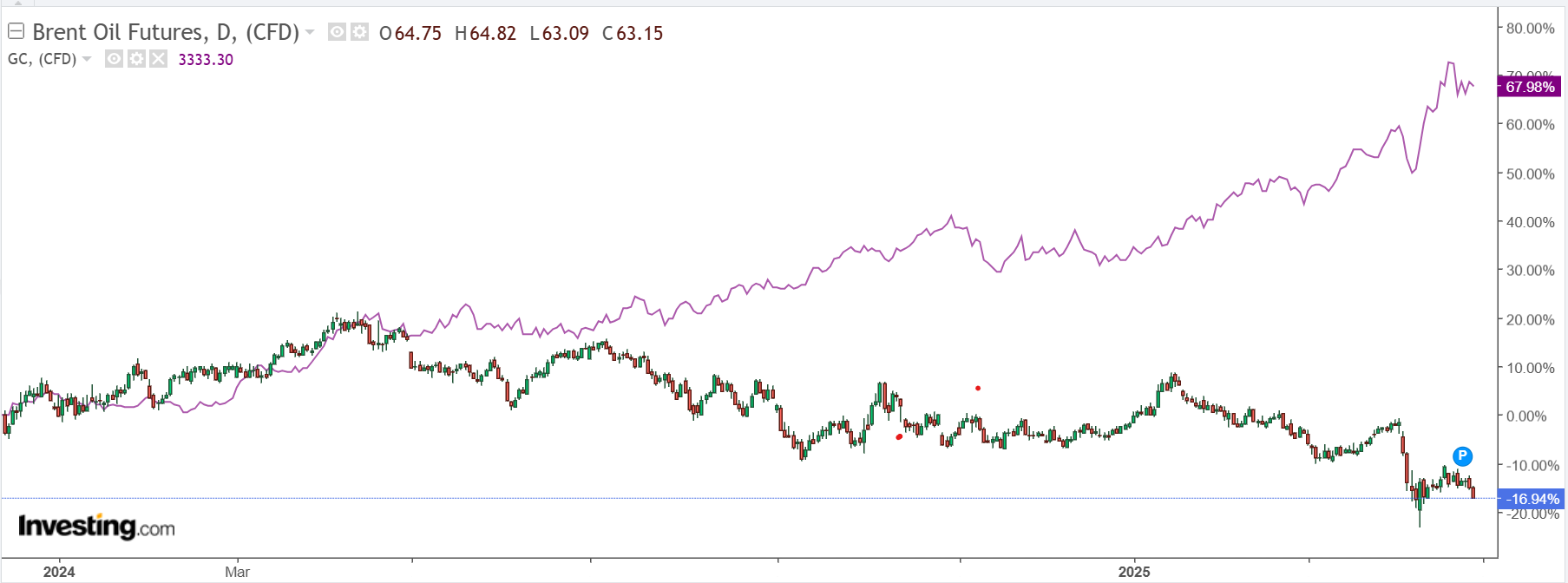

Oil is pointing the way for growth.

Metals meh.

Mining meh.

EM meh.

Junk has entered autobid as equities rise.

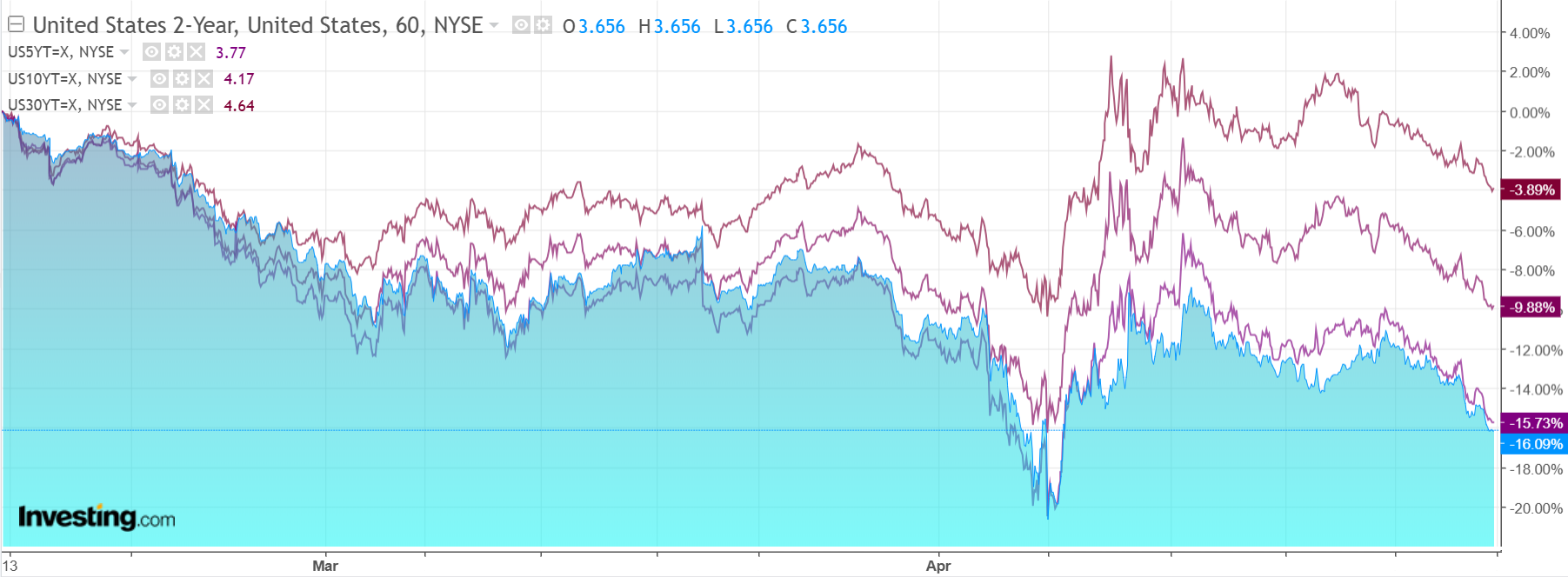

And yields fall.

VIX down means stocks up with robots.

Deutsche says DXY is stuffed.

DB tracks two near real-time measures of US capital flows, both showing a sharp stop in foreign inflows to US bonds and equities over the past two months. The evidence suggests either a rapid slowdown or active disinvestment, both of which challenge the USD given the twin deficit backdrop. Notably, despite a recovery in US asset prices, foreign investors continue to show persistent selling pressure, staying largely on a buyers’ strike.

AUD follows EUR.

Which is overcooked.

Perhaps enough AUD rocket for now, but the base case is higher for longer amid DXY revulsion.