DXY is a falling meteor of death. This isn’t going to help tariff inflation. EUR is breaking out.

AUD blasted higher.

Even concrete boots rose.

Oil is down. Gold could do anything here.

Commdos reflated a touch.

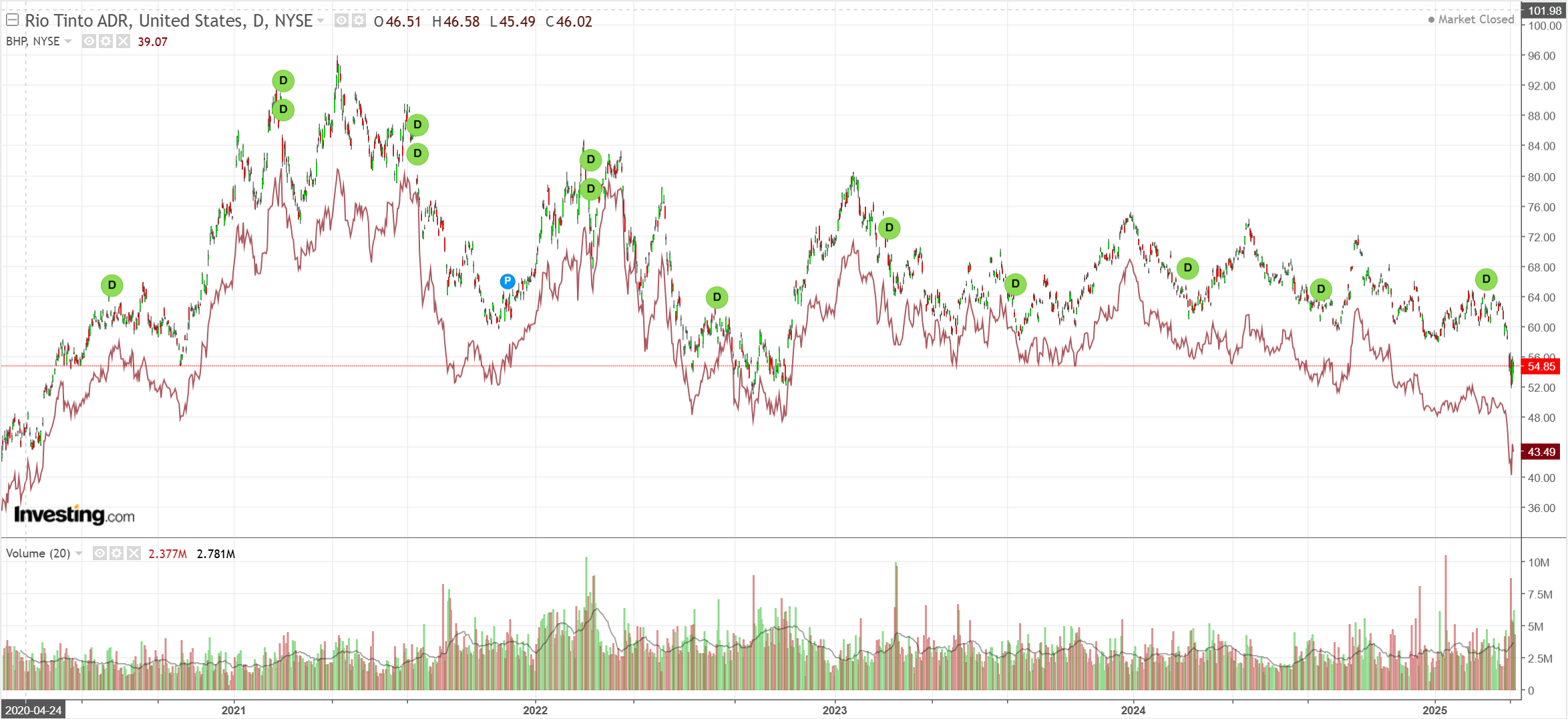

Big miners did not.

EM stocks did not.

Junk is falling away again, especially EM.

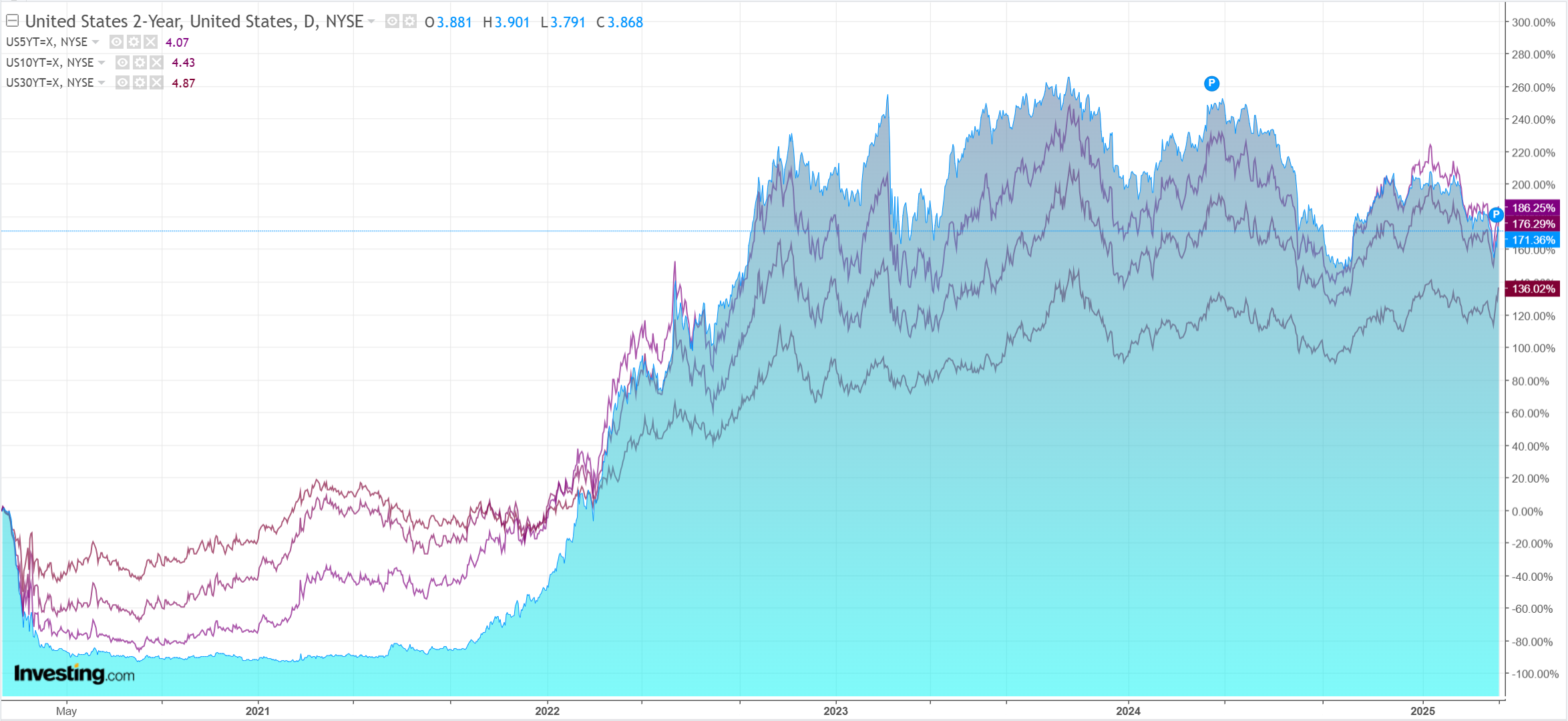

As the US long-end jackknifes.

And stocks reverse down.

The only market you should be watching is US Treasuries and whether or not they are going to stabilise.

So far, the signs are not good as the basis trade unwind returns.

To put it simply, who wants to own US debt here as:

- A tariff inflation shock looms over a recession.

- A deficit of 6.3% of GDP is about to get worse, not better, despite fiscal tightening.

- DXY is in freefall.

- Confidence in US institutions is decimated.

This is the stuff of an emerging market debt crisis, not the underpinnings of the world’s reserve currency.

The market last night appears to be pricing in some kind of intervention by the Fed.

Probably in the form of QE initially to stabilise yields.

But, consider, the wealth losses in the US so far, although large, have not yet priced in the above.

And, with each passing day, the Trump administration makes more enemies amid a fractured polity with large job losses to come.

This is a powderkeg, and if it goes off, the US could spiral into a civil strife abyss.

I am not trying to be alarmist, but the Trump administration appears to have no idea what it is doing, with unknowable and, more importantly, uninvestable consequences.

At such times, a failure of imagination is as much your investment enemy as anything.

AUD up while the Fed put is explored, beyond that, who the hell knows.