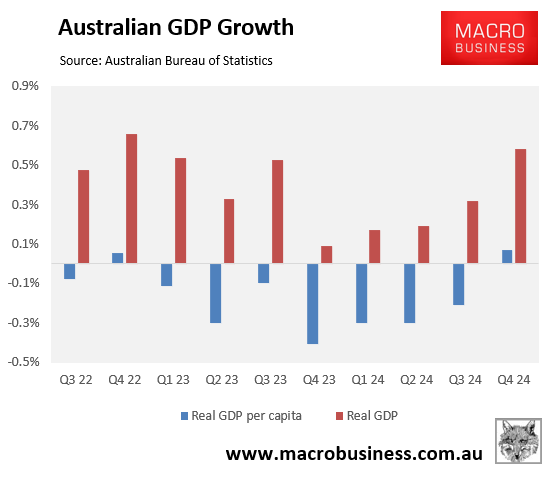

The Australian Bureau of Statistics’ (ABS) Q4 2024 national accounts revealed that the economy finally emerged from a per capita recession following 21 consecutive quarters of decline.

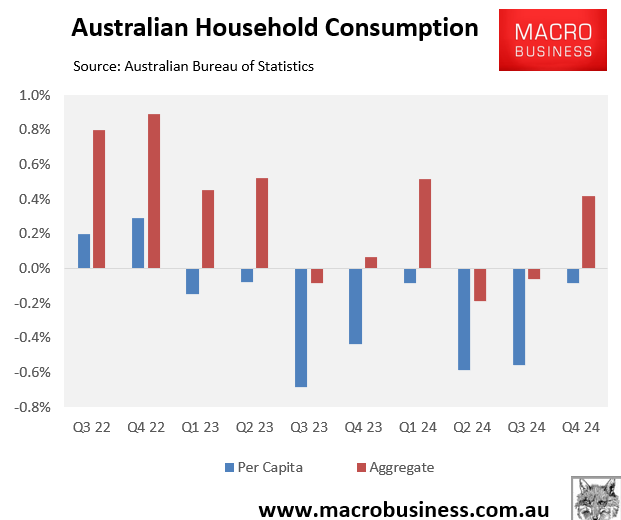

Australia’s per capita recession was driven by the household sector, where consumption fell for a record eighth consecutive quarter.

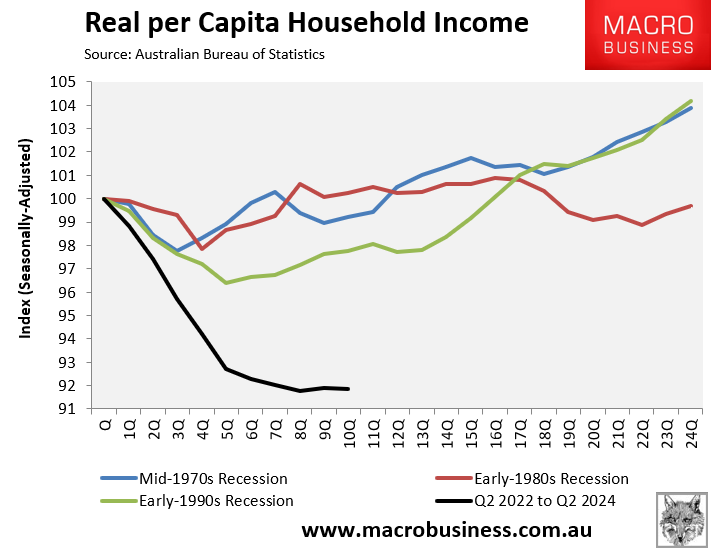

The decline in per capita consumption followed a record 8% decline in real household disposable incomes.

The Q1 GDP result, due for release in early June, is already looking shaky following Cyclone Alfred, which effectively shut Southeast Queensland and Northern Territory down for a week.

Economists tipped that Cyclone Alfred could wipe a quarter of a percentage point off quarterly growth, pulling the economy back into a per capita recession.

The International Monetary Fund’s (IMF) latest World Economic Outlook has also downgraded Australia’s GDP forecast for 2025 from 1.6% to 2.1%, which would extend the economy’s weakest period of growth (outside of the 2020 pandemic) since the early 1990s recession.

“Major policy shifts are resetting the global trade system and giving rise to uncertainty that is once again testing the resilience of the global economy”, the IMF said in the document.

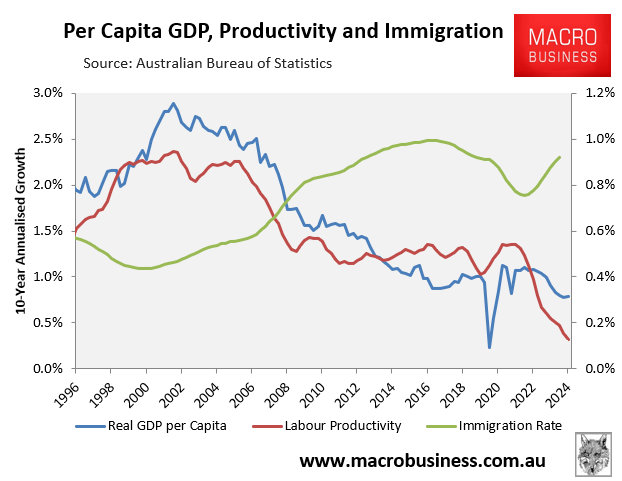

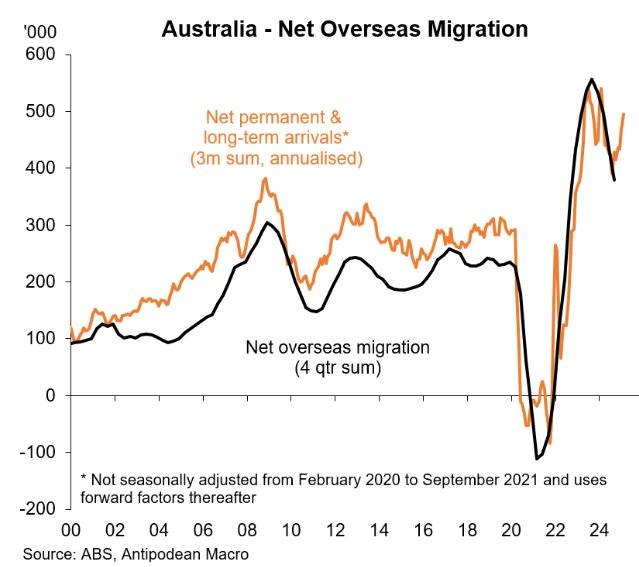

The March federal budget projected that Australia’s population would grow by 1.6% this calendar year amid a sharp decline in net overseas migration.

However, the apparent rebound in net overseas migration in January and February suggests that migration and therefore population growth will likely exceed the budget’s forecasts.

As a result, the impacts of Cyclone Alfred and IMF’s latest growth forecasts suggest that the Australian economy could fall back into a per capita recession.