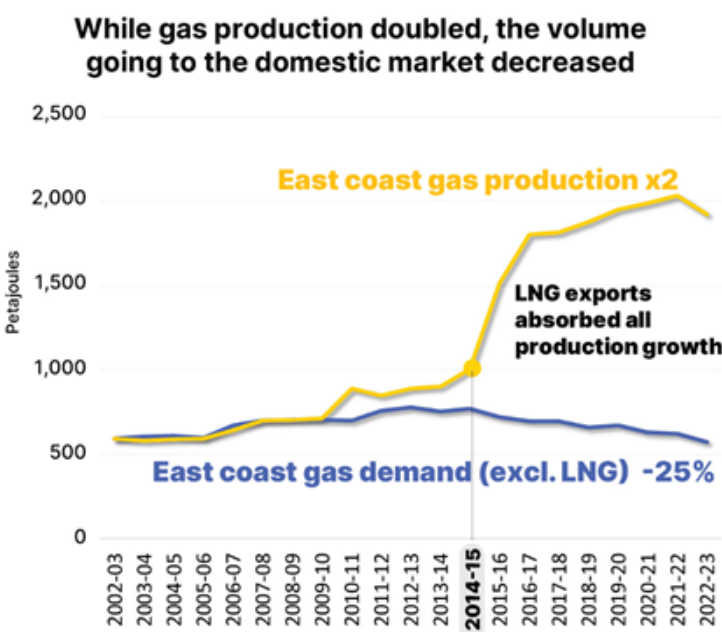

East Coast Australia has doubled its gas production over the past decade, yet the domestic market has been supplied with 25% less gas.

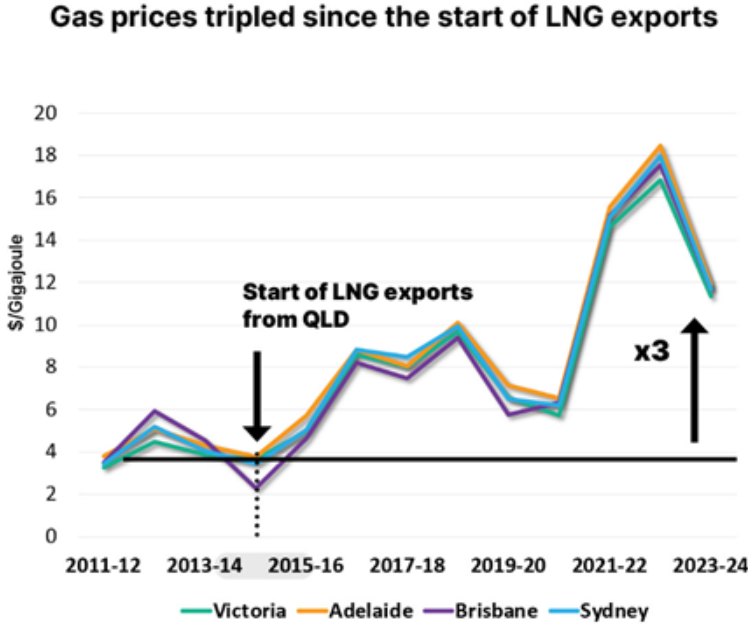

Part of this decline in domestic gas use reflects demand destruction: the tripling of prices has caused manufacturers to shutter and reduced consumption.

Despite being a major exporter, East Coast Australia now faces shortages of gas at home and the prospect of importing LNG.

LNG import terminals are planned to commence operations from the end of the year, beginning in Port Kembla and then in Victoria and South Australia.

If these LNG terminals open, the East Coast gas price will shoot up to import parity prices of around $20 a gigajoule, from around $12 a gigajoule currently.

As a consequence, electricity prices will also shoot up, reflecting gas’s key firming role, which has made it a marginal price setter for electricity.

Liberal leader Peter Dutton has launched an excellent East Coast gas reservation, which promises to deliver $10 a gigajoule gas by requiring uncontracted (spot) gas to be directed into the domestic market.

Doing so would eliminate the need to import LNG.

Shell Australia chair Cecile Wake begrudgingly admitted that the Coalition’s gas reservation policy would drive down gas prices.

Wake said the policy would “potentially push more supply into the market than there is actual demand … and when that happens, it has the effect of potentially driving prices even lower than the $10 [a gigajoule].”

If that is not a ringing endorsement of the Coalition’s reservation policy, I don’t know what is.

The Coalition has also promised to invest $1 billion into a Critical Gas Infrastructure Fund to increase gas pipeline and storage capacity.

Extra pipeline capacity and/or storage is vital to enable flows of gas to Victoria during the peak winter months when the north-south pipeline operates at capacity.

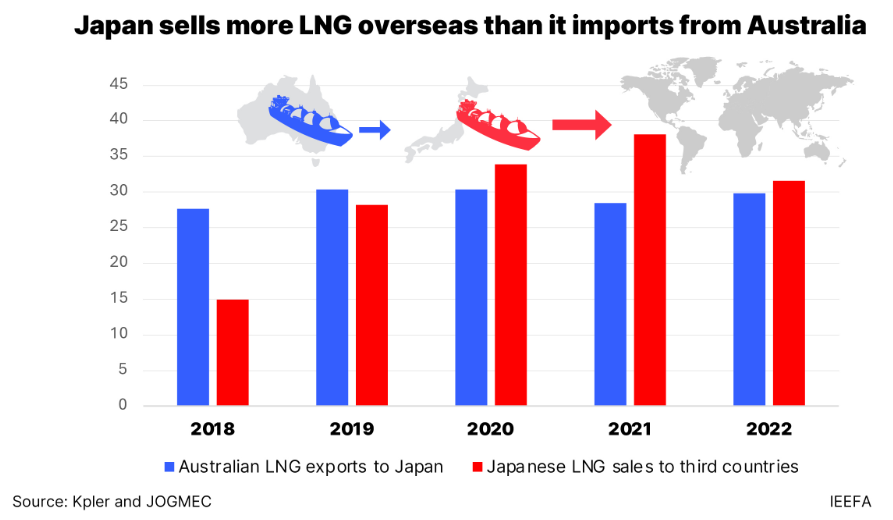

While East Coast Australians face crippling shortages and soaring gas costs, despite exporting nearly three quarters of its gas, Japan is busy importing far more Australian gas than it needs and reselling it for profit to other Asian nations.

Now, a Tokyo-based think tank has warned Peter Dutton against implementing a gas reservation policy, arguing that it would harm Japanese profits:

“Huge investment was made on the expectation they [Australian producers and their Japanese partners] could generate revenue from long-term contracts but also revenue from selling into the spot market”, Tatsuya Terazawa, chief executive of the Institute of Energy Economics Japan, said.

“If the idea is to restrict the freedom of selling in the spot market, that would affect the profitability of these projects. Our policy is to expand our LNG network for Asia, and Australian gas assists in this”.

The strategy has also proved hugely profitable for Japanese trading houses such as JERA, Mitsubishi, Tokyo Gas and Mitsui, all of which buy gas wholesale from Australia, as well as the US and Qatar.

Since 2020, Japan has sold more LNG overseas than it has imported from Australia…

Japan’s own LNG demand has fallen in recent years, as nuclear and renewable energy gained weight in the country’s energy mix.

Why should the profits of Japanese trading houses take precedence over the interests of Australian residential and industrial consumers?

Japan should be politely told to f#$k off. Australian gas must be reserved for Australians first.

Otherwise, Australians face surging gas and electricity costs, higher inflation, further deindustrialisation, lower productivity growth, and declining living standards.