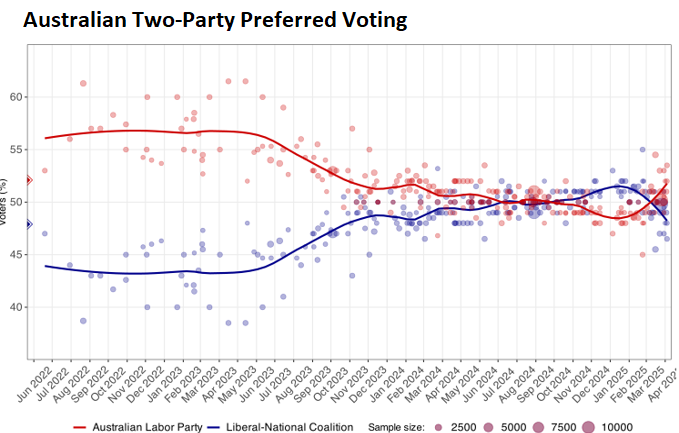

The Albanese government is primed to win the upcoming federal election, with all recent opinion polls showing them leading the Coalition on a two-party preferred basis.

House prices will undoubtedly skyrocket following the election of a second-term Labor government.

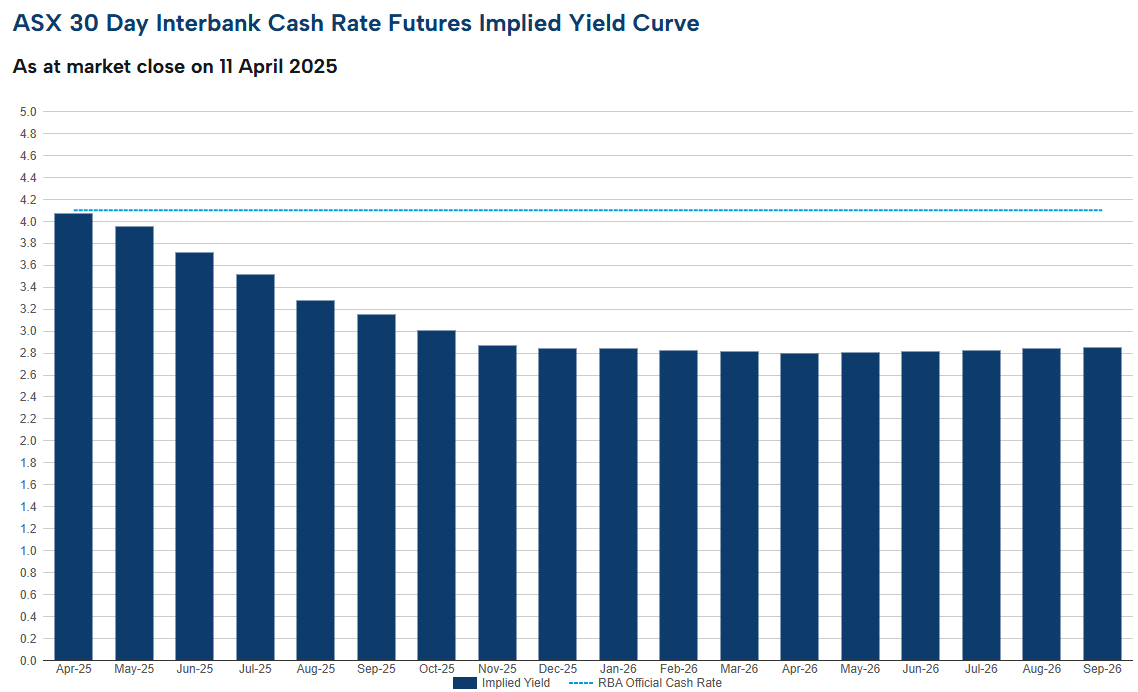

First, the latest interest rate predictions from the futures market tip that Australia’s official cash rate will decline to 2.85% by the end of the year, down from 4.10%.

This 1.25% of monetary easing will significantly increase mortgage affordability, borrowing capacity, and therefore home prices.

Second, the Albanese government announced over the weekend that it will enable every first home buyer to purchase a home with only a 5% deposit, avoiding lenders mortgage insurance (LMI).

5% deposits for all first home buyers – making it easier for you to buy a place of your own. pic.twitter.com/MYQhXToyv7

— Anthony Albanese (@AlboMP) April 12, 2025

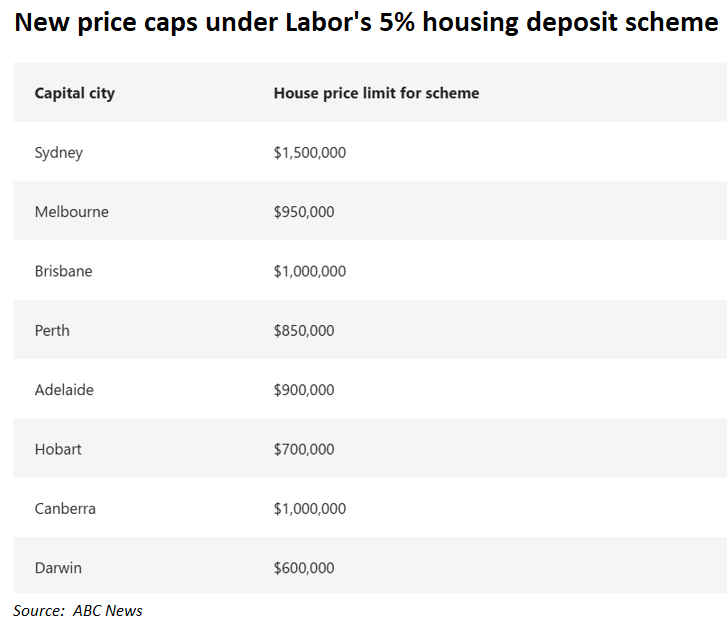

Under the policy, every first home buyer will be eligible to purchase a home with only a 5% deposit from 1 January 2026. The government will guarantee up to 15% of the loan value, thereby eliminating the need for LMI, which currently costs the average buyer around $23,000.

The scheme will not have income caps or a limit on the number of places available. Labor will also lift the price cap for properties eligible under the scheme to ensure that it benefits nearly every first home buyer (see table below).

“When a young person saves a 5% deposit, my government will guarantee the rest with their bank”, Prime Minister Anthony Albanese said.

“This will help people buy their first home faster, without paying the burden of Lenders Mortgage Insurance”.

The policy effectively represents a national taxpayer-supported subprime mortgage scheme. It will significantly increase buyer demand and borrowing capacity, thereby driving up home prices.

Labor’s policy is also self-defeating from an affordability perspective, as it will simply bid prices higher, making homes structurally less affordable.

Australians will also be left paying back larger mortgages, while taxpayers will be on the hook covering negative equity losses in the event of a future house price crash.

Prime Minister Anthony Albanese tried to soften the announcement by promising to spend $10 billion to partner with state developers and industry to build up to 100,000 homes—with these homes reserved for sale only to first-time home buyers.

However, this announcement, which equates to only $100,000 a home, is light on detail and likely would not boost home construction for several years, whereas the government’s 5% deposits would boost demand for established homes from 1 January 2026.

Ultimately, the biggest winners of Labor’s policies are the owners of investment properties, who will likely see the value of their assets soar.

The Coalition also announced that it would make mortgages tax deductible on interest paid on the first $650,000 for first home buyers of new builds.

All first home buyers earning up to $175,000 if they are single and $250,000 if they are part of a couple would be eligible.

The Coalition’s policy is marginally superior to Labor’s in that it would apply to new homes only and therefore would boost supply.

However, it is reckless in that it will narrow the tax base and drain the federal budget of tax revenue at a time when it is facing a decade of budget deficits. It would also be highly inflationary for new home prices.

Throwing more taxpayer money at the housing bubble is utterly reckless. This is particularly true when there are more effective and less costly ways to address the housing crisis, such as significantly reducing immigration.

Substantially lower immigration would reduce rents and prices directly while also alleviating the housing shortage. It would not require a cent of taxpayer dollars and would improve livability in Australia’s major capital cities.