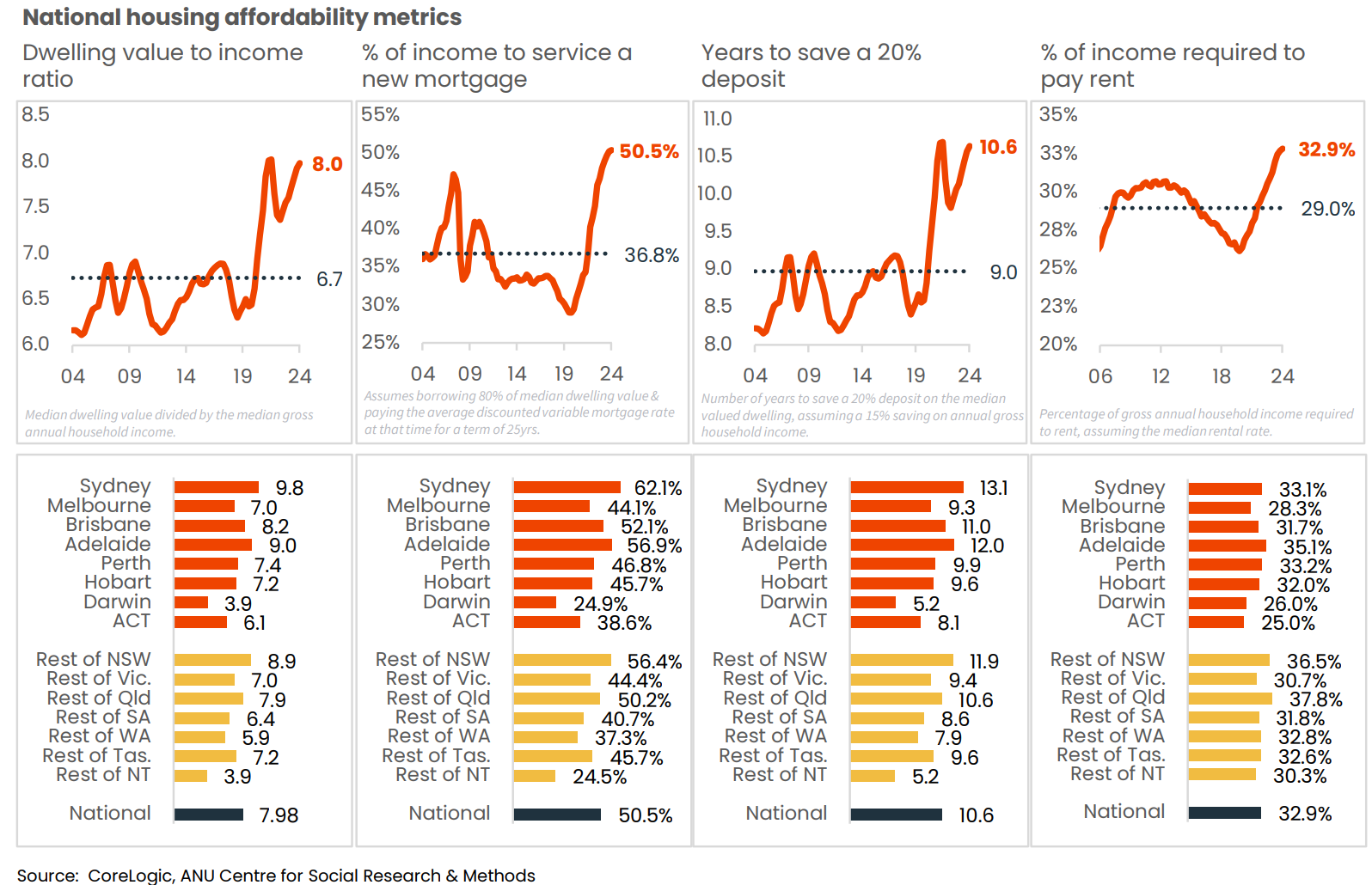

CoreLogic has released the following snapshot of housing affordability across Australia, broken down by four metrics.

As illustrated above, affordability to purchase or rent nationally was tracking at its worst level in history at the end of 2024. Specifically:

- The national dwelling value-to-income ratio was an equal record high of 8.0 as of 31 December 2024, up from a 20-year average of 6.7.

- The percentage of median income required to service a mortgage on the median-priced home was a record high of 50.5% at the end of 2024.

- The number of years required to save a deposit was 10.6 at the end of 2024, up from the decade average of 9.0.

- The percentage of gross annual household income required to service the median rent was a record high of 32.9% at the end of December 2024.

CoreLogic research director Tim Lawless attributed the declining affordability to “a long running under-supply of appropriate housing relative to demand”.

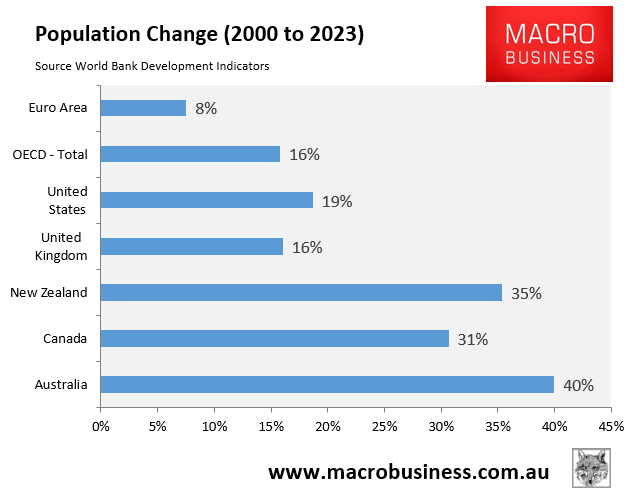

This is a fair criticism given that Australia’s population has grown by 8.7 million since the turn of the century on the back of high immigration, which has significantly boosted demand for housing and driven the shortage.

Lawless also criticised the policies put forward by both sides during the election campaign.

“Most economists agree that policies announced in the lead up to the election are more focused on applying a Band-Aid to the symptoms of housing affordability rather than addressing the underlying issues that have created such an unaffordable housing sector”, he said.

Given that a “long-running undersupply” of housing is responsible, the best solution to Australia’s housing affordability crisis is to reduce net overseas migration significantly.

Excessive immigration negatively impacts housing affordability, particularly for first-time buyers and renters, for the following reasons:

- It pushes up rents directly, negatively impacting tenants and making it more difficult for prospective first-time buyers to save a deposit.

- It puts upward pressure on dwelling values, making purchasing harder.

- It forces Australians to live in smaller homes (e.g., small apartments) or further from the city centre.

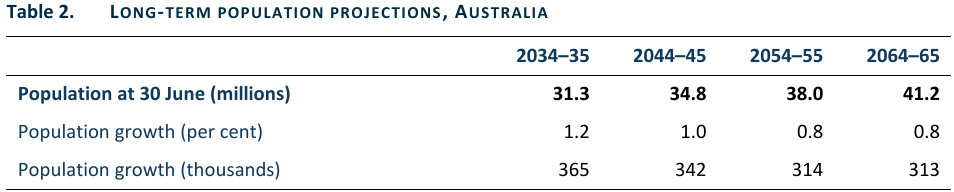

The latest Population Statement from Treasury’s Centre for Population, released in December 2024, projected that Australia’s population will increase by 13.5 million in just 40 years.

Source: Centre for Population (December 2024)

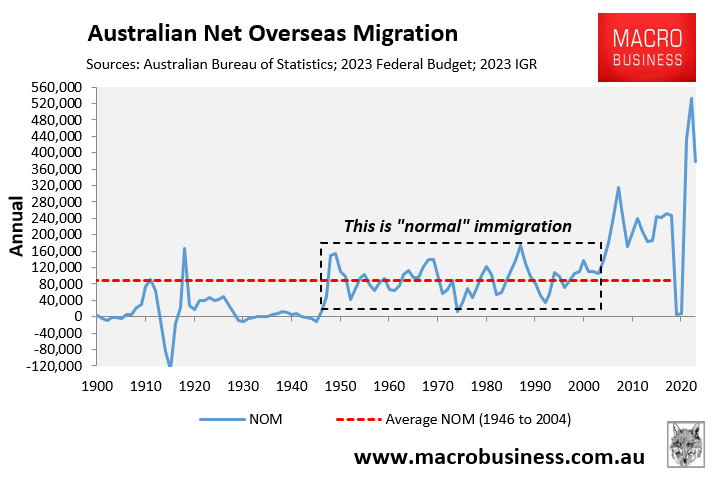

This projected 13.5 million population increase will be driven by a permanently high net overseas migration of 235,000 annually. This level of immigration is around 150% higher than the 90,000 average net migration in the 60 years after World War II.

A 13.5 million population increase is equivalent to adding another Sydney, Melbourne, and Brisbane to Australia’s current population in only 40 years.

To maintain living standards, all of the housing and infrastructure in these three large cities would need to be replicated in only 40 years.

The projected rapid population growth will mean that the “long running under-supply of appropriate housing relative to demand” continues, perpetuating the crisis.