CoreLogic’s March housing results show that rental values are at record highs, having increased a further 0.6% in March.

Source: CoreLogic

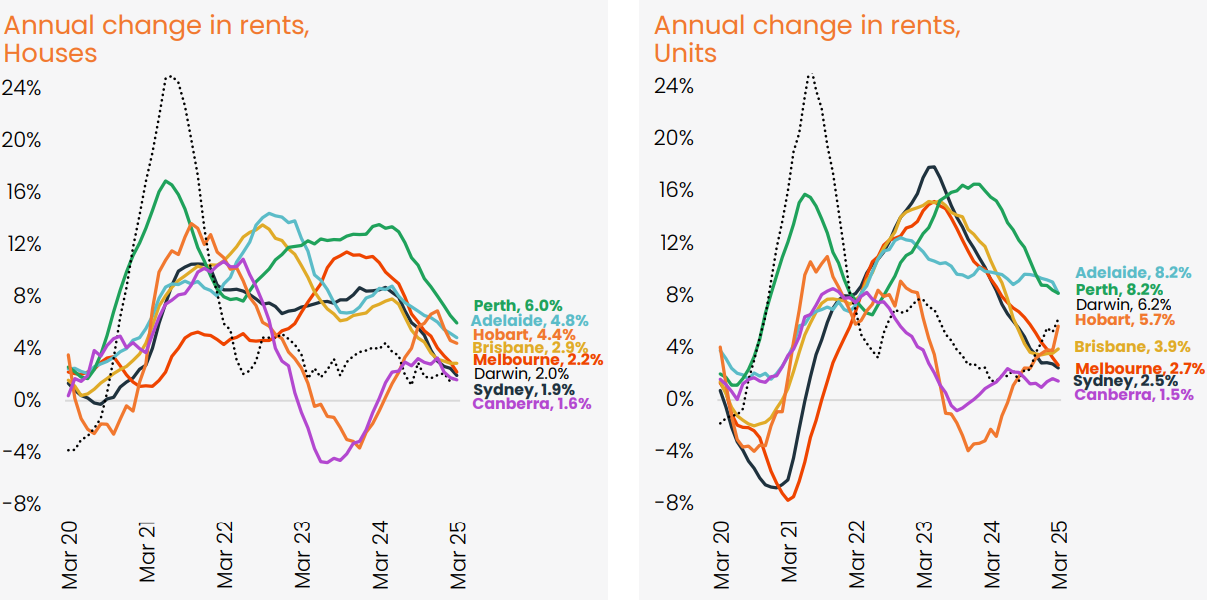

Dwelling rents rose across every capital city in March, led by a 1.2% lift in Hobart, while Melbourne recorded the smallest monthly rent rise, up just 0.3%.

The good news is that annual rental growth has moderated from a peak of 9.7% over the 12 months ending November 2021 to 3.8% over the past 12 months. This represents the slowest annual change in rents since March 2021.

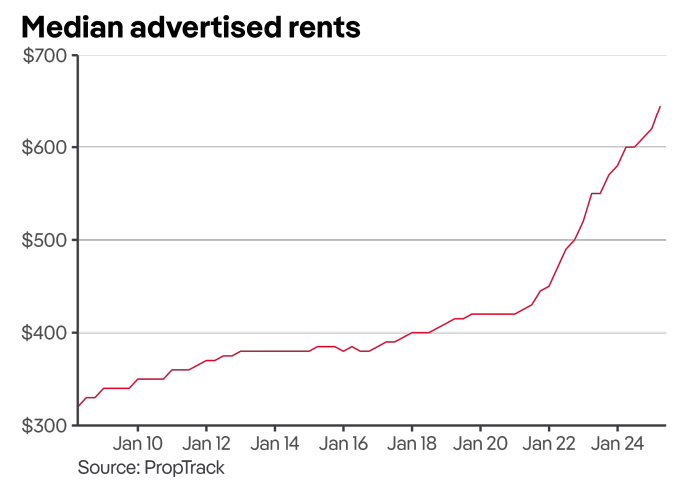

“Nationally, rents have risen 38.4% over the past five years, more than double the 15.4% rise seen in wages over the five years to December 24”, noted CoreLogic’s head of research, Tim Lawless.

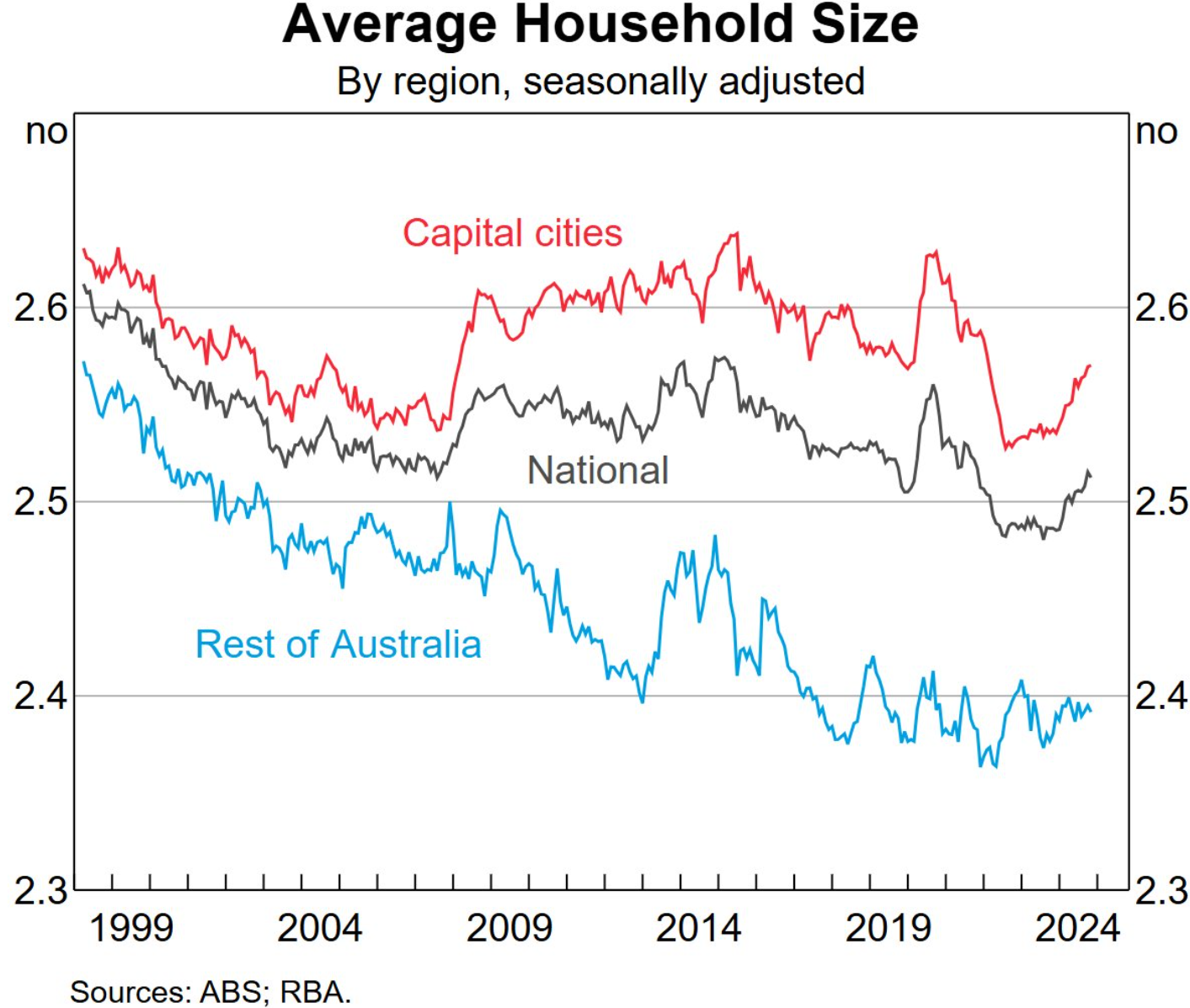

“As overseas migration normalises and the average household becomes larger, we should see a further slowdown in rental growth”, Lawless said.

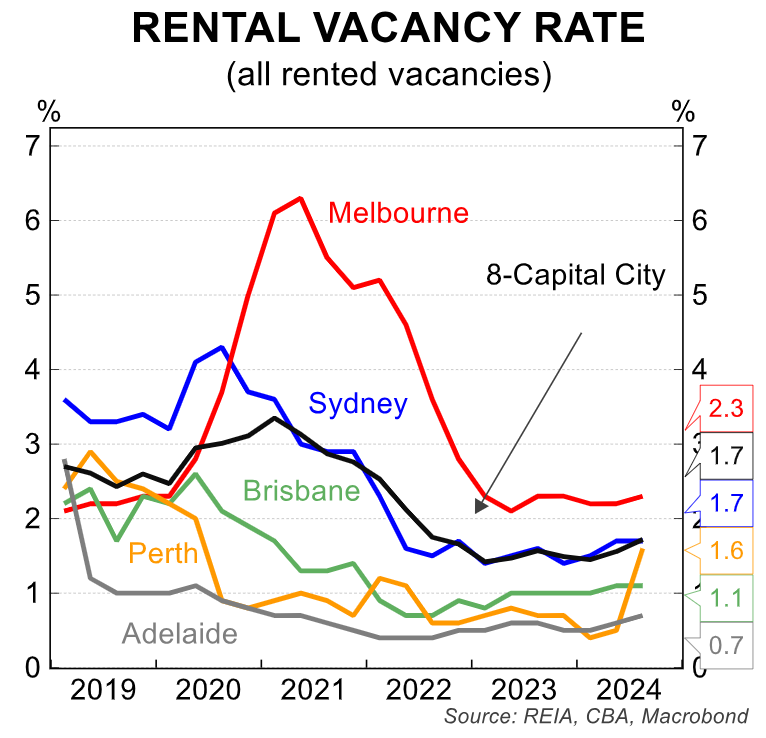

“However, considering the national vacancy rate, at 1.5%, remains less than half the pre-COVID decade average of 3.3%, it’s hard to see rents retreating any time soon”.

PropTrack’s latest rental market report, released last month, claimed that rents nationally have increased by 48% since the beginning of the pandemic.

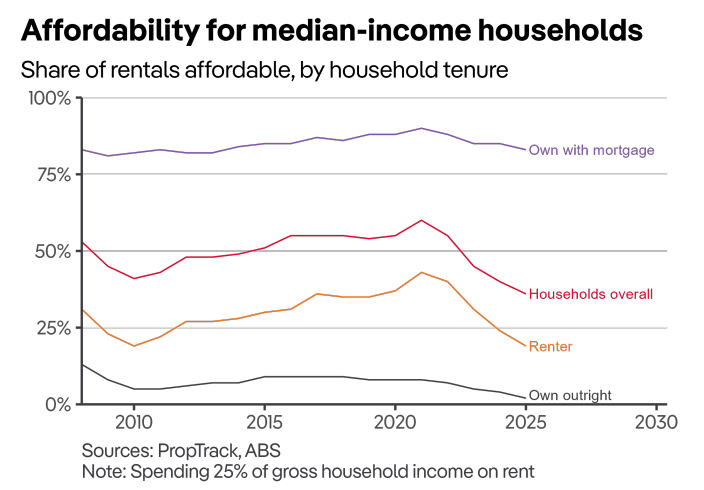

PropTrack also claimed that Australian rental affordability was at a record low, with only 36% of rentals nationally affordable to the median-income household and only 19% affordable to the median renter household.

Australians have mitigated the rental crisis by moving back into shared housing.

As illustrated below, the average household size has rebounded, tracking above the levels of the early-to-mid-2000s across the capital cities.

As a result, the rental vacancy rate has eased slightly but remains tight overall.

As explained by Alan Kohler over the weekend:

“The root of the housing crisis is that dwelling approvals have been declining for 10 years and immigration has been rising for 20 years, with the result that too many people are now chasing not enough houses”.

The solution, therefore, requires running a significantly smaller migration program where housing and infrastructure construction can keep pace.

Otherwise, Australian tenants will continue to suffer from shortages, requiring them to pay in rents or to live in group housing.