Electric vehicles have been heavily subsidised in Australia.

A recent analysis by the Institute of Public Accountants estimated that the federal budget has lost approximately $564 million annually in tax revenue due to the Fringe Benefits Tax (FBT) exemption for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

More than 100,000 novated leases for BEVs and PHEVs have been taken out under the FBT exception.

Other subsidies for BEVs include an increase in the luxury car tax threshold and an exemption from paying road user charges via the 50.8 cents per litre fuel excise.

Several states and territories offer BEV subsidies, albeit these are being phased out.

To encourage the adoption of new BEVs, NSW, Victoria, Queensland, and South Australia granted a $6,000 discount on the purchase price. They ceased in 2023.

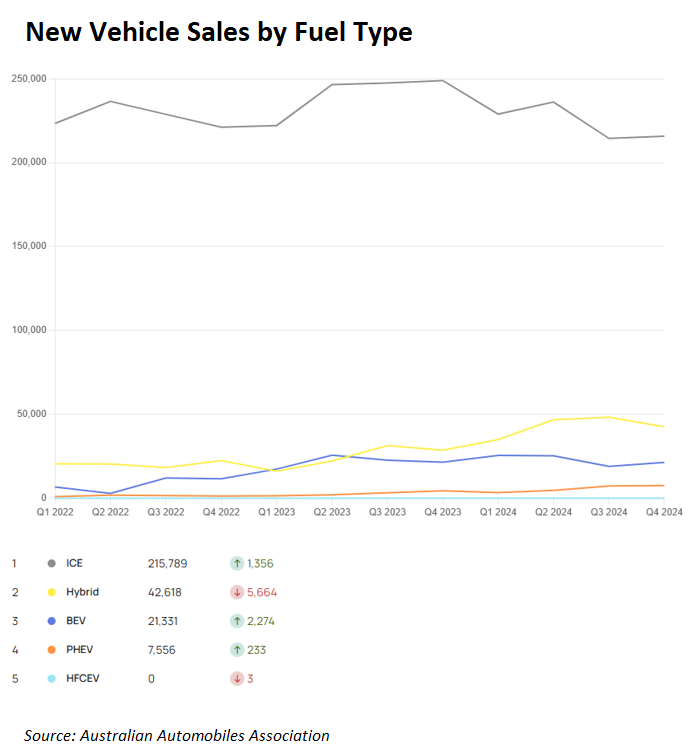

Despite the considerable subsidies, BEV sales have stagnated, whereas PHEV sales have boomed.

According to the Australian Automobile Association’s Electric Vehicle Index, quarterly BEV sales peaked in Q2 2023 at 25,696, and quarterly sales volumes have since fallen, accounting for just 7.7% of total sales in 2024.

PHEVs only comprised around 2% of total car sales in 2024, but their sales more than doubled.

The FBT exemption for PHEVs expires today, triggering panic in the industry and calls for the subsidy to be reinstated.

“People are switching away from electric vehicles to plug-in hybrids”, CarExpert.com.au founder Paul Maric told Yahoo Finance.

“It’s the worst time possible for this kind of thing because the people just don’t want to buy electric vehicles and they’re going to be removing the only real subsidy that is currently sort of gaining traction”.

Research released in October prepared for the National Automotive Leasing and Salary Packaging Association (NALSPA) showed that 61% of PHEV owners purchased their cars precisely because of the FBT exemption, with 90% claiming the tax break made a “big difference” in their purchasing decision.

“When you do the sums on it, you can actually go down the path of buying a $20,000 to $30,000 more expensive electric vehicle and still have it cost the same as a cheaper vehicle once you take into account the tax benefits that you get out of it”, Maric told Yahoo Finance.

Aman Gaur, the policy head of the Electric Vehicle Council lobby group, is concerned that removing taxpayer subsidies will cause more Australians to stick with or switch back to internal combustion engine (ICE) vehicles.

“We know the FBT exemption is an important tool that is helping more Australians afford and access the latest EVs”, he said.

Rohan Martin, Chief Executive of the National Automotive Leasing and Salary Packaging Association, claimed that removing the tax cut was a “lost opportunity”.

“Once the bulk of people move into a plug-in hybrid, they’re on their electrification journey”, he said.

Maric believes that the expiry of the FBT exemption and the sagging demand for BEVs could usher in a significant shift towards regular hybrids.

“People realise that that is the type of vehicle you need to buy if you want to protect your re-sale value, and if you still want the benefits of having a fuel and energy efficient vehicle”.

“Stepping up to a plug-in hybrid or even an electric vehicle, you’re adding the complexity of having these batteries and then the charging equipment”.

“Whereas with a hybrid, we’re seeing them hold their value extremely well, and anything electric at the moment is depreciating”.

The government should abolish all subsidies and let consumer preferences decide.

There are far better ways to spend scarce taxpayer funds than subsidising people’s car purchases.

If electric vehicles are as good as proponents claim, they will sell themselves without needing generous taxpayer subsidies.