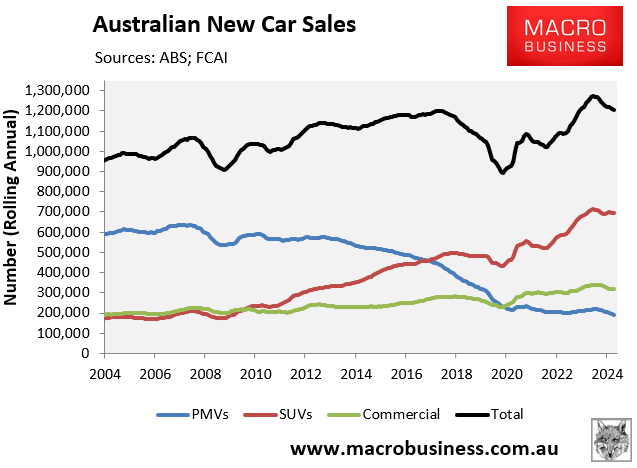

The Federal Chamber of Automotive Industries (FCAI) released new car sales data for March, which revealed that 108,606 new cars were delivered during the month, and a total of 1,206,558 were delivered over the year.

Annual new car sales declined by 0.9% over the year, with the market continuing to trend downward since peaking in mid-2024.

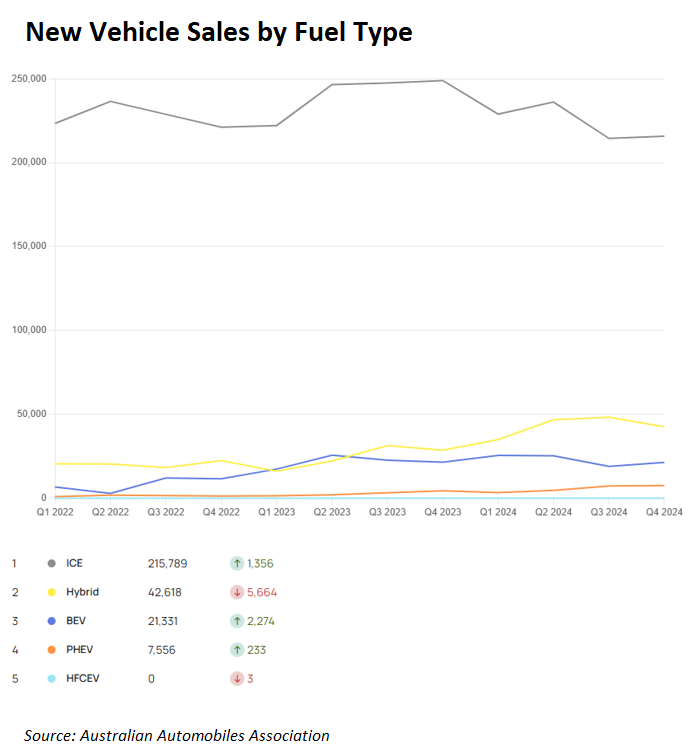

The Australian Automobile Association’s Electric Vehicle Index, which includes quarterly sales data up to Q4 2024, indicates that battery-electric vehicle (BEV) sales reached their peak in Q2 2023 at 25,696 units and have declined since then, accounting for only 7.7% of total sales in 2024.

This trend has continued into 2025, with FCAI reporting disappointing BEV sales in March, following poor sales in January and February.

EVs comprised only 4.9% of total sales reported to the FCAI, compared with 9.5% in March 2024 and 6.8% in March 2023; however, two non-FCAI EV brands have yet to report their March 2025 sales publicly.

“We are at a critical point in transitioning to a lower-emission vehicle fleet. But the reality is clear: Australian families and businesses are not shifting in large numbers to EVs”, FCAI CEO Tony Weber said.

“While the supply of EVs is increasing, now with 89 models available in Australia, the demand for EVs is weak. The early adopters have acted but the rest of the vehicle-buying public has not followed”.

“This is consistent with a number of other advanced markets around the world”.

“The Australian automotive industry has long advocated for an ambitious and achievable emissions standard. Once again, questions must be asked about the Government’s modelling and in particular their assumptions about consumer acceptance of new low-emissions technologies”, Webber said.

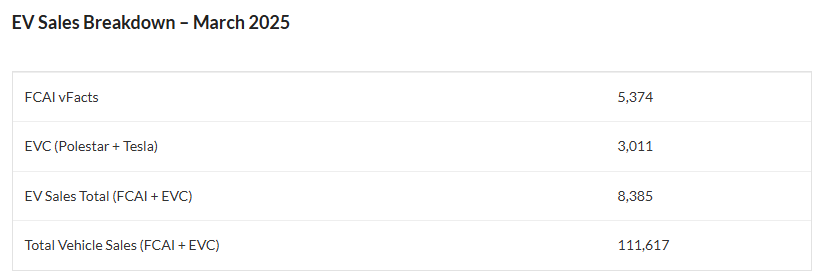

Separate data compiled by The Driven show that a total of 8,385 BEVs were sold in Australia in March, accounting for 7.5% of the total market.

Source: The Driven

The March 2025 numbers shown above were lower than those for the same month in 2024, when 10,464 BEVs were sold, accounting for 9.5% of the market.

BEV sales over the first three months of 2025 were 17,902, according to The Driven, well below the 25,552 recorded in the same period in 2024.

The reality is that heavy taxpayer subsidies have artificially inflated the sales of BEVs.

More than $550 million of tax revenue is estimated to have been lost annually due to the Fringe Benefits Tax (FBT) exemption for BEVs and plug-in hybrids (PHEVs). Although FBT exemptions for PHEVs ended on 1 April 2025.

BEVs receive other subsidies, including an increase in the luxury car tax threshold and exemption from paying road user charges via the fuel excise rate of 50.8 cents per litre.

Several states and territories also provide BEV subsidies, although these are being phased out.

Governments should cease wasting taxpayer money and instead leave purchasing decisions to customer preferences and the market.

There are considerably better uses for taxpayer money than to subsidise people’s car purchases.