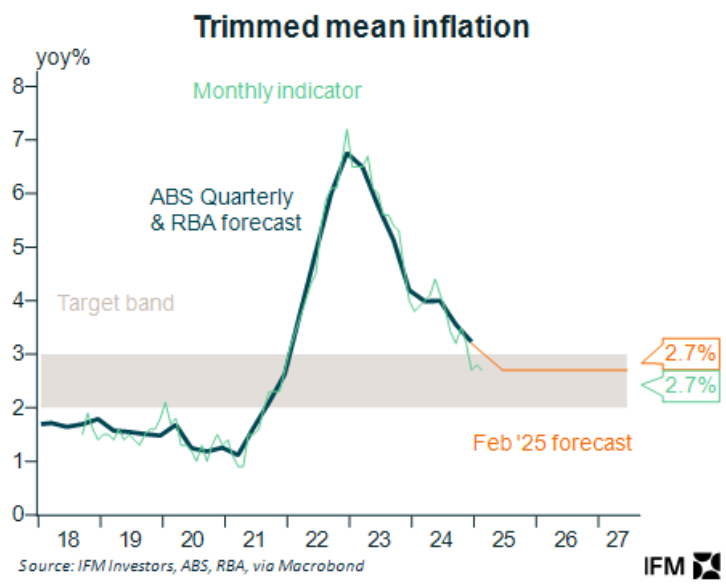

Last week’s softer-than-expected monthly inflation gauge from the Australian Bureau of Statistics (ABS) was matched by the Melbourne Institute’s (MI) trimmed mean inflation gauge for March.

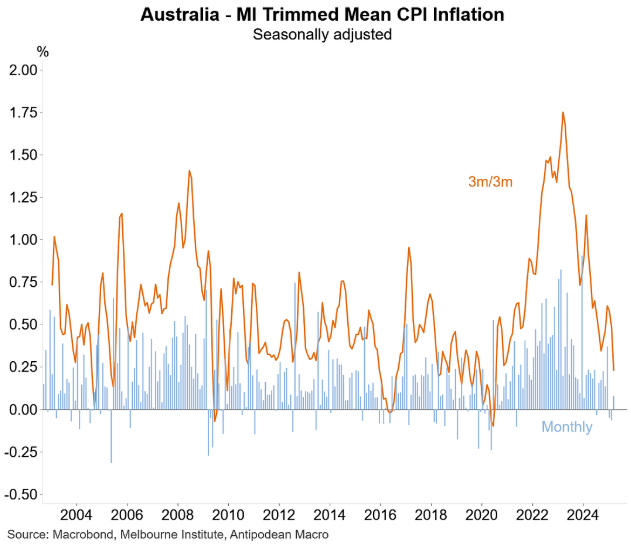

As illustrated below by Justin Fabo from Antipodean Macro, the seasonally adjusted trimmed mean inflation fell to its lowest level since 2020 on a 3-month average basis.

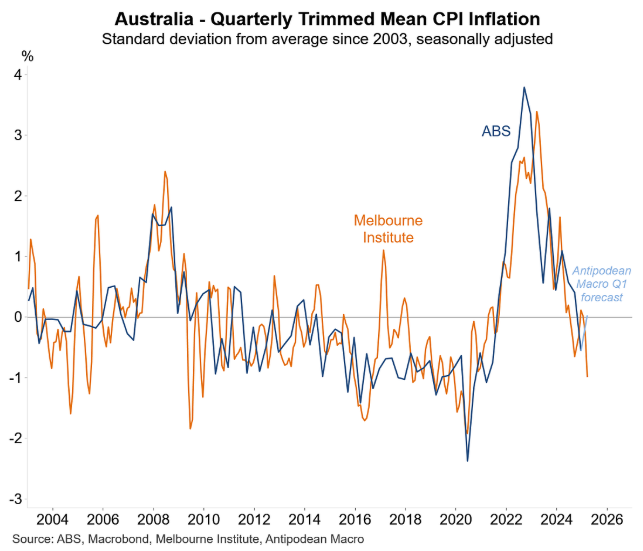

The following chart from Fabo shows that the MI trimmed mean inflation fell below the average since 2003.

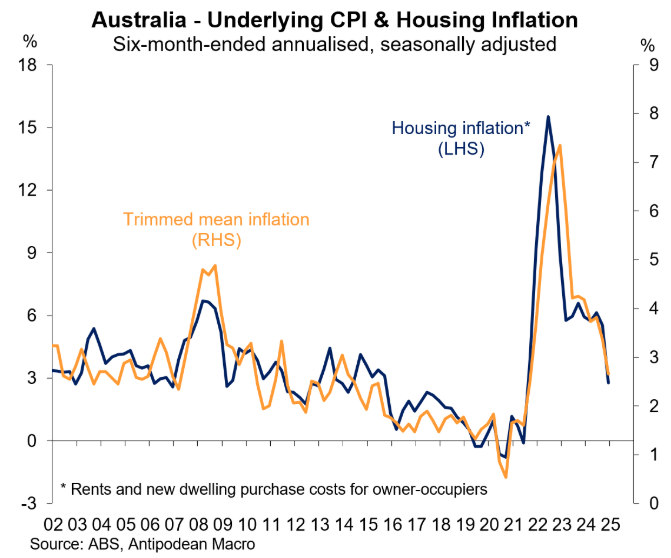

Separate data released last week by Fabo showed that declining housing inflation (i.e., rents and new home prices) augurs well for trimmed-mean inflation.

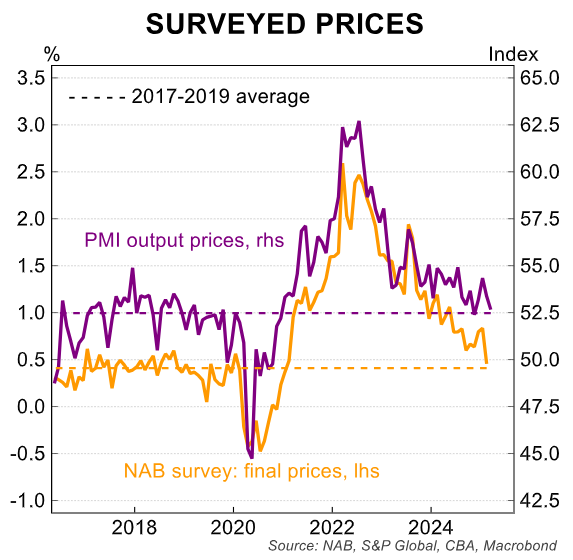

The latest consumer price gauges in the NAB business survey (February) and the S&P PMIs (March) also confirmed that the disinflation process is continuing.

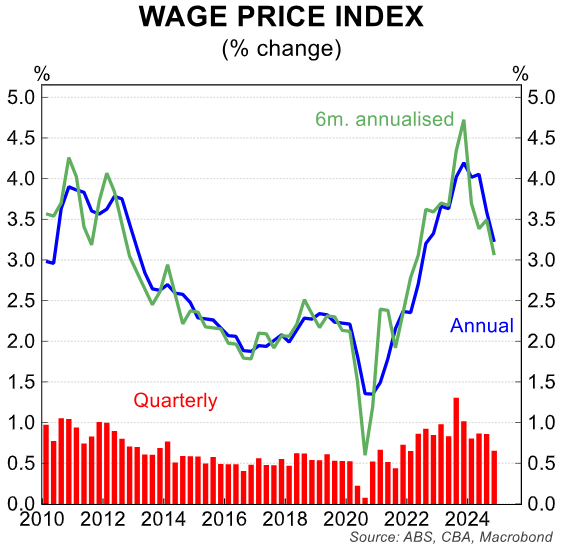

The recent wage data is also consistent with ongoing disinflation.

The Q4 2024 Wage Price Index (WPI) was softer than market and RBA expectations at 0.65% for the quarter, marking the weakest quarterly growth outcome since Q1 2022.

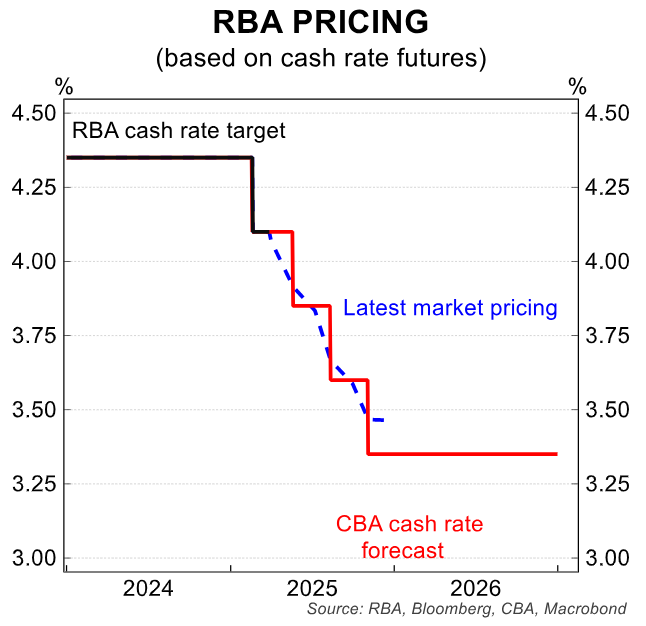

As a result, the Reserve Bank of Australia (RBA) is poised to reduce interest rates further.

Most economists expect the RBA to cut again at the May board meeting, following the release of the Q1 CPI.

The market has also priced in additional rate cuts throughout the year.