Former RBA man Peter Tulip does a good job of destroying the current array of house price appreciation policies offered in the election.

He concludes at the AFR.

Immigration policy is not usually considered as “housing policy”, but it actually has larger effects on affordability than most of the measures discussed above. The Coalition is proposing to reduce net overseas migration by 100,000 a year, relative to budget projections. Econometric modelling I did while at the RBA would suggest that such a change would reduce housing prices and rents by 11% over a decade.

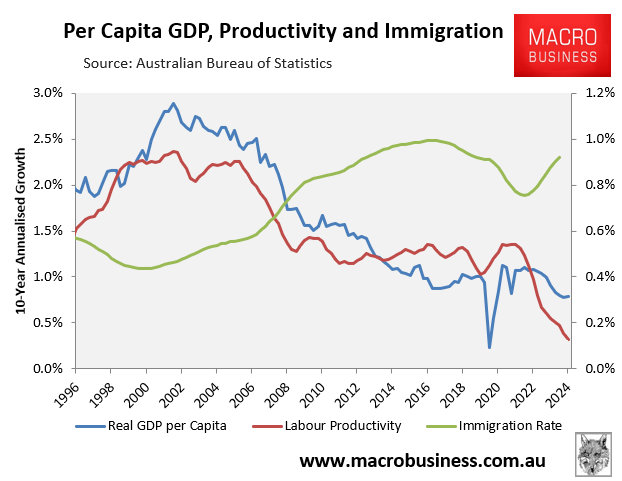

However, a reduction in immigration has large economic and social costs. It would worsen the fiscal deficit, reduce export earnings, reduce productivity, and slow technological progress. It would reduce living standards overall despite the improvement in housing affordability.

I assume Tulip repeats the RBA’s refrains about immigration because, if he didn’t, he might be accused of “racism” and all of that.

But he also makes several mistakes that confuse flow with stock.

Immigration is probably near the top of the list of factors that influence house prices. Credit price and availability are the two most important factors.

If we cut immigration, the economy would slow, and interest rates would fall much further than otherwise, sending house prices up, at least in the short-to-medium term.

The economy is a flow of prices, not a stable stock; a river, not a lake.

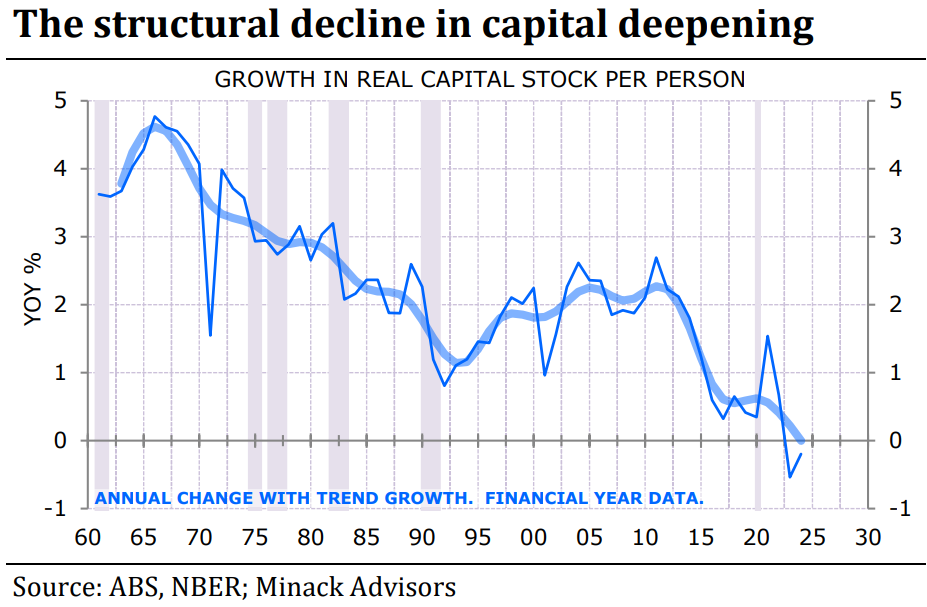

Other stocks and flows in the economy that would change if immigration were cut, and about which Tulip is obviously wrong, include productivity, which would lift, not fall, as capital shallowing ceased.

It is no surprise that Australia’s productivity growth slowed after immigration rose, owing to this capital-shallowing effect.

Equally, higher productivity and no eternal labour supply shock from cheap foreign workers mean higher wages, so Tulip’s assertion of fiscal harm is exaggerated if not completely wrong as well.

Bracket creep would inject large, new, qualitative budget income flows instead of today’s quantitative flows of more and more, ever poorer, people.

Governments would also not need to spend so much on infrastructure, government services, etc.

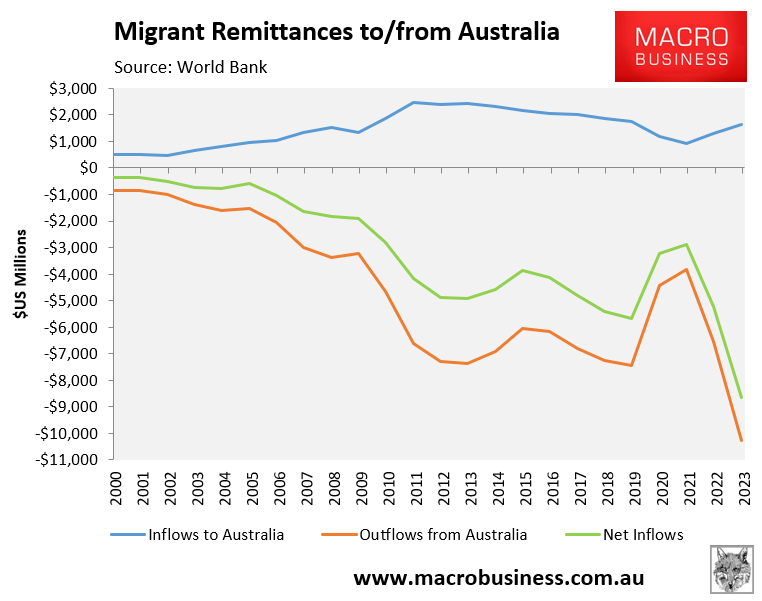

Nor would slashed immigration impact export earnings. That’s just stupid. Though, it would crash foreign remittances and very likely improve the current account deficit.

All of these insights come to bear on the most important insight.

The housing debate is always far too limited in the media, and thus, it enables politicisation, not policy.

House prices to the moon no matter what!