On every metric, Australian housing is unaffordable.

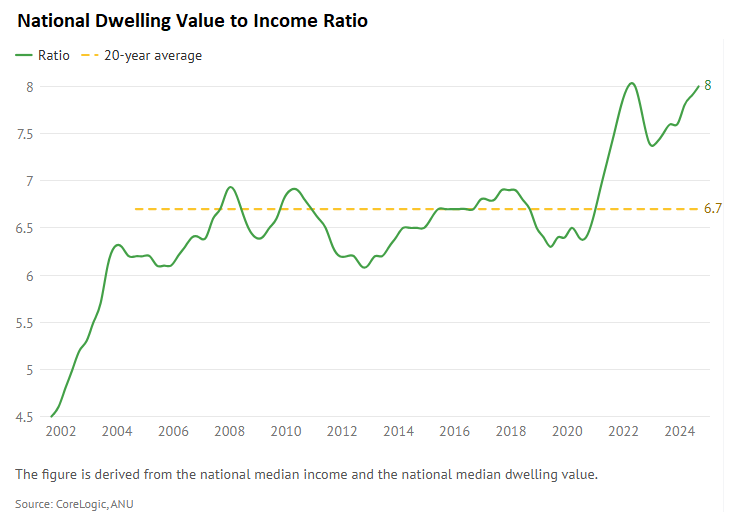

At the end of 2024, the national dwelling price-to-income ratio was 8.0, up from a 20-year average of 6.7 and nearly double the level of the early 2000s.

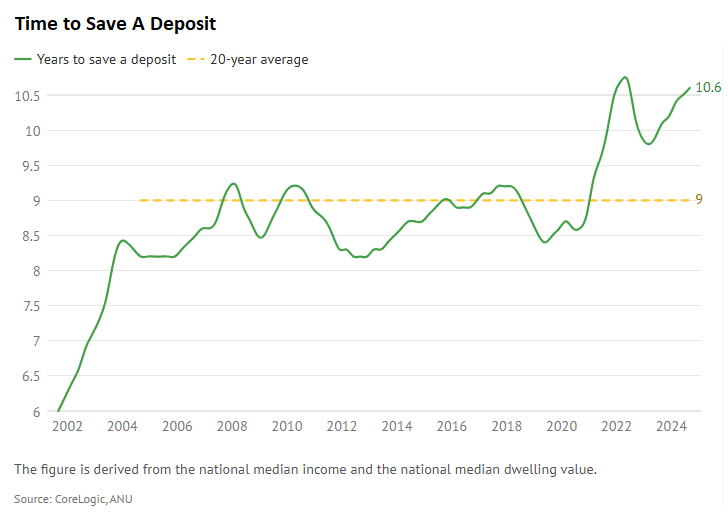

The number of years taken for a median-income household to save a deposit on a median-priced home was 10.6, up from 6.0 in the early 2000s.

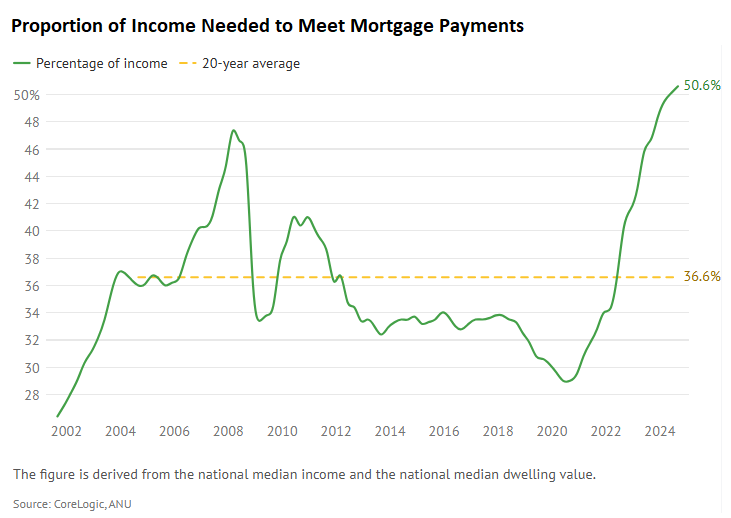

At the end of 2024, the median-income household needed a record high 50.6% of their income to meet mortgage repayments on the median-priced home.

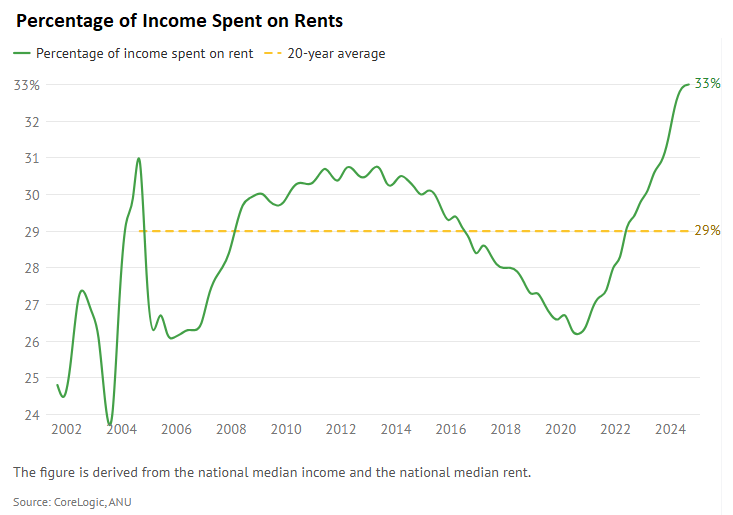

Finally, the share of income needed by the median-income household to meet median rental payments was a record high 33% at the end of 2024.

Despite the appalling metrics, Michael Yardney, the founder of Metropole Property Strategists, claims that “the real solution to Australia’s housing crisis may be rising house prices”.

Why? because “developers won’t build unless it’s profitable, and current prices don’t support viable returns”.

“Most large-scale developers reckon that prices have to rise 15-20% to make taking on the risk of developing new projects viable”, Yardney says.

“This isn’t just about greed; it’s about sustainability”.

“If prices continue to stagnate—or worse, fall—then the incentive to build diminishes, further exacerbating the shortage”.

Yardney also claims that “with strong population growth, continued supply shortages, and falling interest rates, today’s prices will seem like a bargain in 10 years”.

“By allowing house prices to rise, we enable a cycle of reinvestment into building more homes, which is crucial for meeting the needs of our growing population. It’s a tough pill to swallow but think of it as a short-term pain for long-term gain”.

Obviously, if home prices continue to rise, then affordability will by definition worsen. So too will the housing crisis.

The solution to Australia’s housing shortage is not for prices to rise so that it becomes a bit more profitable to build new homes.

Rather, it is to lower population demand via cutting immigration so that Australia doesn’t need to build as many homes.

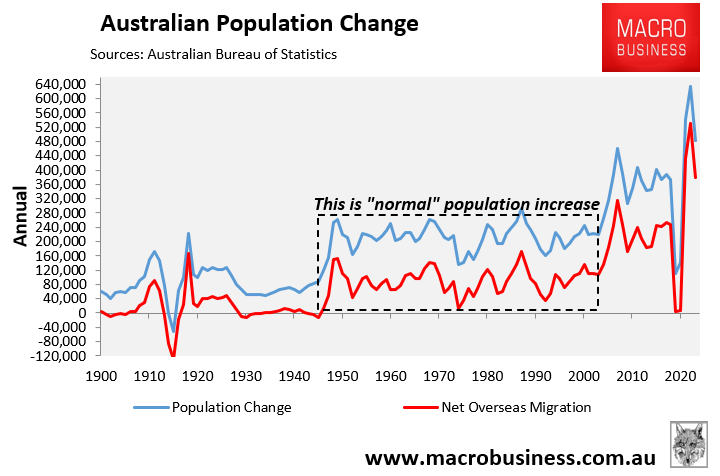

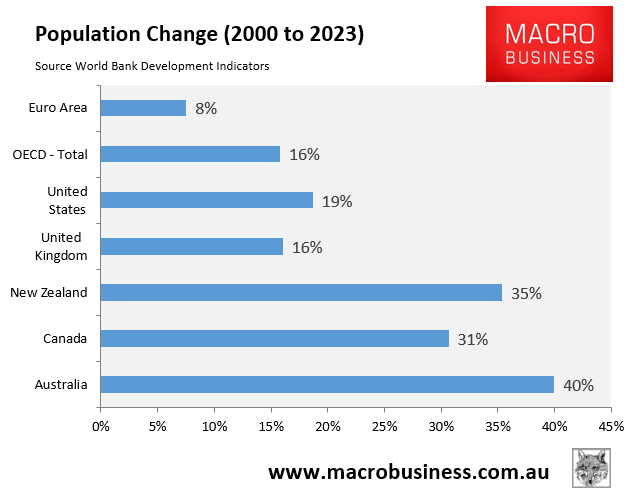

Australia has experienced the fastest population growth in the advanced world this century, which is why we are suffering from a housing shortage.

Significantly reducing immigration offers multiple benefits for housing affordability.

First, it would ensure that housing supply keeps up with demand, ensuring no housing shortages.

Second, it would lift rental vacancy rates and reduce rental inflation, benefiting tenants.

Third, lower rental inflation would enable first home buyers to save a deposit more quickly.

Finally, lower immigration would lower house prices directly, other things being equal, making it more affordable to purchase.

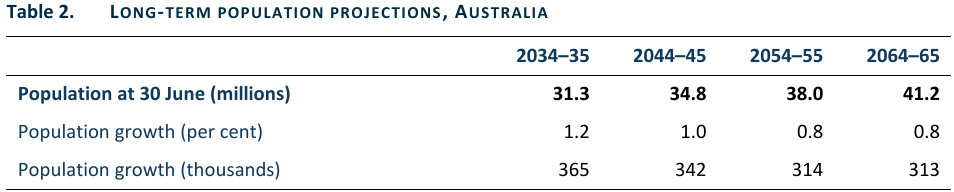

The latest projections from the Centre for Population show that Australia’s population will balloon to 13.5 million people over the next 40 years, equivalent to adding another Sydney, Melbourne, and Brisbane to the nation’s current population.

Source: 2024 Population Statement (Centre for Population)

Such excessive population growth will ensure that Australia’s housing market remains in a state of permanent crisis.