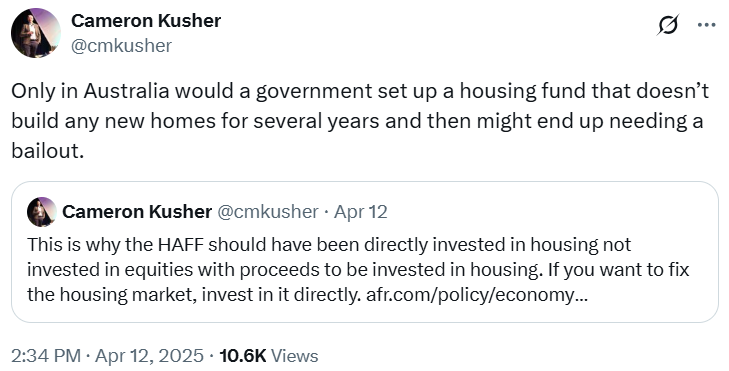

To quote independent housing analyst Cameron Kusher, “Only in Australia would a government set up a housing fund that doesn’t build any new homes for several years and then might end up needing a bailout”.

On Friday, it was reported that Labor’s signature Housing Australia Future Fund (HAFF), which was created with $10 billion of government debt in November 2023 and aims to build 30,000 social and affordable homes over five years via investment earnings, could require a taxpayer bailout.

The government is required to draw down $500 million on 1 July 2025. Given the global share market slump, there are fears that the HAFF’s balance could fall below its original $10 billion level.