Asian stock markets are doing somewhat better in response to the late rebound on Wall Street overnight but a big air of caution remains as the new month gets underway and the world awaits the onslaught of the new tariffs from the Trump regime tomorrow on April 2nd. The USD is pushing back against most of the major currency pairs with even Yen pulling back while the latest RBA meeting and subsequent press conference gave almost no reaction to the Australian dollar which remains below the 63 cent level.

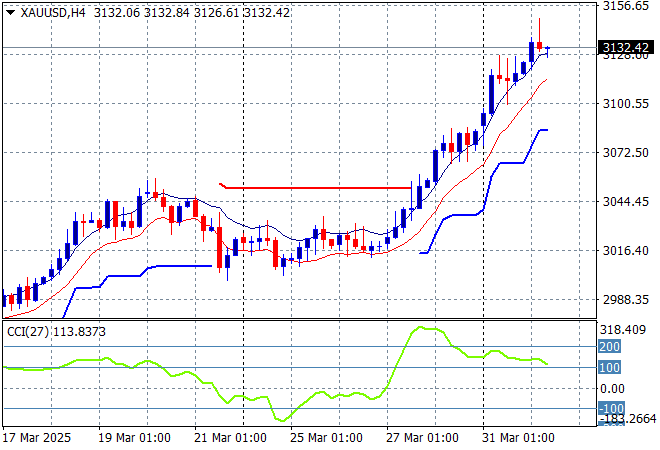

Oil markets are building some really good upside momentum with Brent crude breaking above the $74USD per barrel level while gold also continues to push higher, now soaring to the $3130USD per ounce level with short term momentum still extremely overbought!

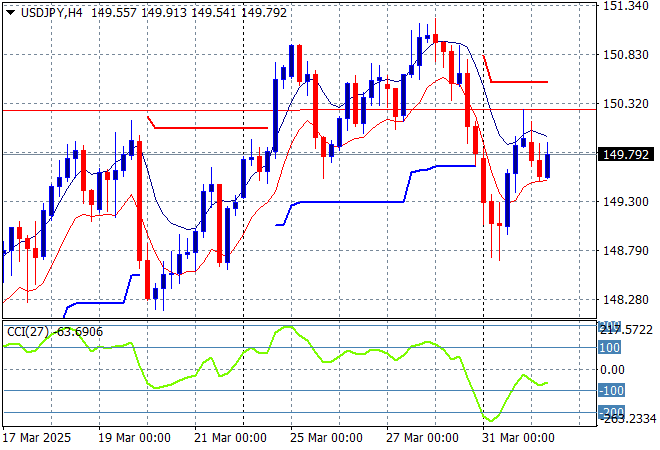

Mainland Chinese share markets are lifting slightly in afternoon trade with the Shanghai Composite up 0.3% while the Hang Seng Index is up by 0.4%, currently at 23211 points. Japanese stock markets are trying to stabilise after slumping in the previous session with the Nikkei 225 down 0.1% to 35616 points while the USDPY pair has failed to hold above last week’s highs at the 150 level, pushed back to the Friday night lows:

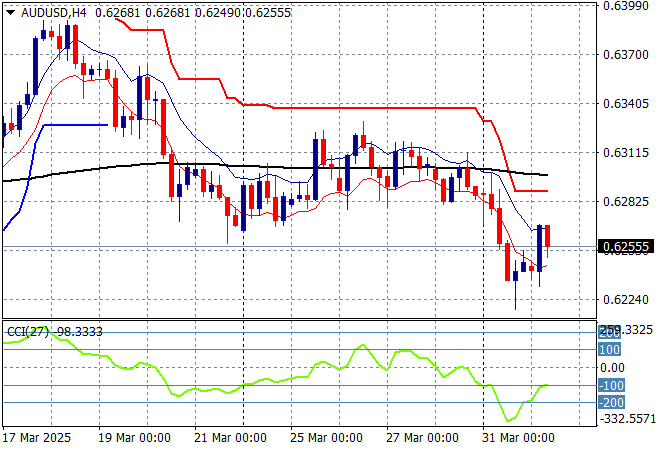

Australian stocks were again the best performing with the ASX200 closing more than 1% higher to close at 7925 points while the Australian dollar has bounced back slightly but is still well below the 63 cent level as the RBA held fire:

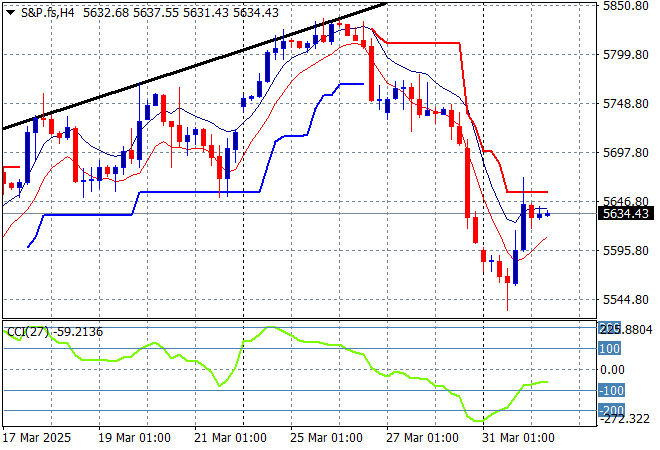

S&P and Eurostoxx futures are down and up respectively with the latter playing catchup to the bounce lead by Wall Street but a lot of caution is still hanging around. There is another dead count bounce forming here with the S&P500 four hourly chart showing a return to the previous lows of the post Trump election breakdown:

The economic calendar includes some flash inflation prints in the EU followed by a speech by ECB President Lagarde and then the US ISM Manufacturing survey.