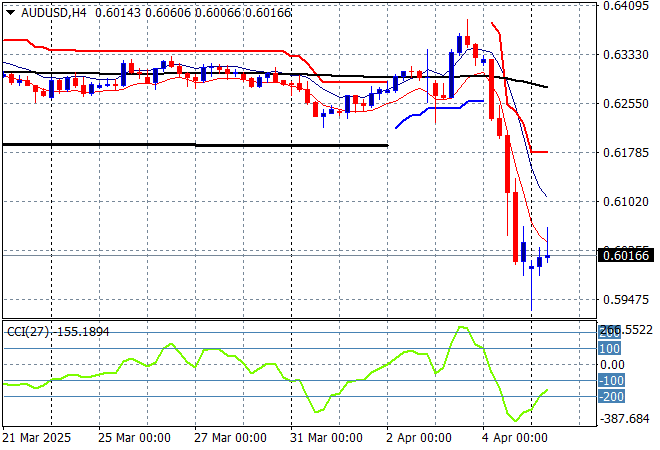

Well hasn’t this been a fun start to the trading week! A proper bath of blood here on Asian markets after the epic volatility from Friday on Wall Street as it looks like all the 2024 gains will be wiped out as the US at least will enter a bear market. All risk markets are being affected including commodities with the biggest casualty, so far being the Australian dollar which gapped down to the mid 59 cent level on the open against the USD but also falling against all the crosses.

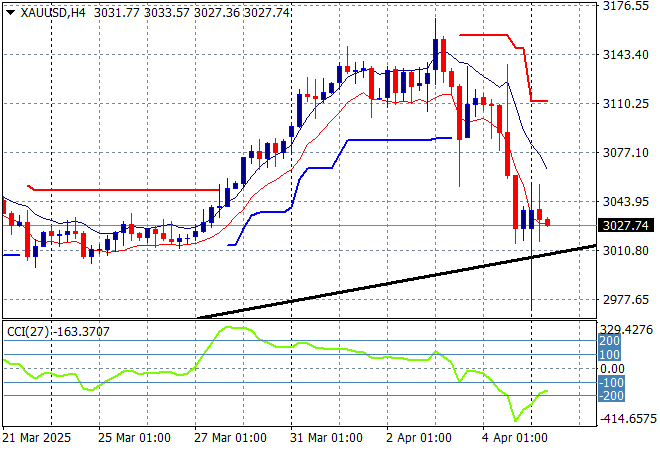

Oil markets continue to pull back very sharply with Brent crude now below the $64USD per barrel level while gold is struggling but just holding on above the $3000USD per ounce level:

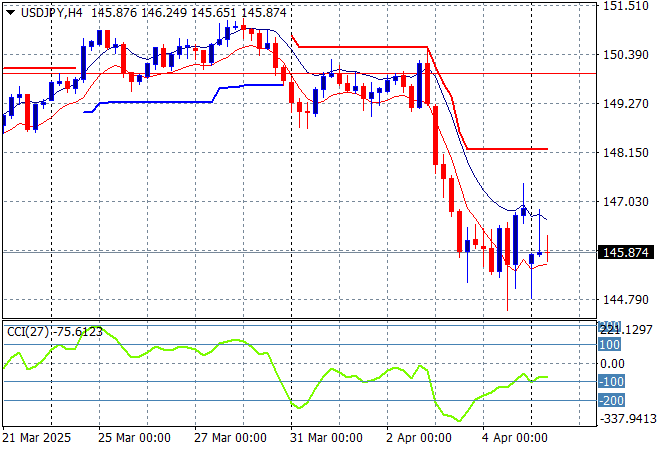

Mainland and offshore Chinese share markets reopened in shocking fashion with the Shanghai Composite losing more than 7.5% to 3100 points while the Hang Seng Index has plummeted more than 11%, currently at 20162 points. Japanese stock markets went limit down for awhile there with the Nikkei 225 falling 6.7% to 31519 points while the USDPY pair gapped below the 145 level before a small recovery in afternoon trade to return above the 145 level:

Australian stocks have not escaped the carnage with the ASX200 closing some 4% lower at 7346 points while the Australian dollar gapped sharply lower at the open before recovering in late afternoon trade to be just above the 60 cent level again but for how long:

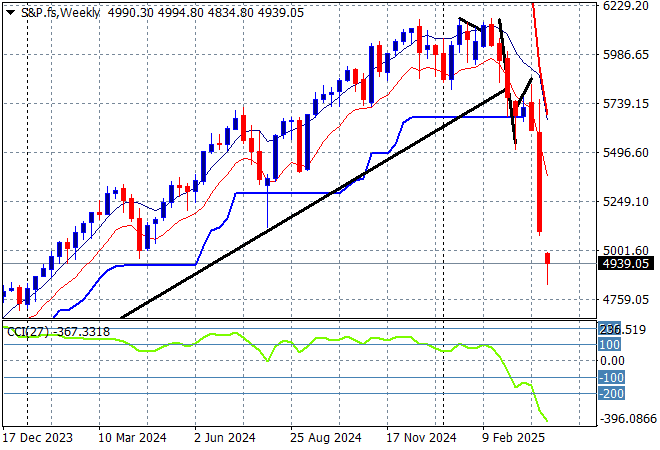

S&P and Eurostoxx futures are down significantly again with more selling expected on Wall Street tonight with the S&P500 weekly chart showing a complete wipe out of all the 2024 gains – good luck to whomever sold their stocks before King Trump came to his golden throne in January:

The economic calendar is usually quiet following the US NFP print, not that it matters at the moment.