Everything is awesome again as Asian share markets rebound following a fake news rally on Wall Street overnight but looking through the bounceback its more than apparent that everything remains decidedly on edge, particularly with the growing trade war between China and the US. The USD lost ground against all the majors in the correlated risk action with the Australian dollar back above the 60 cent level while Euro and Pound Sterling are looking better headed into the London session.

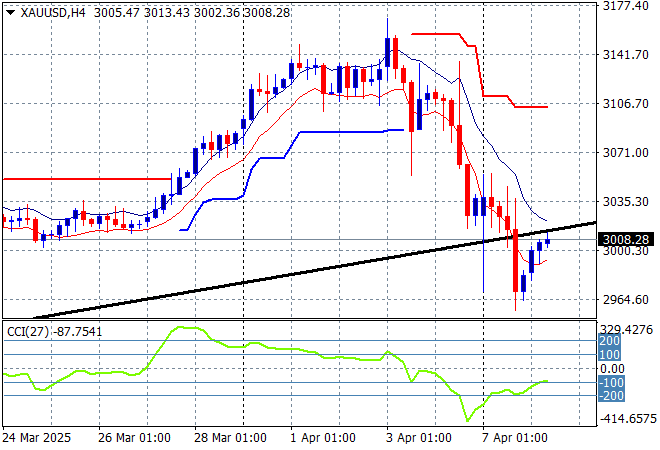

Oil markets however are failing to stabilise with Brent crude still below the $64USD per barrel level while gold is struggling to get back on track but is barely holding on above the $3000USD per ounce level:

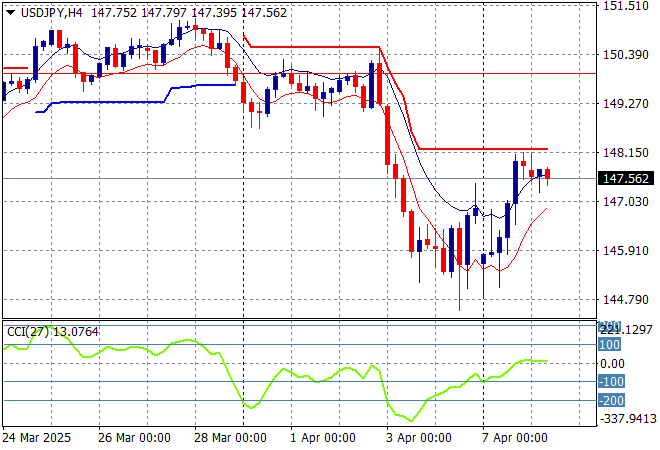

Mainland Chinese share markets are treading water in a calm but frantic way, watching what will happen with the next spat of tariff/counter-tariff moves with the Shanghai Composite up 0.4% to just get above the 3100 point level while the Hang Seng Index has moved a similar amount higher, currently at 19910 points. Japanese stock markets were very positive however and have soared higher with the Nikkei 225 up nearly 6% to 32908 points while the USDPY pair pushed back above the 147 level in afternoon trade to just below short term resistance:

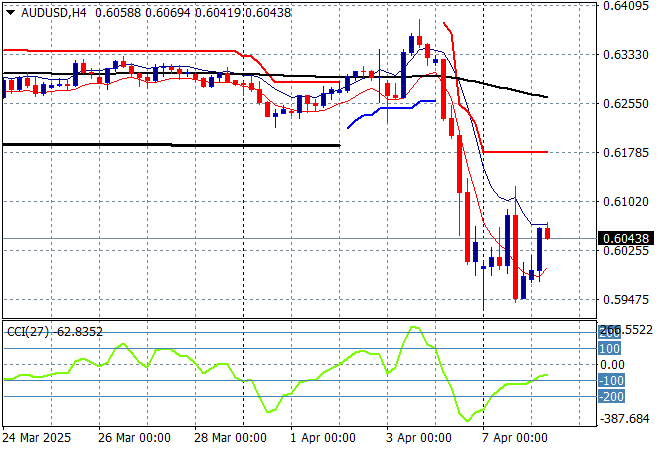

Australian stocks have had a modest bounce back with the ASX200 closing some 2% higher at 7510 points while the Australian dollar followed suit with a near 100 pip move higher to almost the mid 60 cent level but for how long:

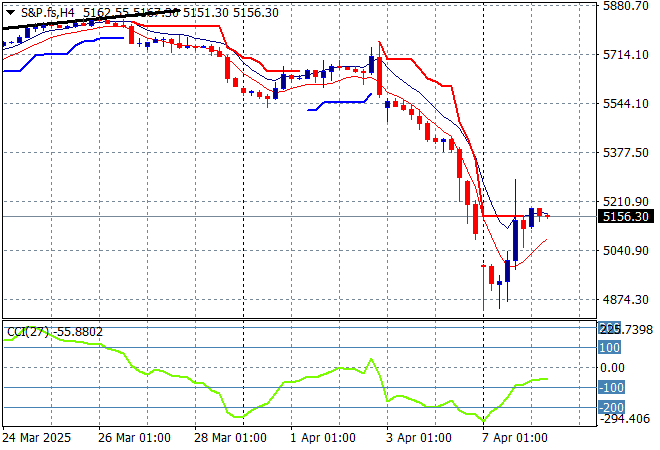

S&P and Eurostoxx futures are up 1.5% or so as we head into the London session with the S&P500 four hourly chart showing a classic dead cat bounce underway – watch out for the whiskers!

The economic calendar is quiet again tonight with some peripheral speeches but not much else to watch out for.