The number is 104, or approx. 10 more points than the average IQ in the White House but it will rattle markets around the world as the 104% tariffs on China from the Trump regime take effect, but this looks to be just another blip in the blooming trade war that has no end. S&P futures are down at least 2% going into tonight’s session with Asian markets down across the board – except in China. The USD lost ground against all the majors although Yuan is still at a record high while the Australian dollar can’t seem to get back above the 60 cent level.

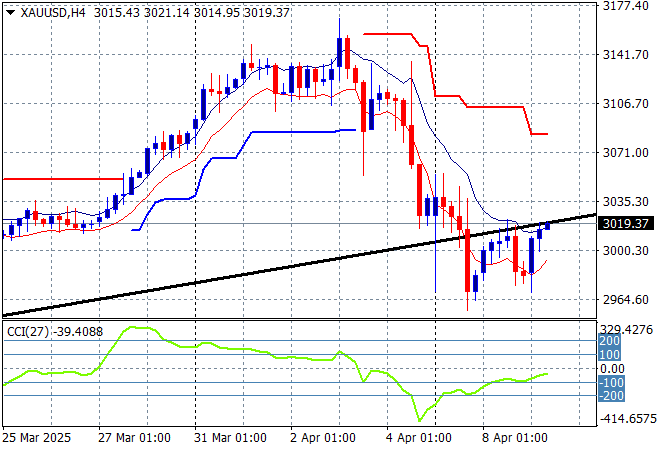

Oil markets are failing to stabilise with Brent crude now ready to move below the $60USD per barrel level as global recession fears build while gold is struggling to get back on track but has been able to get back above the $3000USD per ounce level:

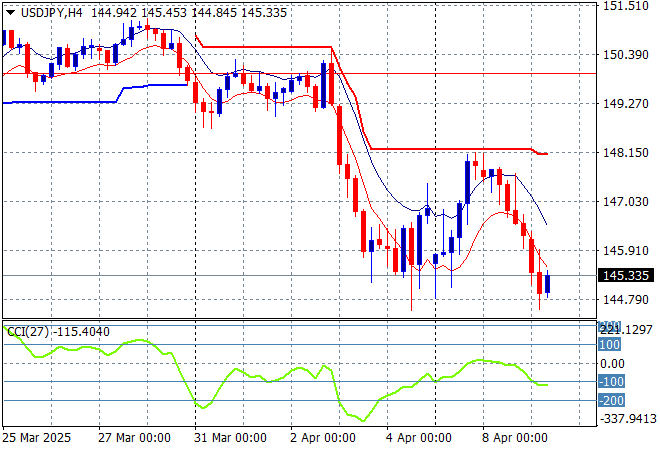

Mainland Chinese share markets are actually rallying this afternoon despite the counter-counter-counter tariff onslaught with the Shanghai Composite up 0.9% to extend above the 3100 point level while the Hang Seng Index has pulled back the other way, down 1.3% to 19860 points. Japanese stock markets are falling sharply however with the Nikkei 225 down over 4% to 31640 points while the USDPY pair has tried to stabilise at the 145 level but remains well below short term resistance:

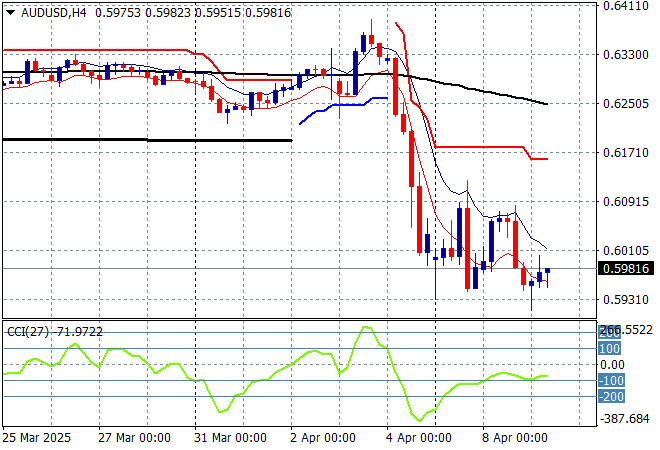

Australian stocks have had a big pullback as well with the ASX200 closing nearly 2% lower at 7510 points while the Australian dollar followed again declining back below the 60 cent level where its finding a modicum of support at the mid 59 area, but for how long:

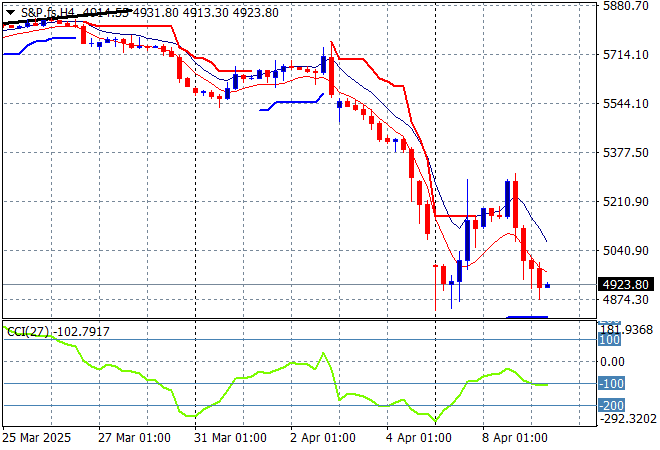

S&P and Eurostoxx futures are down 2% or so as we head into the London session with the S&P500 four hourly chart showing a classic dead cat bounce underway – watch out for the whiskers!

The economic calendar will look closely at the latest FOMC minutes tonight.