The Con Artist in Chief has dumped and pumped global stock markets with his near complete folding of the tariffs announced mere days (feels like months) ago, with huge rallies across Asian markets today as they play catchup to Wall Street. Even Chinese markets are floating higher despite the fact that this is but a temporary reprieve as the global economic trade war is still going to steamroll actual economies outside of stock and bond markets. Indeed it was the wobbles on US Treasuries that sent the Orange Mussolini to the negotiation table, as even his regime can’t escape the bond market. The USD has lost ground against most the majors although Yuan is now back to its 2024 levels while the Australian dollar had a wild ride to almost exceed the 62 cent level.

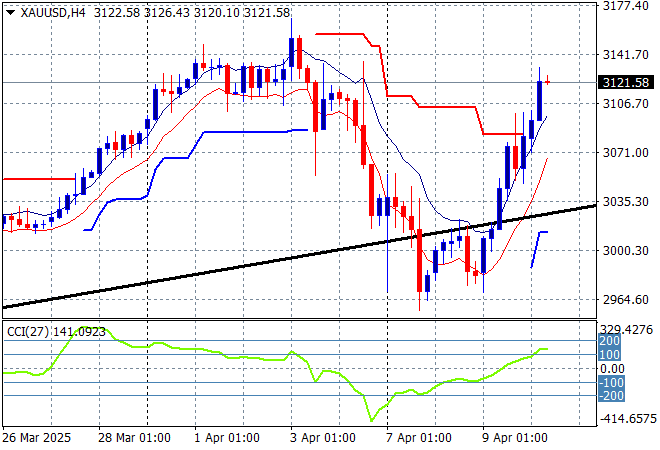

Oil markets are trying to stabilise with Brent crude steadying at the $65USD per barrel level while gold is getting back on track to shoot back above the $3100USD per ounce level:

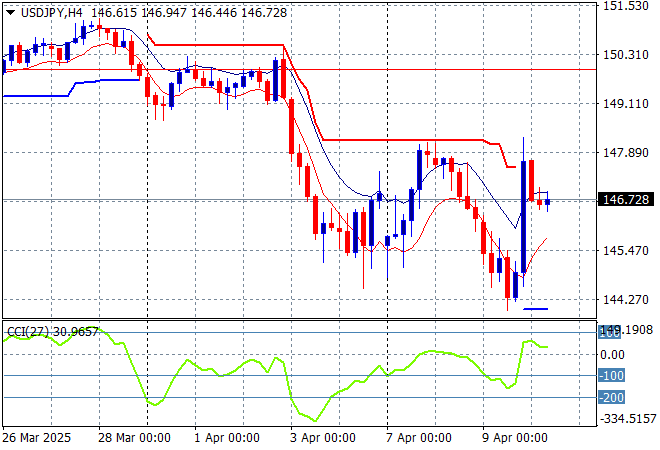

Mainland Chinese share markets are actually still higher this afternoon despite the major trade war with the US with the Shanghai Composite up 1% to extend above the 3200 point level while the Hang Seng Index has pushed some 3% higher to 20898 points. Japanese stock markets are the best performers however with the Nikkei 225 up nearly 9% to 34561 points while the USDPY pair has tried to stabilise at the 146 level but remains well below short term resistance:

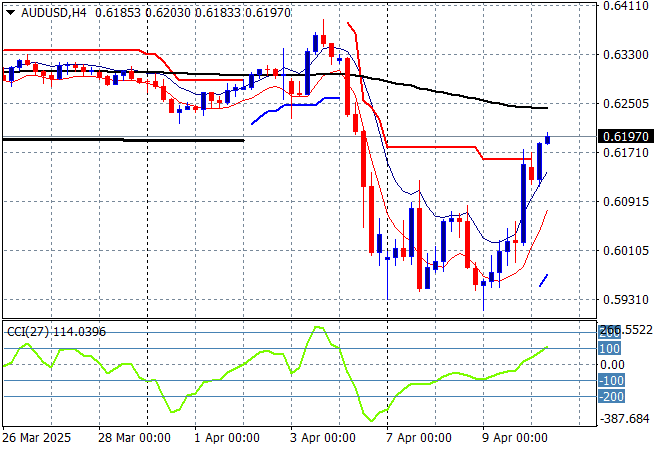

Australian stocks have had a big bounceback as well with the ASX200 closing nearly 4.5% higher at 7709 points while the Australian dollar followed suit as it nearly breaks through the 62 cent level after bouncing off the mid 59 area, but for how long as it comes up against former support now resistance:

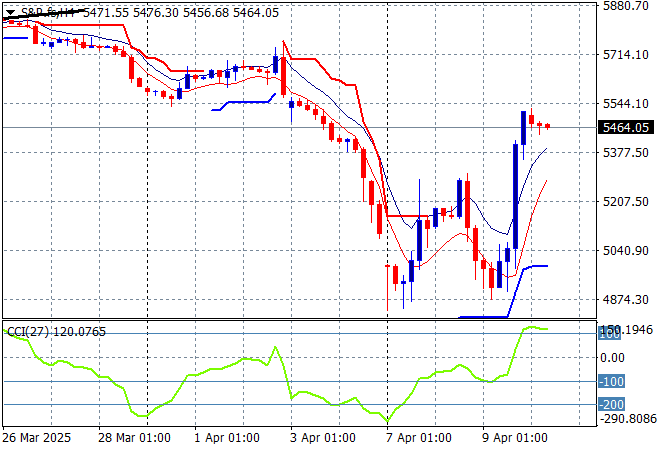

Eurostoxx futures are up 7% as they play catchup while S&P futures are a little flat as we head into the London session with the S&P500 four hourly chart showing a classic dump and pump scheme underway – watch out for more volatility ahead:

The economic calendar will focus squarely on the US March CPI print and initial jobless claims tonight.