You can’t stop the bond music as we see seismic shifts in global trade and risk markets with the pressure on US Treasuries building further even as the Trump regime tries to backtrack its kindergarten level economic stupidity, while the Chinese, EU and Canada deftly move the chess pieces around the table. The USD is fast losing its reserve currency basis with almost all the majors including gold zooming higher with the Australian dollar almost breaching the 62 cent level. Volatility in stock markets remains high but could escalate from here as bond markets remain rattled.

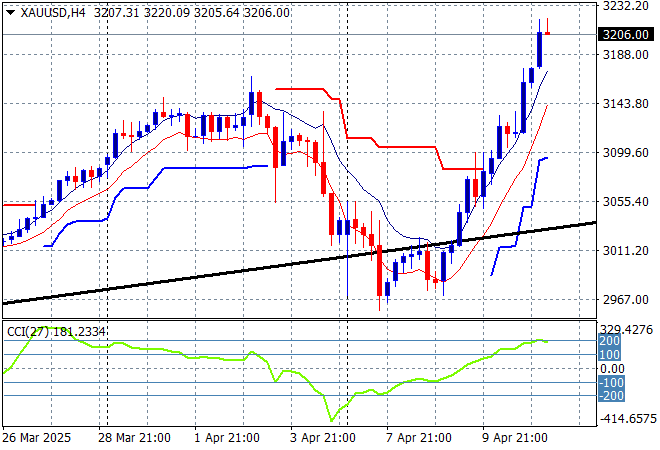

Oil markets are trying hard to stabilise with Brent crude steadying at the $62USD per barrel level but just barely while gold is getting back on track as it shoots back above the $3200USD per ounce level in what looks like an unsustainable move, but who wants to own USD right now?

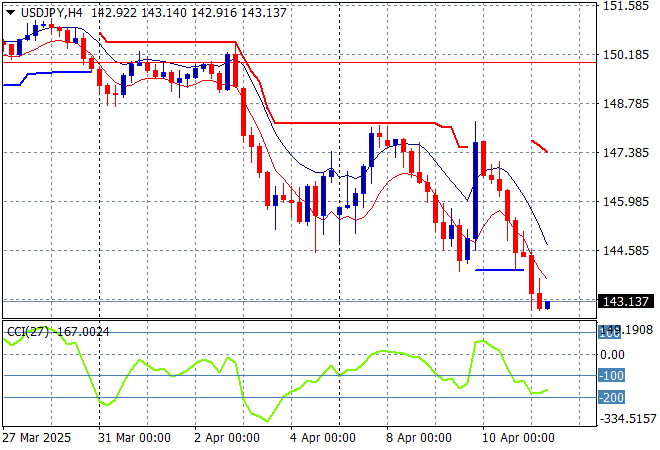

Mainland Chinese share markets are still higher this afternoon despite the major trade war with the US with the Shanghai Composite up 0.3% to extend above the 3200 point level while the Hang Seng Index has pushed some 0.5% higher to 20798 points. Japanese stock markets are the worst performers however with the Nikkei 225 down nearly 4% to 33184 points while the USDPY pair has failed to stabilise as it sells off sharply sending it down to the 143 level:

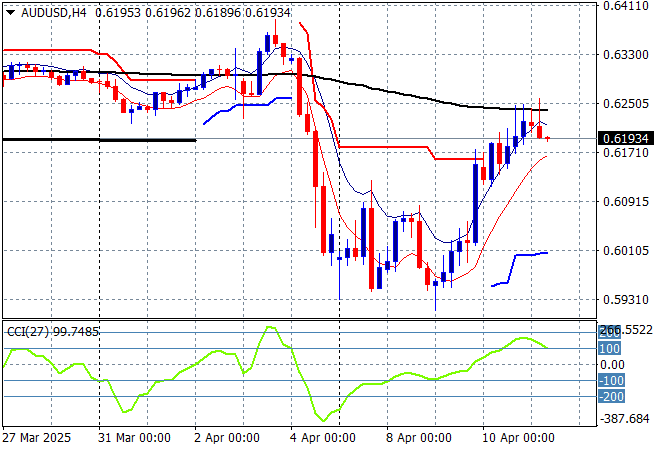

Australian stocks have pulled back the least with the ASX200 down just 1.3% at 7606points while the Australian dollar has found resistance again at the 62 cent level/200 day moving average area after its strong bounce off the mid 59 area, but for how long as this is all about the weaker USD so far:

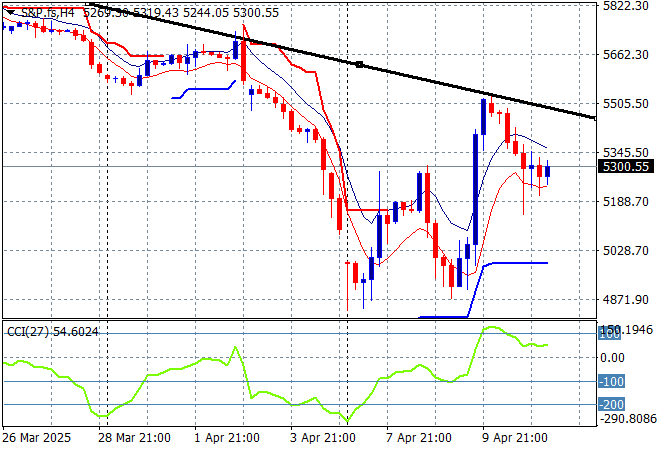

S&P and Eurostoxx futures are diverging again as the latter play catchup as we head into the London session with the S&P500 four hourly chart showing a classic dump and pump scheme underway – watch out for more volatility ahead:

The economic calendar ends the week with the latest US PPI inflation print tonight.