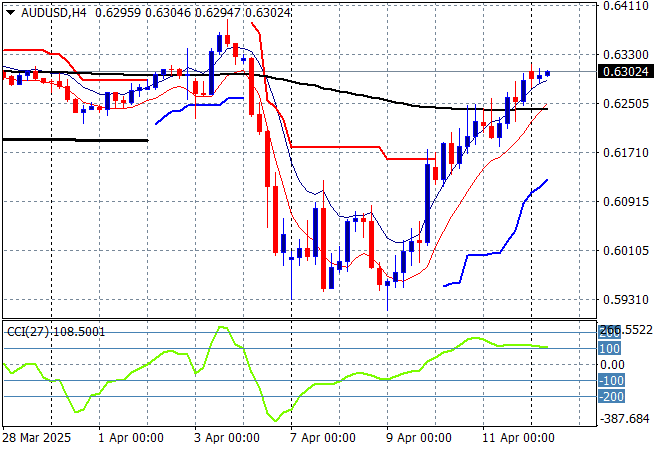

Finally a relatively non-volatile trading session today although the newsflow remains weird with more Trumpian two-steps around tariffs on Chinese goods, while all eyes remain on the canary in the mine – the bond markets. The USD is still slowly weakening as it loses its reserve currency status with almost all the majors including gold lifting slightly higher with the Australian dollar breaching the 63 cent level this afternoon.

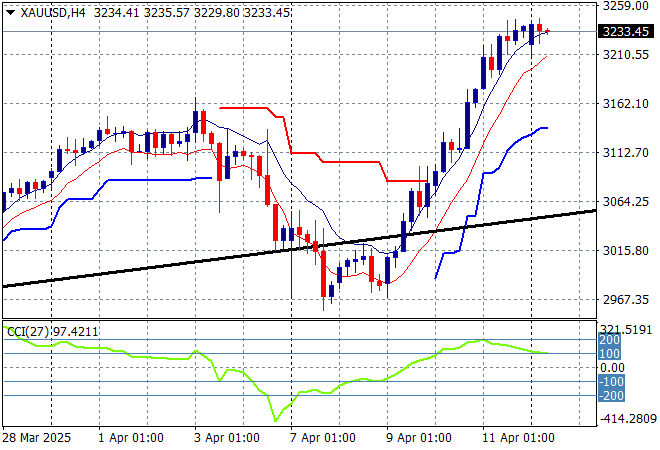

Oil markets are trying hard to stabilise with Brent crude steadying just below the $65USD per barrel level while gold is getting back on track as it remains well above the $3200USD per ounce level in what looks like an unsustainable move, but who wants to own USD right now?

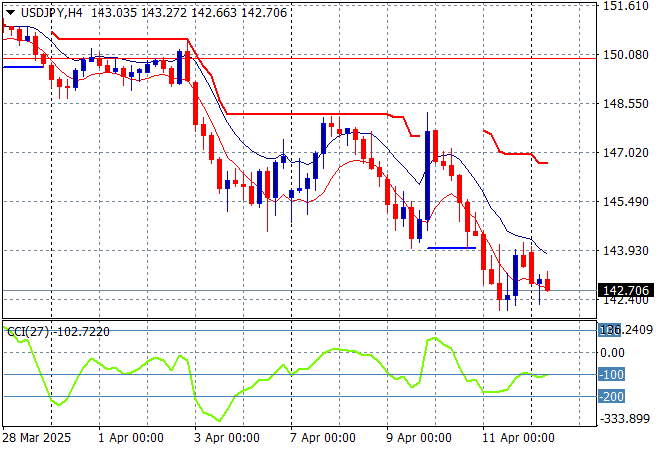

Mainland Chinese share markets are pushing higher this afternoon despite the major trade war with the US with the Shanghai Composite up 0.7% to extend above the 3200 point level while the Hang Seng Index has pushed more than 2% higher to 21336 points. Japanese stock markets are also playing catchup after a poor showing last week with the Nikkei 225 up nearly 1.7% to 34146 points while the USDPY pair is trying to stabilise at just below the 143 level:

Australian stocks have managed a very solid session with the ASX200 up 1.3% at 7746 points while the Australian dollar is toying with the 63 handle as its melt up on the weaker USD continues so far:

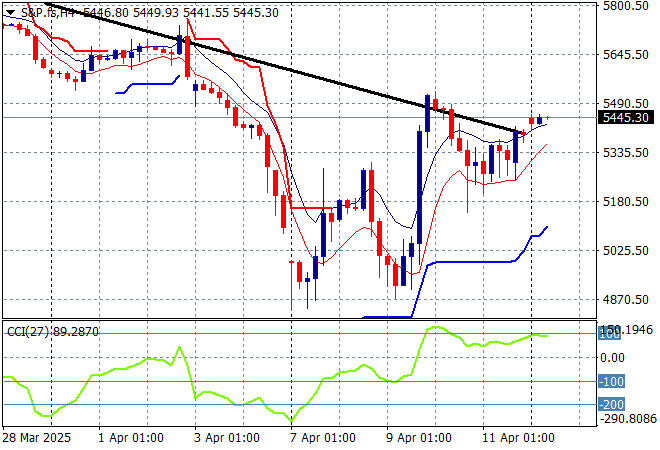

S&P and Eurostoxx futures are lifting slightly as we head into the London session with the S&P500 four hourly chart showing some upside potential:

The economic calendar starts the week relatively quietly with some Treasury auctions and a few peripheral Fed speeches tonight.