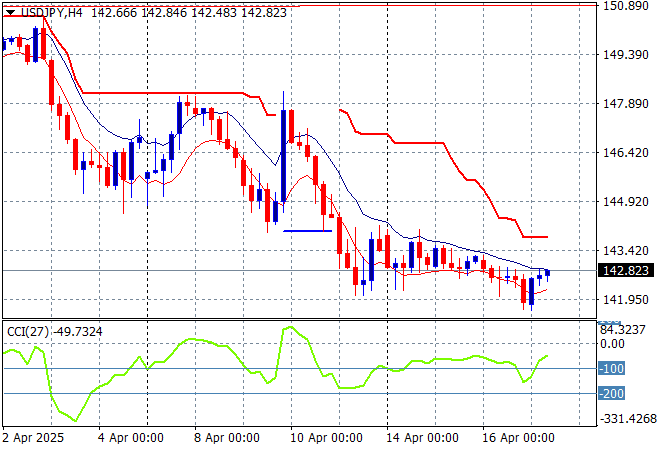

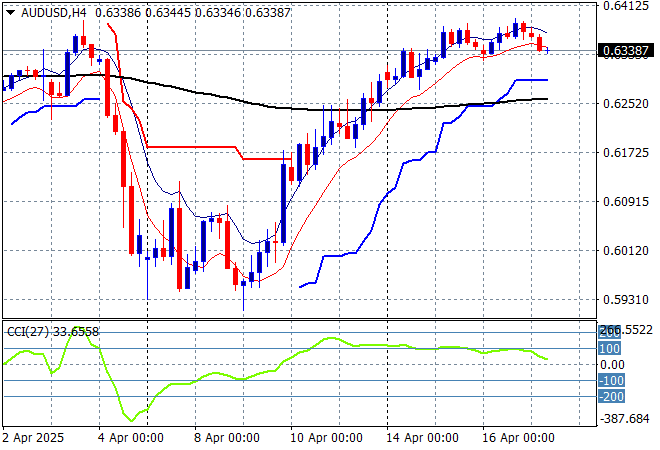

As the world fights back against the Trump regime’s tariff nonsense, the latest Japanese trade figures showing a sharp decline in exports to the US year on year while locally the latest numberwang showed mixed sentiment around employment that could upset the expected cut from the RBA in May. The Australian dollar is still holding firm above the mid 63 cent level this afternoon while Yen is weakening slightly on the trade news.

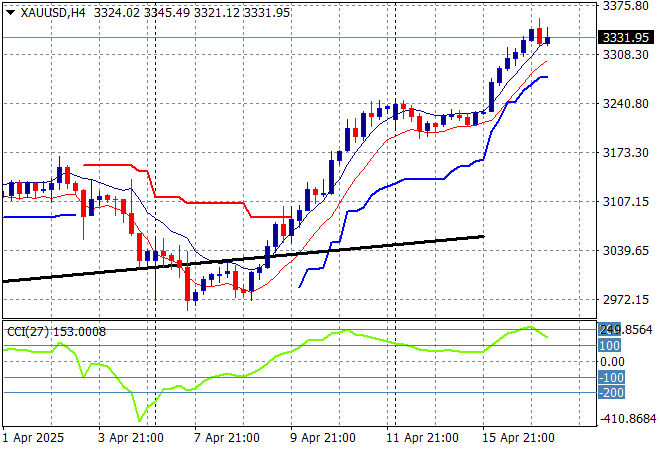

Oil markets are still trying hard to stabilise with Brent crude now breaching the $66USD per barrel level while gold is having another pause after zooming higher on the USD run after breaking through the $3300USD per ounce level:

Mainland Chinese share markets are slightly higher going into afternoon trade with the Shanghai Composite still above the 3200 point level while the Hang Seng Index has lifted 1% or more to recover back above the 21000 point level. Japanese stock markets are also doing well with the Nikkei 225 up over 1% to 34220 points while the USDPY pair is trying to stabilise as it heads back to the 143 level:

Australian stocks have managed a better session than expected with the ASX200 up 0.6% going into the close at 7808 points while the Australian dollar is holding just above the 63 handle despite the latest unemployment figures potentially upsetting the RBA’s May cut signalling as the run on USD continues so far:

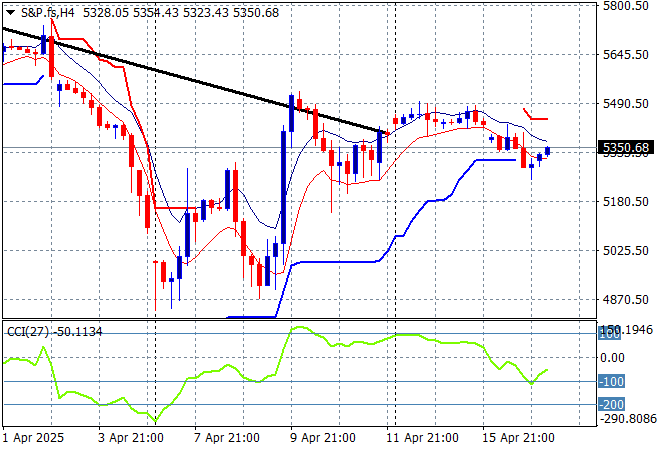

S&P and Eurostoxx futures are trying to fight back after the stumble on Wall Street overnight with the S&P500 four hourly chart showing this rollover phase not quite breaking through support after rejecting the 5500 level:

The economic calendar continues with the closely watched ECB meeting later tonight followed by US housing starts.