Risk markets are still in a positive mood generally speaking as they digest the possible weakening of Chinese tariffs but of course the Orange Mussolini is still a bit confused on what he wants to do at the granular level with more doublespeak during the session. Stocks are still fairly well bid while the USD continues to firm against most undollars as the Australian dollar tries hard but is failing to get back to the 64 cent level this afternoon.

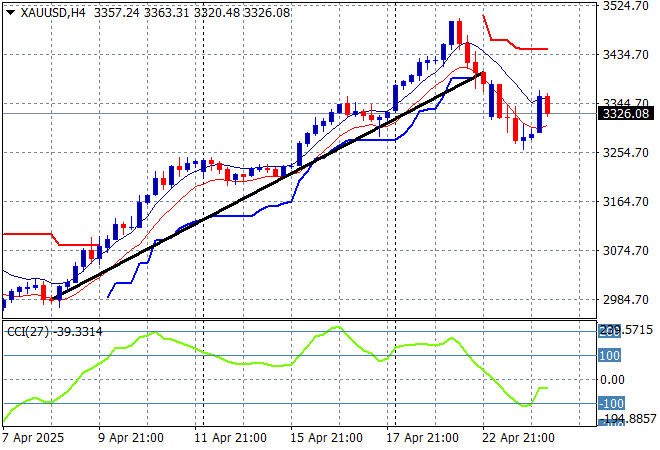

Oil markets are failing to stabilise with Brent crude now sliding down to the $56USD per barrel level while gold is trying to fight back with a slight rebound back above the $3300USD per ounce level:

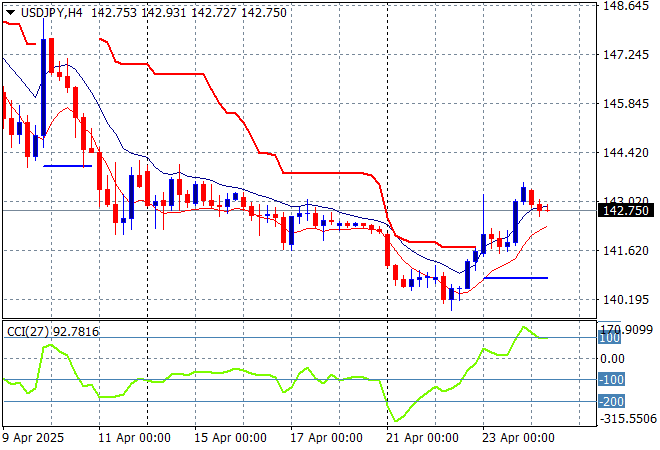

Mainland Chinese share markets are slightly higher going into afternoon trade with the Shanghai Composite just sneaking above the 3300 point level while the Hang Seng Index has pulled back around 1% to remain above the 22000 point level. Japanese stock markets are also doing well with the Nikkei 225 up nearly 0.4% to 35001 points while the USDPY pair is trying to hold above the 142 level:

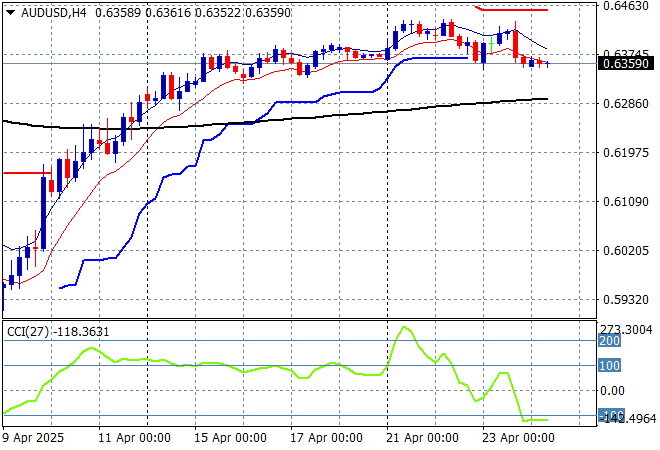

Australian stocks have managed a solid session with the ASX200 up 0.7% at 7976 points while the Australian dollar is holding just below the 64 handle as it recovers from a minor pullback:

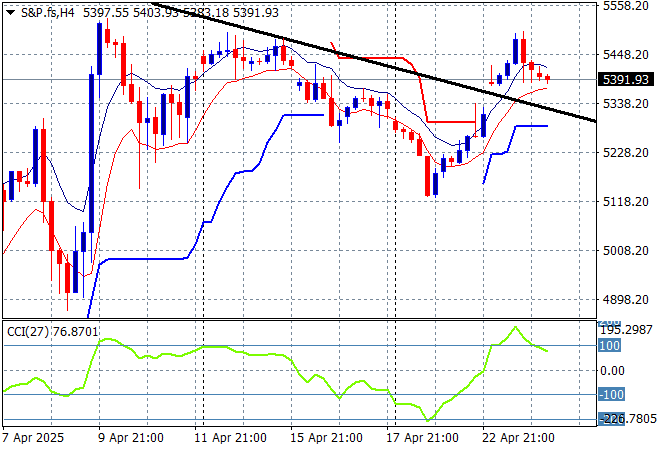

S&P and Eurostoxx futures are sliding back a little going into the London session with the S&P500 four hourly chart showing a deflated breakout at the 5400 point level:

The economic calendar includes the closely watched German IFO survey then US durable goods orders and existing home sales.