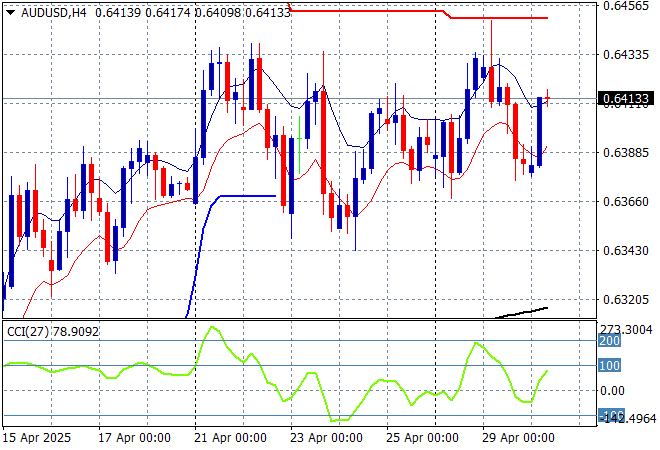

Some interesting local and Chinese reports were absorbed by markets in Asia today, with all eyes really on Friday’s US non farm payroll print and of course, any more waffles coming from the Oval Office about “deals” around Trump’s tariffs. The latest Chinese manufacturing PMI prints weren’t grim as expected but still so a sharp retraction while local inflation data points to a steady as she goes level for prices in Australia, but enough to give the RBA pause. The Australian dollar is trying hard but failed to lift further above the 64 cent level this afternoon.

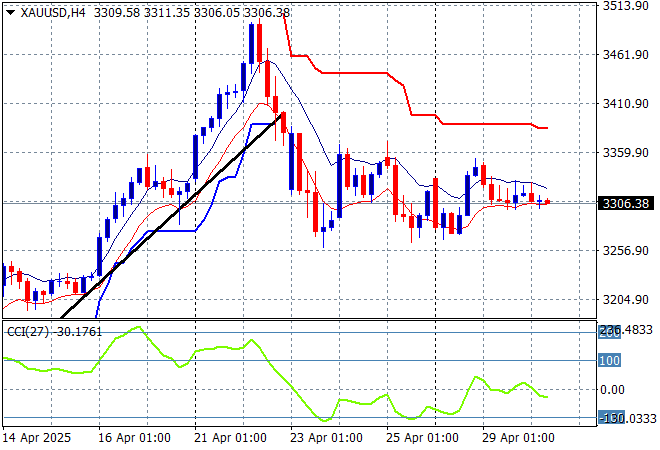

Oil markets are failing to stabilise with Brent crude now sliding below the $63USD per barrel level while gold is trying to fight back but is just holding on the $3300USD per ounce level this afternoon:

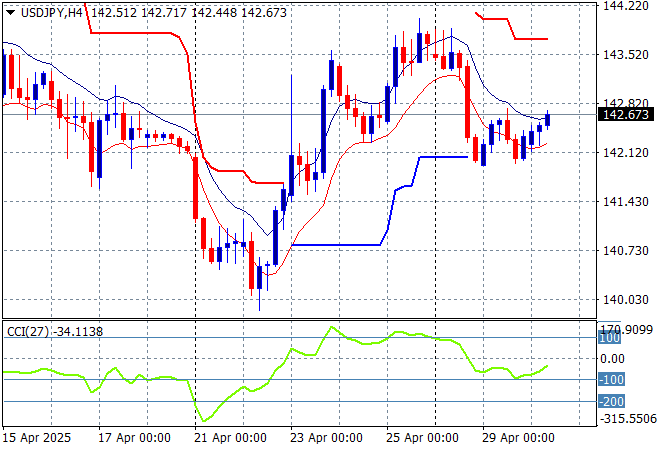

Mainland Chinese share markets are again slightly lower going into afternoon trade with the Shanghai Composite still below the 3300 point level while the Hang Seng Index has lifted just 0.2% to to remain above the 22000 point level. Japanese stock markets are back from holidays with the Nikkei 225 playing catchup to lift 0.4% to 35986 points while trading in the USDPY pair has been similarly positive as it builds above the 142 level:

Australian stocks have managed a very solid session with the ASX200 up more than 1% at 8126 points while the Australian dollar is holding just above the 64 handle as it thinks about another small breakout before this weekend’s election:

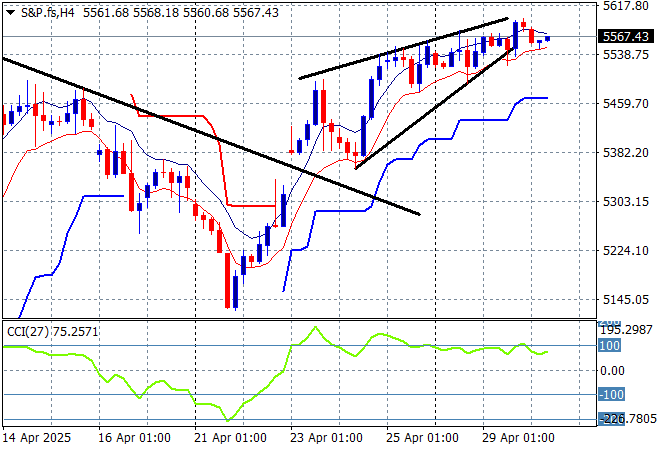

S&P and Eurostoxx futures are sliding back a little going into the London session with the S&P500 four hourly chart still showing a bearish rising wedge pattern here at the 5500 point level:

The economic calendar ramps up with German unemployment and inflation figures for April and then we get the latest US GDP Q1 estimates.