The bath of blood on risk markets continues to spill over with Wall Street falling 6% across the board on Friday night with more carnage expected here on the open of the new trading week in Asia. The latest US jobs figures came in better than expected but were roundly ignored as everything but the kitchen sink was sold as the Chinese hit back with reciprocal tariffs thus wrecking the “Chimerica” entwined economies. The USD came back against the undollars after being hit on all fronts with the Australian dollar the biggest casualty, almost breaking through the 60 cent level as Euro pulled back to its previous weekly highs around the 1.09 level.

10 year Treasury yields initially declined below the 4% level but came back slightly after the jobs report, but the yield curve is still baking in a US recession while oil prices have plunged to new lows, wiping out their recent breakout as OPEC+ announce new production quotes with Brent crude smashed back to the $65USD per barrel level. Gold also suffered after being the stable standout and retraced below the $3050USD per ounce level, finishing at the $3020 level.

Looking at stock markets from Asia from Friday’s session, where mainland and offshore Chinese share markets were closed for a festival holiday and they probably don’t want to re-open this week…

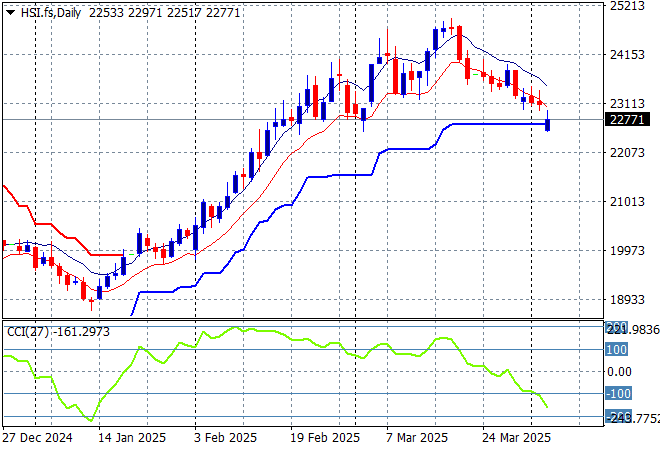

The Hang Seng Index daily chart shows how this recent move looked unsustainable to the upside after recently setting up for another potential breakdown around the 20000 point level. Momentum has retraced from being well overbought after beating the previous monthly highs at the 21500 level and is moving into the negative zone with support faltering at the 22000 point level:

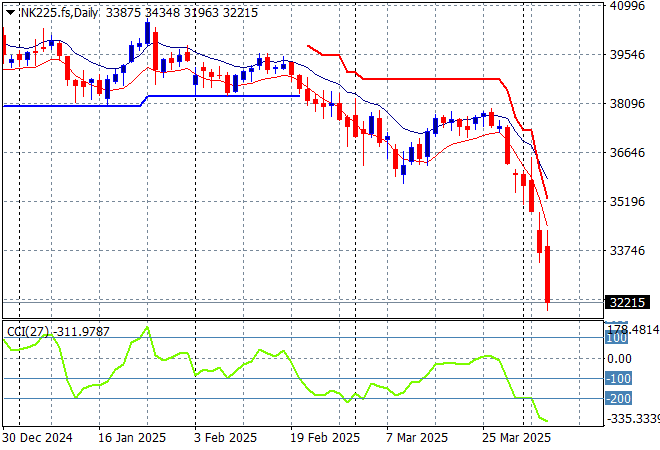

Meanwhile Japanese stock markets were having the worst of it with the Nikkei 225 down nearly 4% at one stage before closing 2.8% lower to 33780 points.

Price action had been indicating a rounding top on the daily chart for sometime now with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level now in full remission. Yen volatility alongside correlation with other risk markets are the main problem here, with futures indicating big losses on the open this morning:

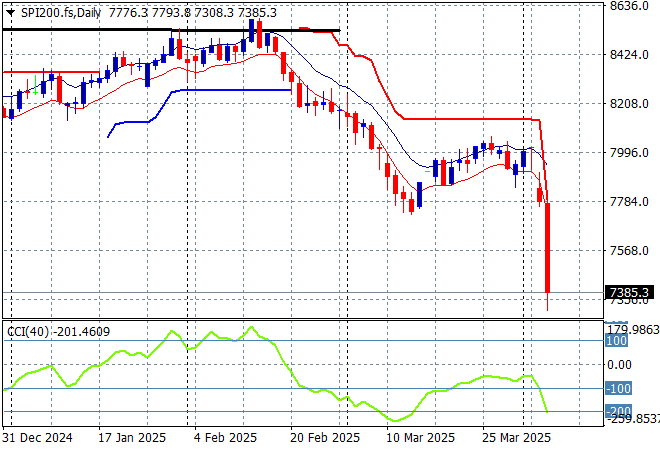

Australian stocks have not escaped the carnage with the ASX200 closing some 2.5% lower at 7667 points.

SPI futures are down at least 4.5% given the bloodbath on Wall Street from Friday night. The daily chart pattern suggests further downside is inevitable as the Chinese counter tariffs take effect and the Australian dollar crashes but I expect a short covering bounce sometime soon…maybe:

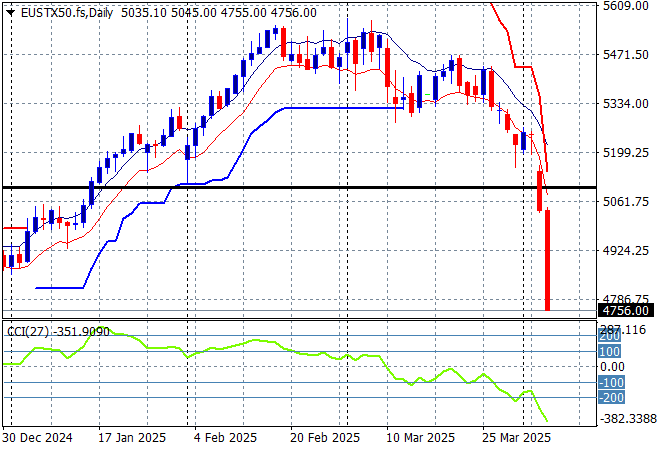

European markets were unable to escape the widespread selling with big moves lower across the continent with the Eurostoxx 50 Index finishing down 4.6% to 4878 points.

This was setting up for a breakdown with short term support taken out and the ATR support from the recent uptrend now broken as momentum went into oversold mode with this overshoot now fulling coming to pass. Support at the previous monthly support levels (black line) at 5100 points failed to hold so 2024 lows are now in sight:

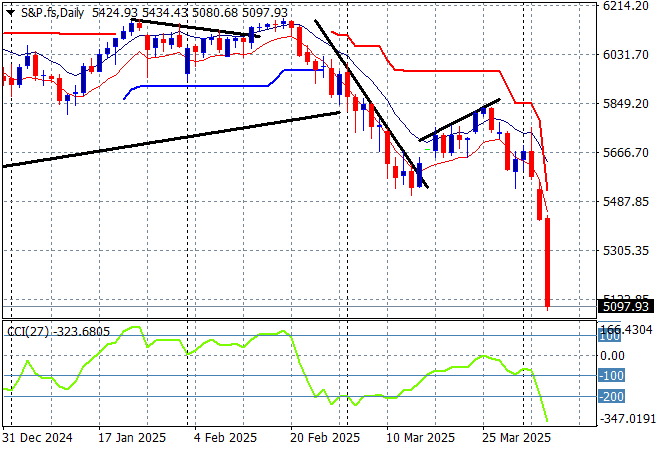

Wall Street saw further collapses with the NASDAQ again losing nearly 6% while the S&P500 also eventually closed more than 5% lower at 5074 points, exceeding their previous biggest one day losses in over five years.

The Trump pump and dump scheme is still in dump phase and could go much lower but could still bounce around on any new tariff re-negotiation announcement but it looks like this pill has more swallowing to go:

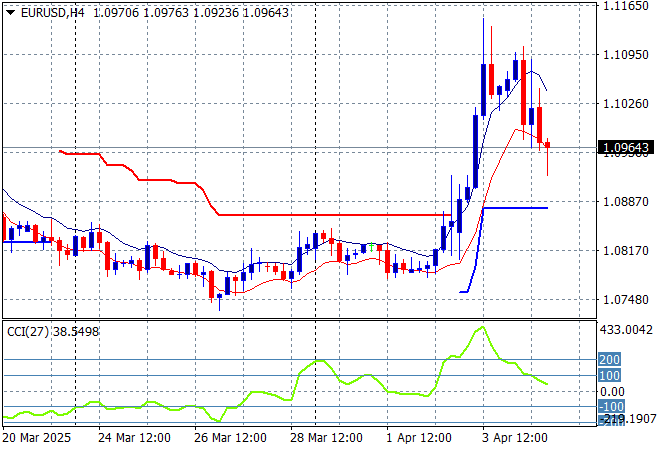

Currency markets flew higher against USD at the announcement of the Trump regime’s new tariff fantasy but are now seeing a return to the “King” Dollar amid the volatility as China and other nations retaliate. Euro saw a reversion back down to the 1.10 level following the NFP print and eventually settled just below that level on Friday night alongside some other reversions by Pound Sterling while commodity currencies were crushed on the OPEC+ and Chinese tariff news.

The union currency spiked up through the 1.11 handle before retracing in the previous session but couldn’t find support at the 1.10 level after the monthly US employment print – aka NFP -was released and is tentatively holding at the mid 1.09 level before the inevitable weekend gap:

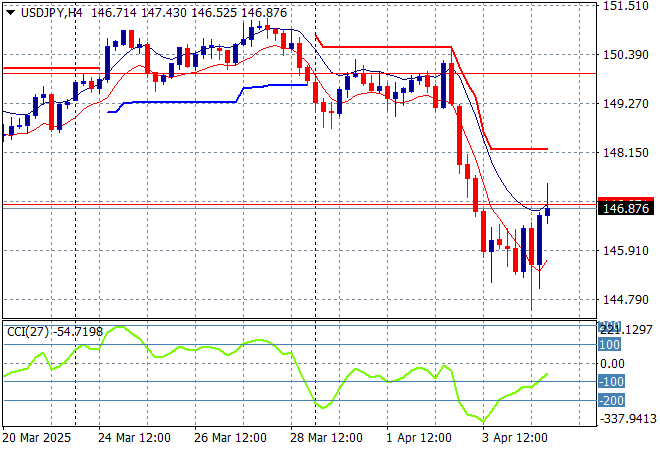

The USDJPY pair continued its sharp decline as Yen appreciated due to the tariff announcements, falling back down to the 145 handle before a quick recovery later in the session to just breach the 146 level.

Short term momentum is now again extremely oversold but is showing a potential swing play here as everyone scratches their head to work out what’s going on with Japanese export industry likely to crumble unless some significant moves are made by the BOJ and Japanese government alongside China:

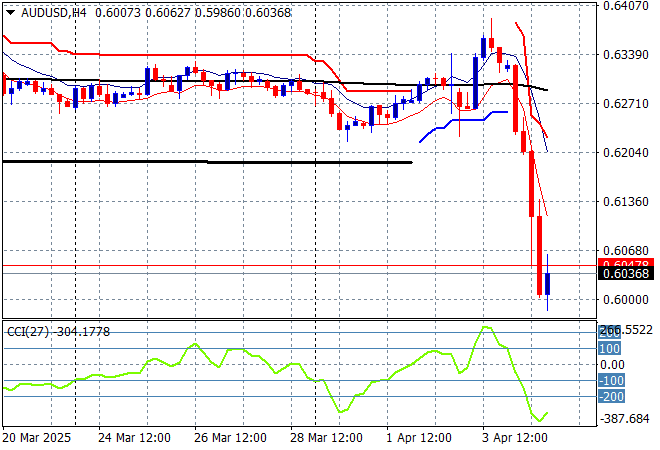

The Australian dollar had a wild ride like other undollars but due to facing far more headwinds from commodity worries it lost a lot of ground on Friday night, falling straight down to the 60 handle, giving the RBA another headache!.

Stepping back for a longer point of view (and looking at the trusty AUDNZD weekly cross) price action is now solidly below the 200 day MA (moving black line) and a new five year low – yes we are back to COVID times. Here comes inflation!

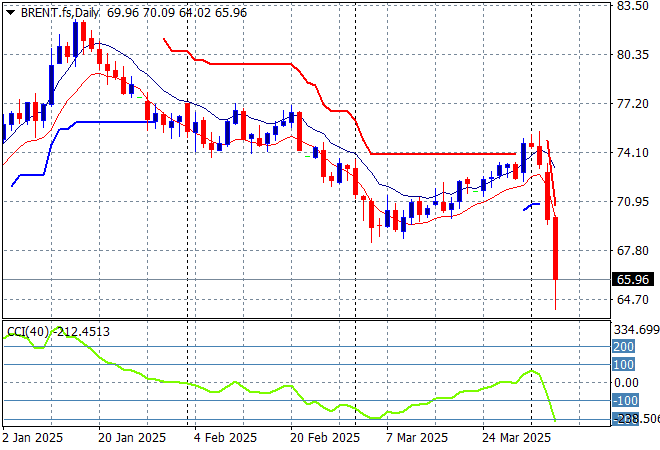

Oil markets had finally broke out as they made positive headway all last week but the double whammy of an engineered US recession plus OPEC+ production increases are seeing a sharp reversal underway with Brent crude pushed sharply lower and now below the $66USD per barrel level.

The daily chart pattern shows the post New Year rally that got a little out of hand and now reverting back to the sideways lower action for the latter half of 2024. The potential for a return to the 2024 lows was building here before this short term bounce and is now baked in :

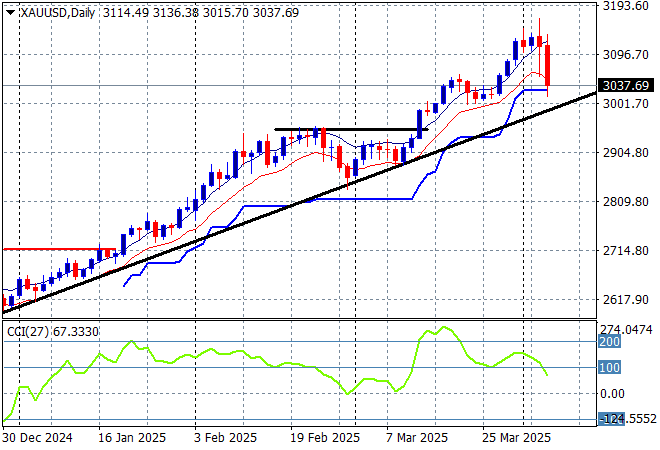

Gold finally suffered some volatility which could be its correlation with silver, but also a minor return to USD flows around the NFP print as the shiny metal fell sharply below the $3100USD per ounce level to daily support levels around the $3030 area.

Watch for short term support to hold with the potential to springboard from here on USD weakness on any dips as the main trendline remains intact:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!