Another fun night on risk markets as Trump folded on his tariff tirade with a 90 day stay of execution – except for China and everyone still gets a 10% hit irregardless of surplus/deficit/other vagaries – so of course the short covering was epic with Wall Street lifting 10% or more after the Royal Twit announcement. Bond markets however are still selling off as underlying the headlines, China is moving more pieces across the chessboard while the Pigeon-in-Chief is strutting around like he’s winning bigly. Currency markets saw similar reversals but not in the same magnitude although the Australian dollar bounced off its recent new low at the mid 59 cent level against USD, heading above the 61 handle this morning.

10 year Treasury yields surged again with another push above the 4.35% level with worrying signs on the long end of the curve while oil prices surged higher with Brent crude back above the $65USD per barrel level. Gold came back in spades as well with a surge above the $3000USD per ounce level, finishing at the $3085 area this morning before the Asian open.

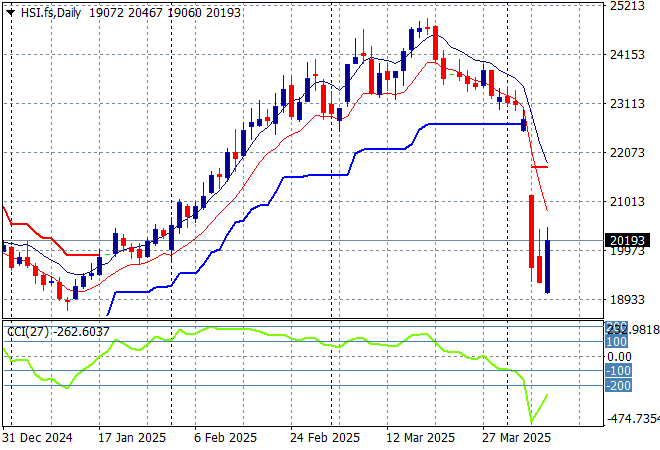

Looking at stock markets from Asia from yesterday’s session, where mainland and Chinese share markets actually rallied in afternoon trade despite the counter-counter-counter tariff onslaught with the Shanghai Composite up 1.3% to extend above the 3100 point level while the Hang Seng Index pulled back the other way, down 1.3% at one stage before recovering to close 0.6% higher at 20264 points.

The Hang Seng Index daily chart shows how this recent move looked unsustainable to the upside after recently setting up for another potential breakdown around the 20000 point level. Momentum has reversed completely to panic selling with support at the 22000 point level completely wiped out. More to come?

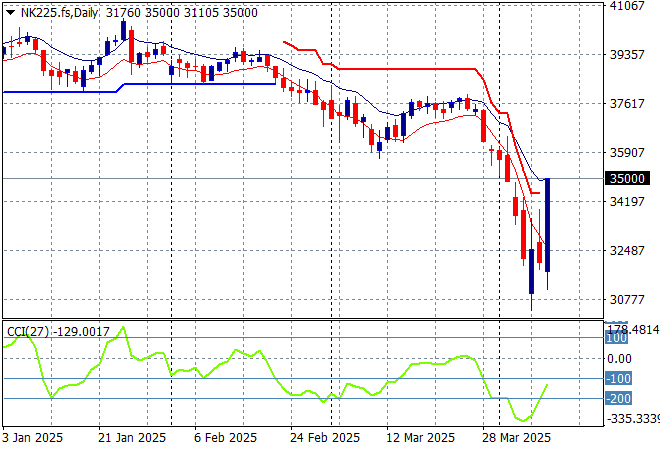

Japanese stock markets are falling sharply however with the Nikkei 225 down over 4% to 31640 points.

Price action had been indicating a rounding top on the daily chart for sometime now with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level now in full remission. Yen volatility alongside correlation with other risk markets are the main problem here, with futures are indicating a big lift on the open this morning:

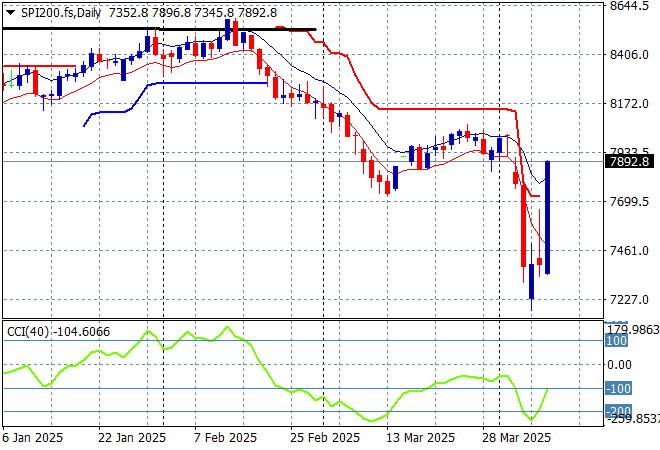

Australian stocks had a modest bounce back with the ASX200 closing some 2% higher at 7510 points.

SPI futures are up 6% or more given the huge reversal of fortune on Wall Street from overnight. The daily chart pattern however suggests further downside is inevitable as the Chinese counter-counter tariffs take effect but watch for a potential short covering rally back to 8000 points or so first:

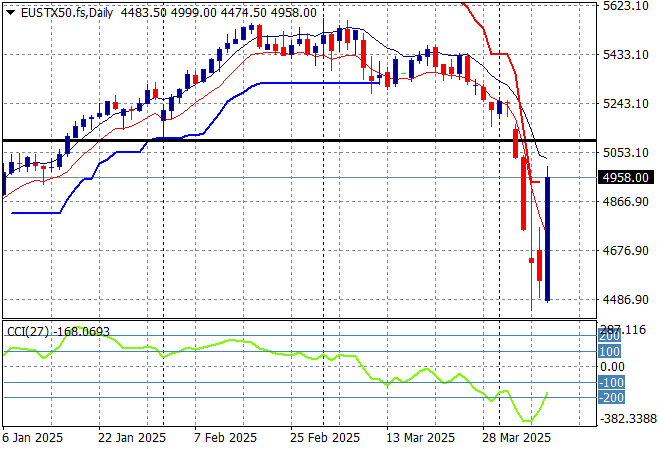

European markets were unable to escape more selling in the cash sessions with more lower moves across the continent with the Eurostoxx 50 Index finishing 3% lower at 4622 points but that has reversed in futures with an expected 5% rally later tonight.

Support at the previous monthly support levels (black line) at 5100 points failed to hold so 2024 lows at the 4400 point level are now in sight, baring a dead cat bounce here. Good time for more European defence stock purchases perhaps:

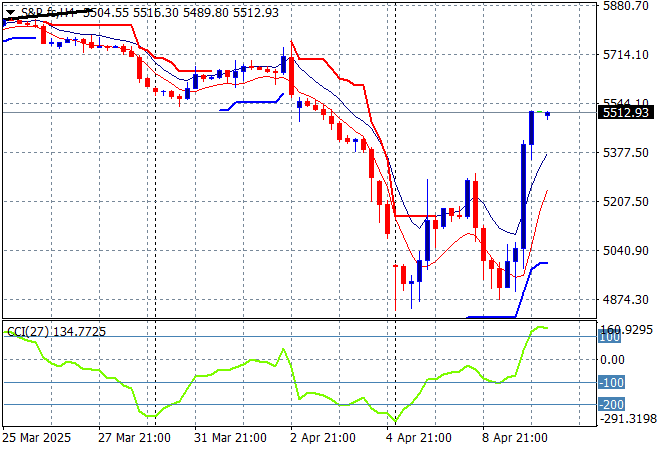

Wall Street was epically volatile – again – but this time to the upside with the NASDAQ out of control soaring 12% higher while the S&P500 jumped more than 6% to eventually close above the 5500 point level. Many Bothans died to give us this volatility.

The Trump pump and dump scheme is now out of dead cat bounce phase and into the “pump that cat full of steroids and see if it revives” stage. I still contend we are going lower but 90 days is a LONG time with that fat idiot in the Oval Office:

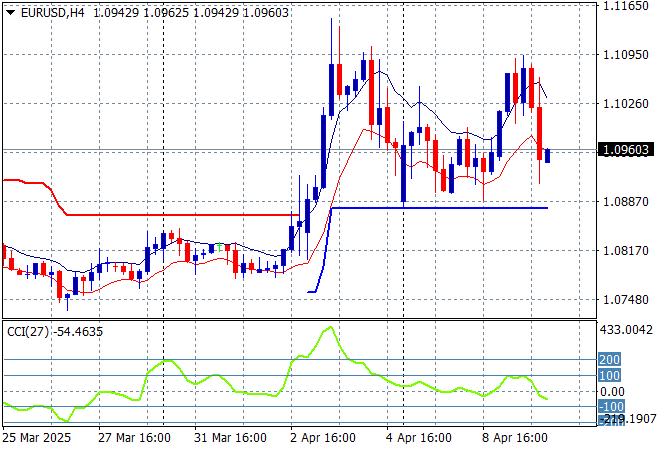

Currency markets had the least volatile moves among the risk complex but there was still a lot of action back and forth towards and away from “King” Dollar with Euro still continuing its reversion back down to the 1.09 level with Pound Sterling remaining near its own four week low.

The union currency spiked up through the 1.11 handle before retracing in the previous session but couldn’t find support at the 1.10 level after the monthly US employment print on Friday and is now getting pushed back towards the 1.09 level proper where a new battle will be fought:

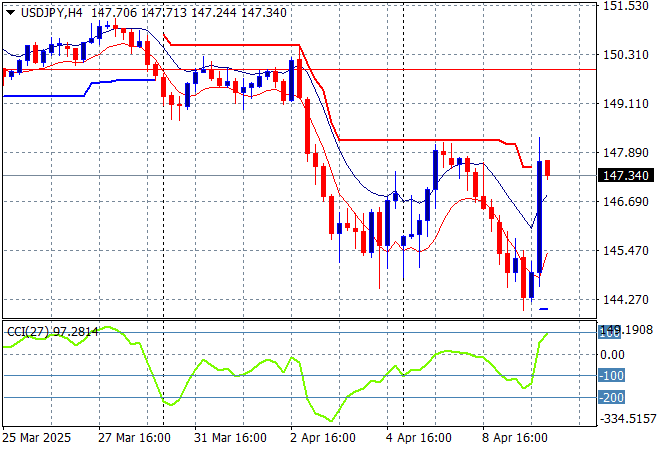

The USDJPY pair bounced back after its sharp decline, but is still hitting short term resistance overhead at the 147 level.

Short term momentum was extremely oversold and showed a potential swing play here as everyone scratches their head to work out what’s going on with Japanese export industry likely to crumble unless some significant moves are made by the BOJ and Japanese government alongside China:

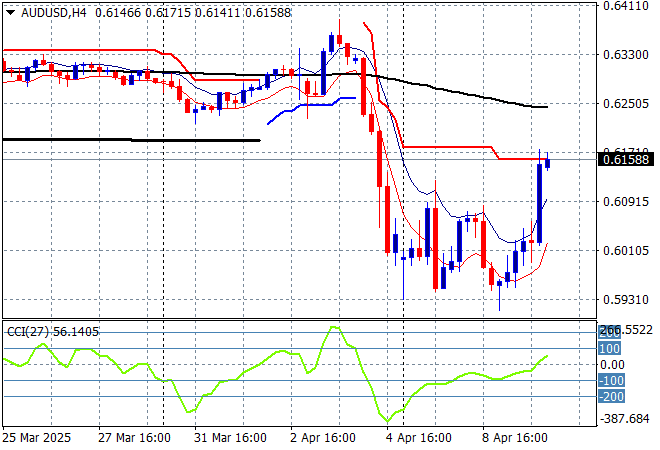

The Australian dollar continues to have a wild ride like everything else as it bounced off the mid 59 cent level overnight, soaring 150 pips to the mid 61 level following the Trump dump.

Stepping back for a longer point of view (and looking at the trusty AUDNZD weekly cross) price action is still solidly below the 200 day MA (moving black line) and near new five year low. This is not yet over but watch for an attempt to get back to the 62 cent level in the short term first:

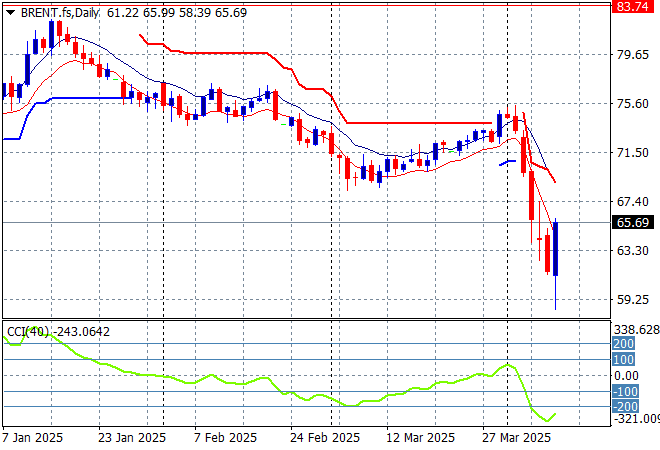

Oil markets also had a sharp reversal with Brent crude pushed back above the $65USD per barrel level overnight after hitting a new low but don’t look out of the woods just yet.

The daily chart pattern shows the post New Year rally that got a little out of hand and now reverting back to the sideways lower action for the latter half of 2024. The potential for a return to the 2024 lows was building here before this short term bounce and is now baked in and then some as demand will collapse despite the very short term change in sentiment:

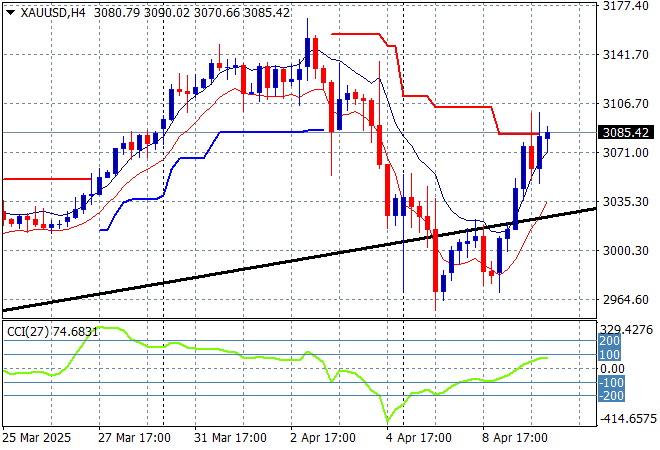

Gold suffered further volatility but this time it was to the upside along with everything else as the shiny metal zoomed above the $3000USD per ounce level after recently breaching its long term trendline to finish this morning at $3085USD per ounce.

Short term support has held here at the $2950 level and made an attempt to get back on track but short term momentum is not yet overbought so we could see a small side down in today’s session back to the $3000 level proper:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!