Risk sentiment is now rolling over again as stock market volatility lifts higher mainly due to potential earning slumps on tech stocks aka NVIDIA due to the Trump regime’s tariff madness. The latest US retail sales figures (pre-tariff numbers) came in as expected and Fed Chair Powell tried to provide some hope through it all with some helpful bidding on US Treasuries reducing yields across the curve. The USD however isn’t recovering with Euro again taking the lead moving higher alongside Yen. The Australian dollar is pushing above the 63 handle alongside a resurgent Kiwi which is now threatening the 60 handle.

Oil prices are trying to build some support with Brent crude finally getting above the $65USD per barrel level while gold had its best one day run in over a decade, zooming more than $100USD per ounce higher to breach a new record high above the $3300USD per ounce level.

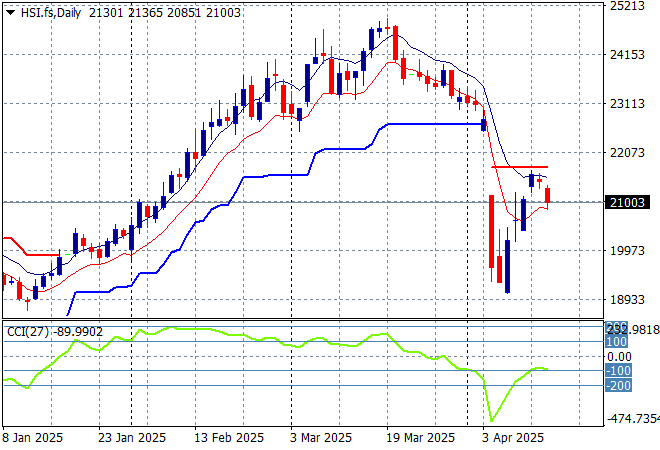

Looking at stock markets from Asia from yesterday’s session, where mainland Chinese share markets were slightly lower going into afternoon trade but have recovered with the Shanghai Composite still above the 3200 point level while the Hang Seng Index was slammed back nearly 2% lower to 20954 points.

The Hang Seng Index daily chart shows how this recent move looked unsustainable to the upside after recently setting up for another potential breakdown around the 20000 point level. Momentum has reversed completely to panic selling with support at the 22000 point level completely wiped out. More to come or is everything awesome:

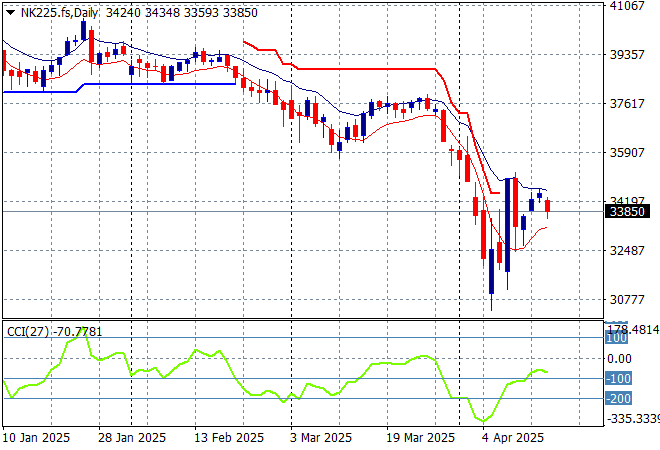

Japanese stock markets are also slipping with the Nikkei 225 down over 1% to 33920 points.

Price action had been indicating a rounding top on the daily chart for sometime now with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level now in full remission. Yen volatility alongside correlation with other risk markets are the main problem here, although futures are indicating a retracement on the open this morning:

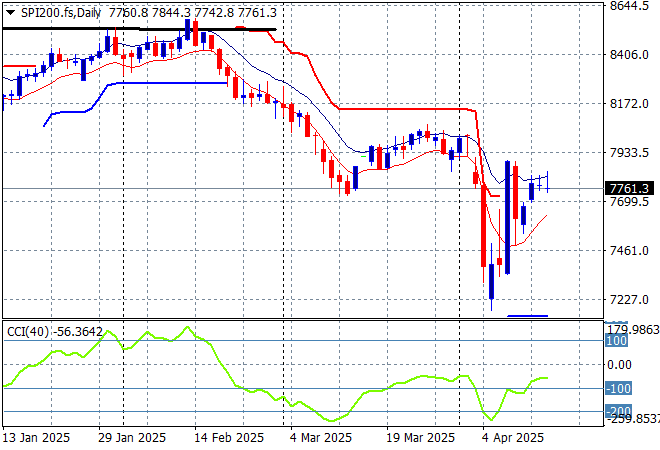

Australian stocks managed another very staid session with the ASX200 barely moving at 7758 points.

SPI futures are down 0.3% but the open does not look good as Wall Street fell sharply overnight. The daily chart pattern suggests further downside is inevitable as the Chinese counter-counter tariffs take effect but watch for a potential short covering rally back to 8000 points or so first:

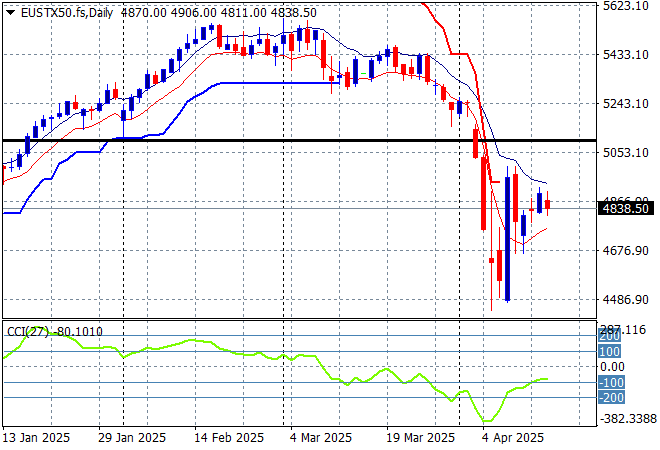

European markets were unsteady in their physical sessions overnight with moderate lifts and losses across the continent with the Eurostoxx 50 Index finishing just 0.1% lower at 4966 points.

Support at the previous monthly support levels (black line) at 5100 points failed to hold so 2024 lows at the 4400 point level are now in sight, baring a dead cat bounce which seems to be forming here. Still a good time for more European defence stock purchases (almost):

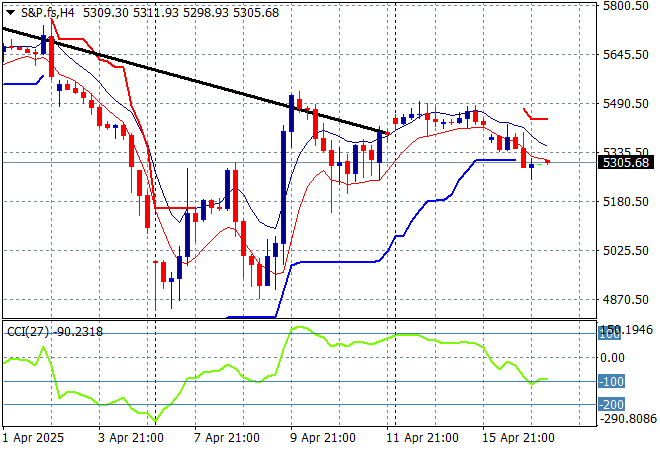

Wall Street surged in volatility with tech stocks leading the way as the NASDAQ dropped 3% while the S&P500 was pushed nearly 2.2% lower to eventually close at the 5275 point level.

There was a lot for US equity markets to absorb overnight but this was mainly led by tech stocks although earnings are under the microscope for industrials as well. This looks like the next stage of the rollover as short term ATR support here on the four hourly chart comes under pressure as momentum wanes:

Currency markets are still wanting to push the US Dollar down with Euro getting back on track overnight to almost push above the 1.14 handle as the latest comments from Fed Chair Powell did not help US stocks or USD holders at all.

The union currency spiked up through the 1.11 handle last week as is finding strong support at that level now to springboard higher although it is considerably overbought and has to navigate quite a few releases coming up this week:

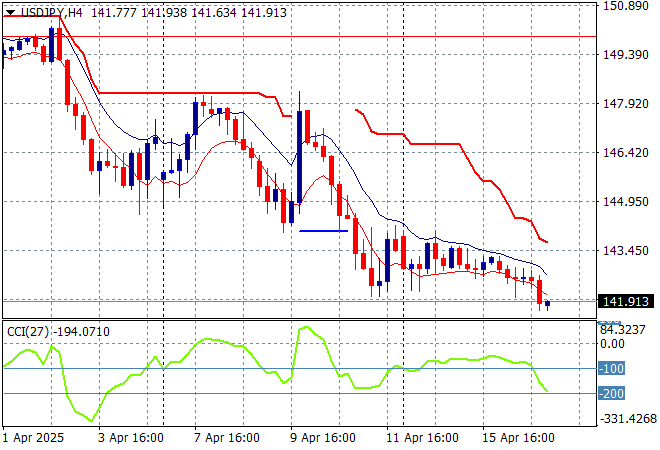

The USDJPY pair is failing to hold at its recent lows after settling at the 143 level without any upside potential building as it now rolls over below the 142 level overnight.

Short term momentum was extremely oversold and showed a potential swing play here but that has disappeared as Yen can only go higher as the USD is dumped amid a new trade bloc forming in the Asia-Pacific with the US. Watch for any break below the 142 level:

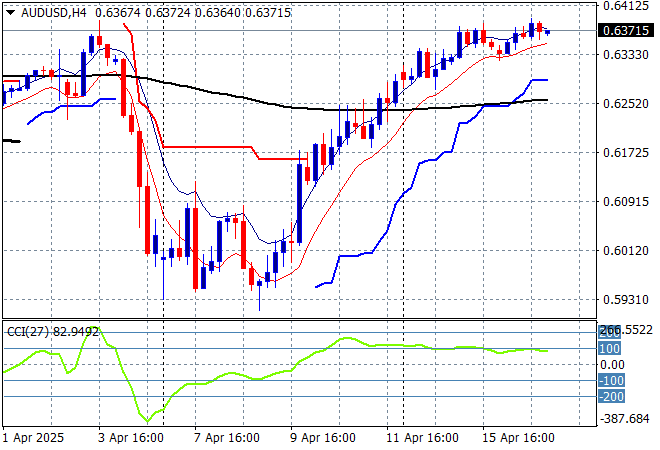

The Australian dollar is slowly extending its gains with a further move above the 63 cent level to now get above the pre-tariff announcement levels, although short term momentum is slowing down here.

Stepping back for a longer point of view (and looking at the trusty AUDNZD weekly cross) price action is still solidly below the 200 day MA (moving black line) and near new five year low. This is not yet over but watch for an attempt to hold here at the 63 cent level in the short term first:

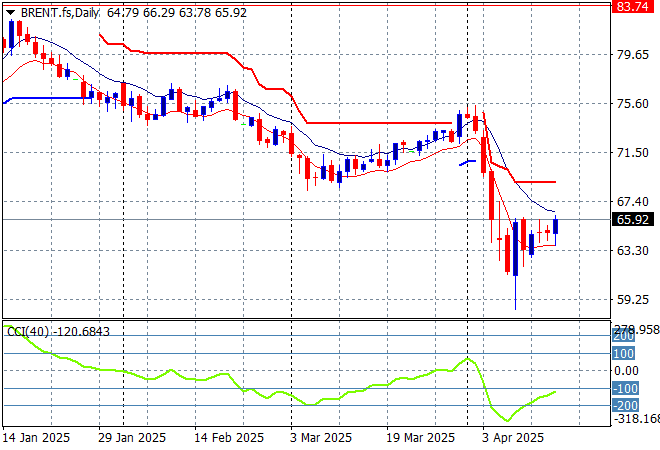

Oil markets are trying hard to hold onto its post tariff pause bounce with Brent crude finally getting back above the $65USD per barrel level after the weekend gap with a small move higher overnight.

The daily chart pattern shows the post New Year rally that got a little out of hand and now reverting back to the sideways lower action for the latter half of 2024. The potential for a return to the 2024 lows was building here before this short term bounce and is now baked in and then some as demand will collapse despite the very short term change in sentiment:

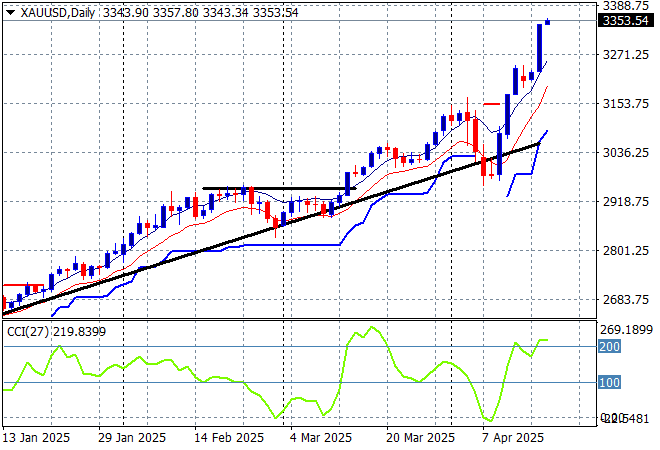

Gold zoomed up above the $3200USD per ounce level last week with a very mild pullback after the weekend gap but has now managed to zoom up through the $3000 level as of this morning as internal support remains very strong.

Short term support has firmed immensely in recent sessions showing some real strength here and while momentum is considerably overbought we could see even more upside here with the $3200 area likely to hold here with a small dip on profit taking:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!