On Wednesday, the all-important Q1 CPI will be released by the Australian Bureau of Statistics (ABS).

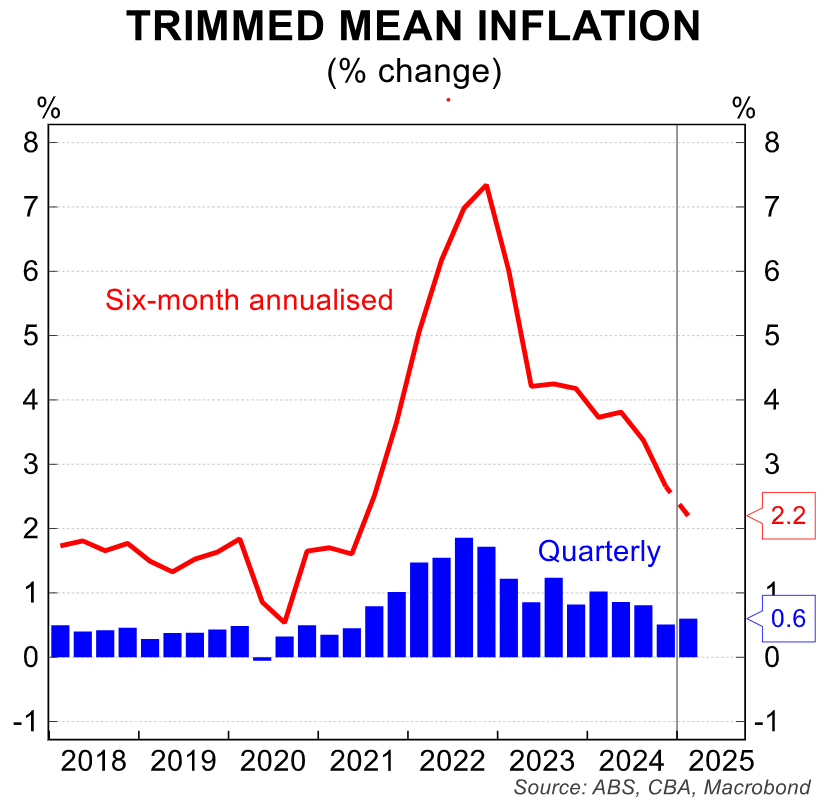

CBA expects the policy-relevant trimmed mean CPI to print at 0.6% for the quarter, bringing the annual rate down to 2.8%, within the RBA’s target band.

Six-month annualised trimmed mean CPI would also slow to only 2.2%, well within the RBA’s target.

CBA believes such a result would rubber-stamp a 0.25% May interest rate cut.

Although CBA sees upside risks to its forecast, with a 0.7% trimmed mean quarterly print more likely than a 0.5% print, it still believes that a 0.25% rate cut remains more likely than not, given the heightened global uncertainty.

Westpac’s economics team holds a similar view, also tipping a 0.6% quarterly trimmed mean CPI print, although it sees upside risk of a 0.7% result.

Westpac believes the RBA will be compelled to cut the official cash rate by 0.25% at its next meeting on 20 May.

Both banks expect the RBA to cut three more times in 2025, including May.

As illustrated in the following chart from Alex Joiner at IFM Investors, financial markets have become increasingly dovish.

As of Thursday, markets were tipping an end-of-year cash rate below 3%, suggesting the RBA will cut four to five more times this year, including in May.

As noted by Joiner on Twitter (X), “It will be interesting how the Bank factors this into its forecasts (combining market pricing with market economist forecasts)”.

Indeed it will. Although, as illustrated above, the futures market changes its interest rate pricing regularly, so the situation is fluid.

The market pricing of four to five rate cuts by year’s end seems too dovish, especially given the stimulatory promises from both sides during the federal election campaign.