Realestate.com.au published an interesting article on how the Victorian government’s increases in taxes on investment property have landlords “under siege” amid falling rents:

The report pointed to PropTrack research showing that median weekly rents declined or remained flat in more than 30 Melbourne suburbs in the year to February, meaning investors could be losing money in these areas.

Propertyology’s head of research, Simon Pressley, claimed that landlords were being driven out of the market, resulting in fewer rental properties being available.

Pressley said that the number of private rental homes across Victoria has declined by more than 48,700 over two years, from 706,892 in 2022 to 658,106 in 2024.

“Many former landlords got fed up with onerous rental legislation and taxes, so they sold over the last few years”, Pressley said.

“Local residents of Melbourne remain reluctant to invest”.

“The weak Victorian economy combined with government attitudes towards investors has discouraged participation”, he said.

I am more critical of the Victorian government than anybody. However, I cannot criticise the government’s investment property tax changes, which has improved outcomes for renters and first home buyers.

The data speaks for itself.

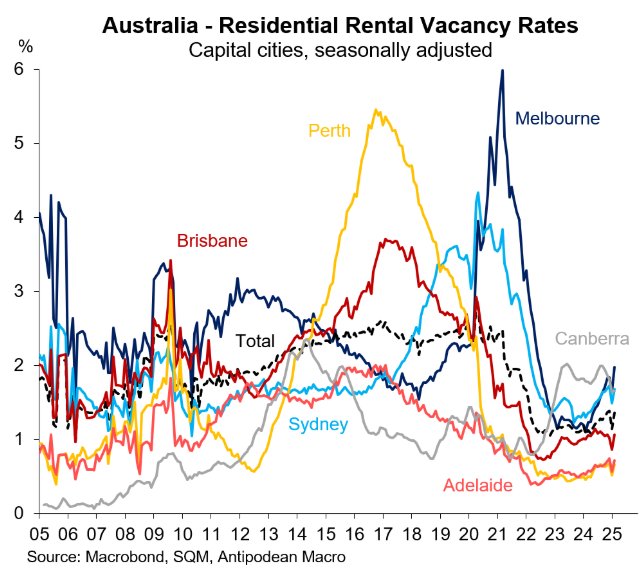

Melbourne’s rental vacancy rate is higher than the other major capital cities.

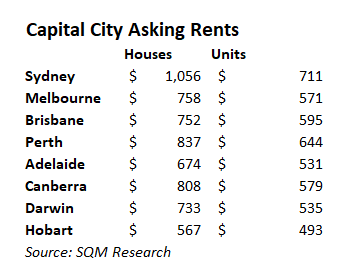

Melbourne’s asking rents are also relatively affordable compared to the other major capital cities.

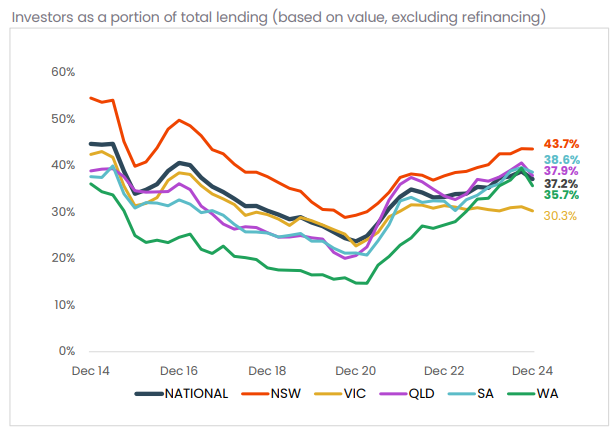

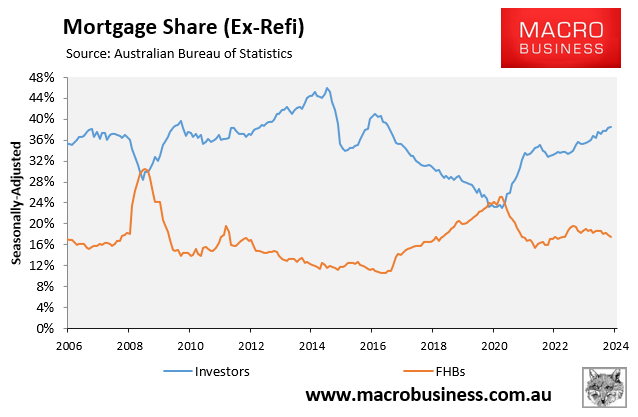

It is true that investor demand has been stifled in Victoria, as illustrated clearly below.

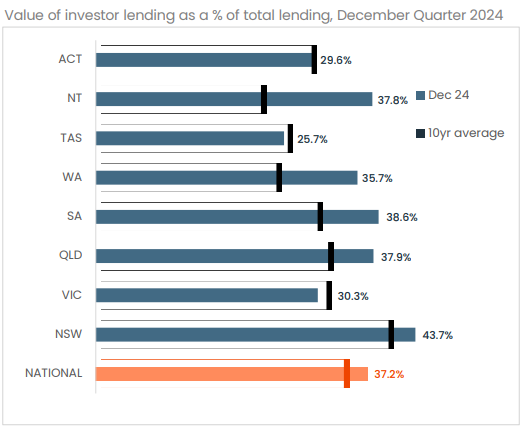

Investors made up only 30.3% of total lending in Victoria in Q4 2024, well below the national average of 37.2%.

Source: CoreLogic

Investor demand is tracking below the decade average in Victoria, whereas it is tracking above the decade average nationally.

Source: CoreLogic

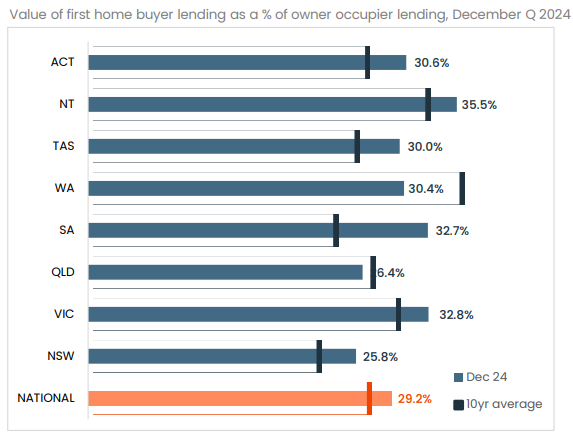

At the same time, Victoria has the highest share of first home buyer lending out of any state in Australia.

Source: CoreLogic

This demonstrates the historical inverse relationship between investor mortgage demand and first-time home buyer mortgage demand.

The evidence presented above shows that if policymakers truly want to increase homeownership rates, they should limit the number of investors in the market.

They should encourage investors to sell to first homebuyers, as Victoria does.