The Australian Bureau of Statistics (ABS) released data on permanent and long-term arrivals and departures to Australia last week.

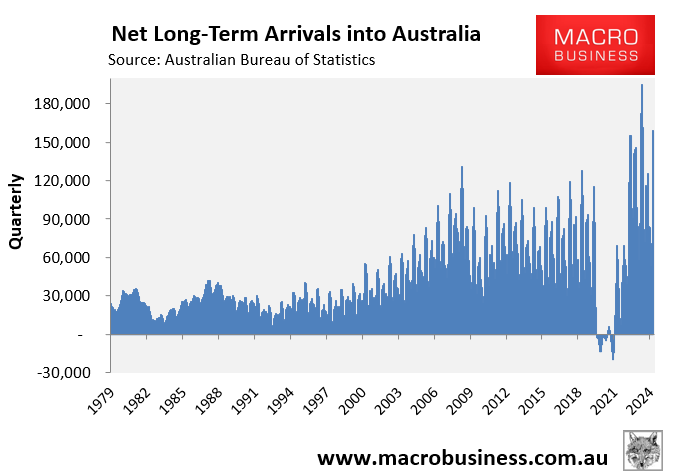

There were 111,740 net permanent and long-term arrivals in February, with 158,980 arriving over the quarter.

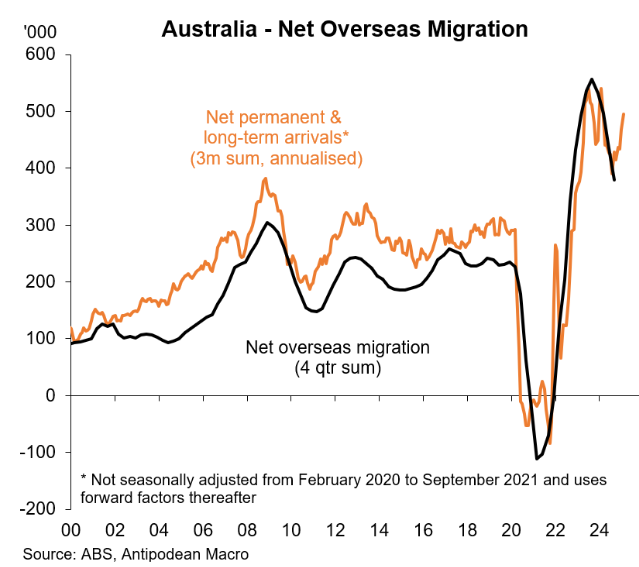

The following chart from Justin Fabo of Antipodean Macro illustrates how net overseas migration appears to have rebounded strongly in Q1 after moderating last year.

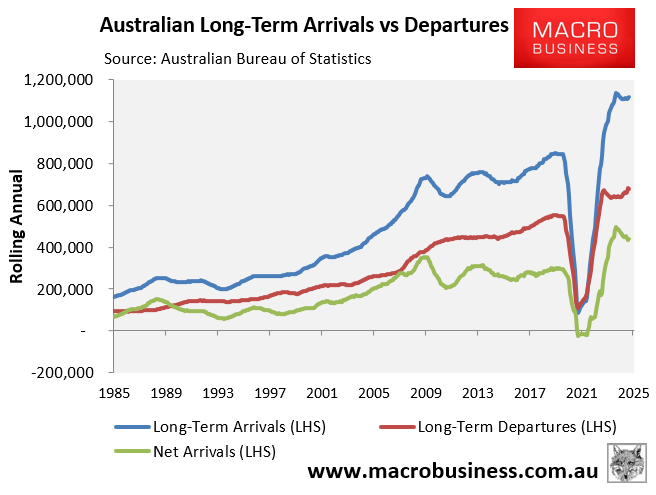

There were 1,118,710 permanent and long-term arrivals in the year to February 2025, partly offset by 680,030 departures.

Indeed, the net permanent and long-term arrivals series appears to have decoupled somewhat from the official quarterly net overseas migration data.

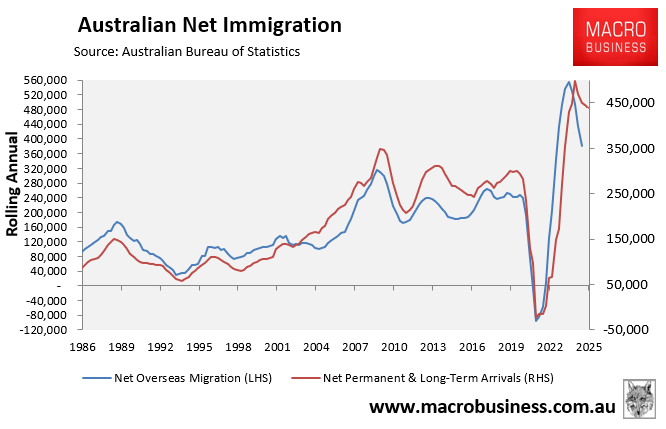

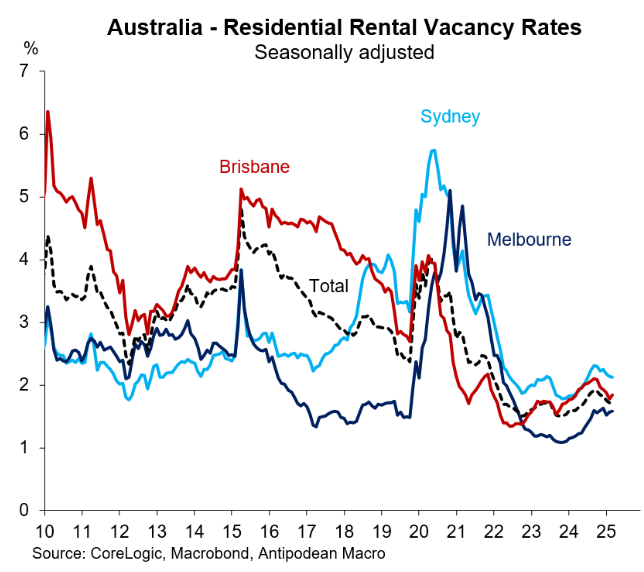

The apparent resurgence in net migration will place further pressure on Australia’s rental market, which is suffering from historically low vacancy rates.

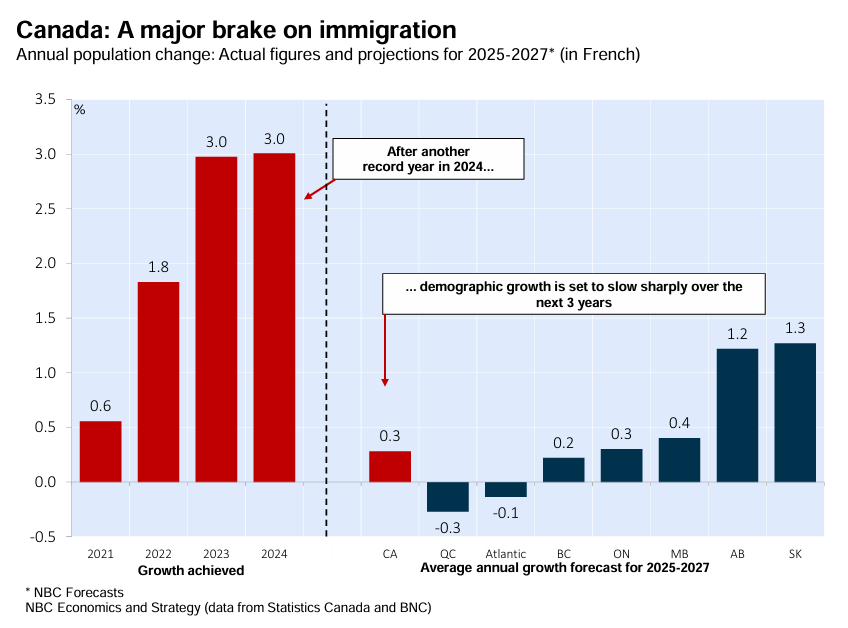

Australia’s situation is in stark contrast to Canada, which implemented an immigration freeze last year and has experienced six consecutive months of rental price falls.

Under Canada’s immigration freeze, the Canadian government is aiming for population growth of only 0.3% over three years.

This rental freeze policy has already yielded results, with Canada’s population growing by only 0.2% in Q4 2024. This represented “the slowest [quarterly] rate since the fourth quarter of 2020 (+0.1%), when border restrictions related to the COVID-19 pandemic were also in place”, Statistics Canada reported.

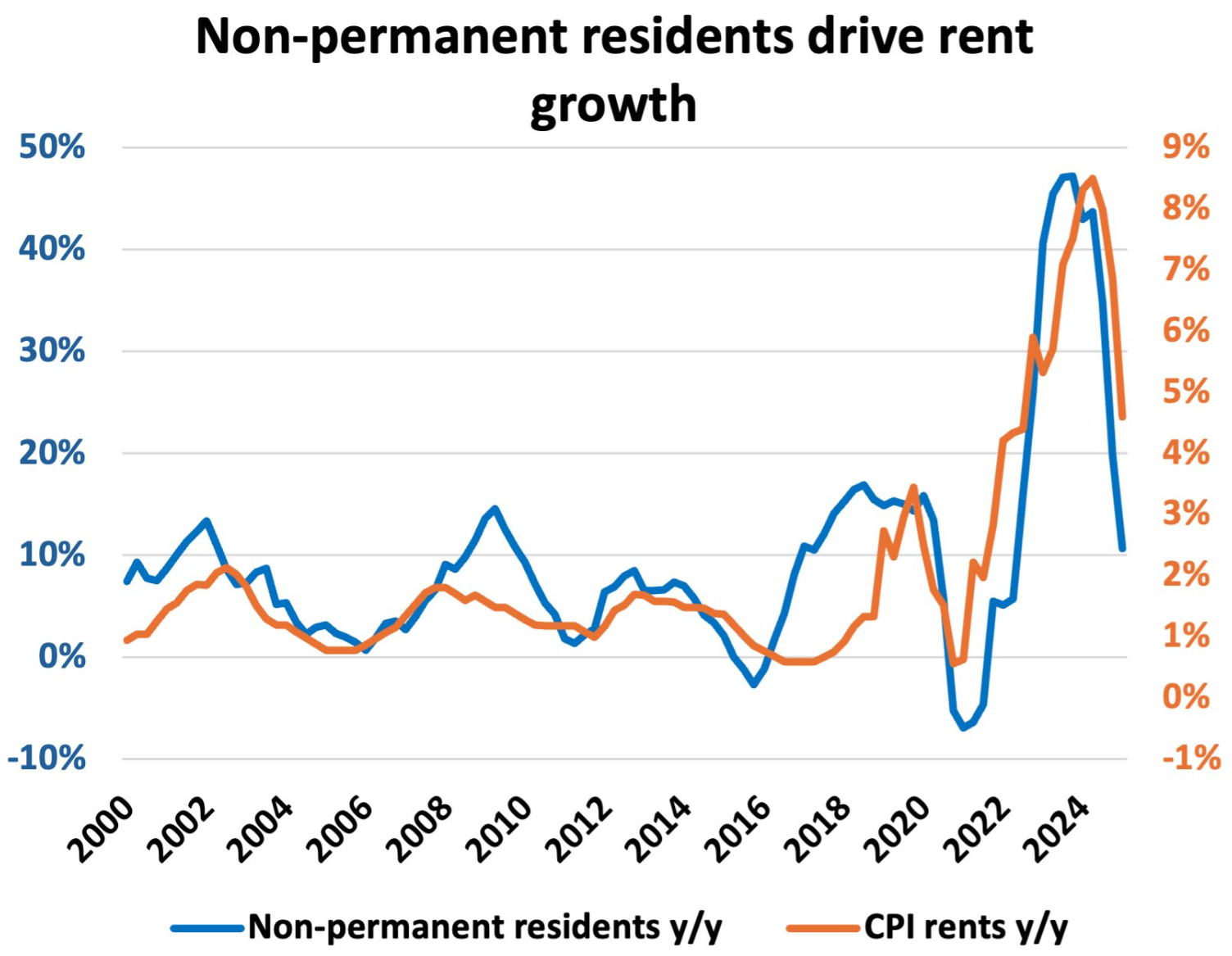

The slowing in population growth was driven by the net departure of 28,341 non-permanent residents in Q4.

“This was the first quarterly decrease in the number of non-permanent residents since the fourth quarter of 2021 (-15,299) and was the largest decline since the third quarter of 2020 (-67,698), when the pandemic-related border restrictions limited the growth in the number of non-permanent residents”, Statistics Canada said.

The impact on the rental market from the decline in temporary migrants is illustrated clearly by the following chart:

Source: Ben Rabidoux

As the rate of temporary migration rose, so did the growth rate in Canadian asking rents. As temporary migration rates fell, so too did asking rents.

Canada and Australia have chosen different responses to their rental crises.

Canada has chosen to freeze immigration, which has resulted in falling rents.

Australia has chosen to maintain a historically high rate of immigration, which will keep the pressure on rents.