They are pouring in now.

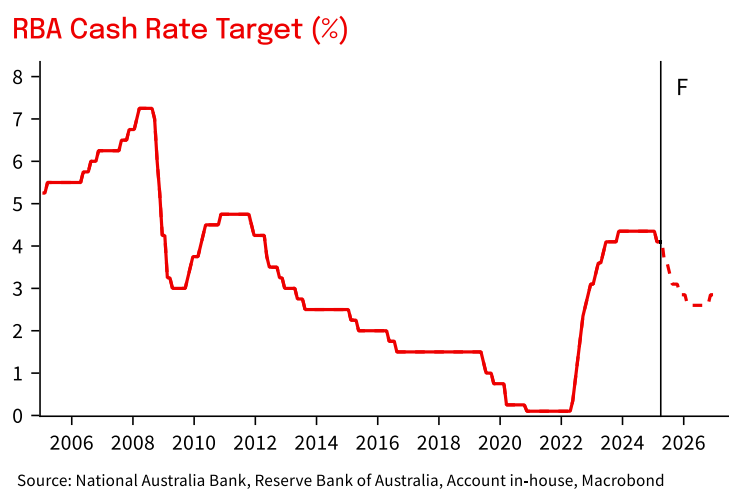

We now see the RBA easing more quickly through mid-2025 taking the cash rate to 2.6% by February.

We expect the RBA to cut by 50bps in May, followed by 25bps in July, August, November and February.

Headwinds from the global environment have intensified, but error bounds around our forecast are large given uncertainty remains exceptionally elevated.

We have slightly revised up our unemployment rate in the near term, and shaved growth for 2025 but ultimately expect a larger policy response is required to keep activity on track.

Meanwhile, Deutsche reversed its 50bps call for May.

I still see even more easing through 2026. The tariff shock will be compounded by ongoing property problems and iron ore supply.

China without property means stimulus won’t be enough!

The local private sector economy is in the doldrums, to say the least, thanks to the RBA starving the pig before market day.

MOAR is coming!