Last week, the Queensland government announced that it would repeal the state’s legislated renewable energy targets. They were set at 50% by 2030, rising to 80% by 2035.

Energy Minister David Janetzki stated that the renewable energy targets were “always unachievable”. He added that the government is also likely to amend the state’s existing 2035 target of reducing emissions by 75%.

The Queensland government also announced that it would extend the operating life of its coal-fired power stations beyond 2035.

Federal Energy Minister Chris Bowen criticised the QLD state government for the move and reassured that it would not impact the nation’s net zero ambitions.

The QLD government’s announcement makes sense. The state is one of the largest exporters of coal in the world, much of which goes to China.

Why shouldn’t Queenslanders burn their coal themselves and give themselves cheap and reliable energy instead of exporting their coal to Asia? If Queensland exported less and burned more coal at home, the climate would be no worse off.

The industry superannuation fund-backed IFM Investors has also withdrawn from the federal government’s net zero carbon emissions scheme known as Climate Active. It joins businesses such as accounting software firm Xero and fund manager Perpetual that have left the Climate Active scheme in recent weeks, amid speculation that the scheme may be scrapped after the 3 May election.

A spokesman for the Department of Climate Change & Energy says a decision on the future direction of the Climate Active scheme has not yet been made, with any decision to be made by the next government.

The world’s three largest emitters have committed to burning more coal:

Last week, President Trump signed four executive orders aimed at boosting the US coal industry. Trump aims to revive the nation’s coal industry by streamlining project approvals and opening up more federal land for coal mining.

The four executive orders include designating coal as a critical mineral and preventing ‘discrimination’ against the use of coal for power generation rather than greener fuels.

President Trump stated that his administration is “bringing back” an industry that his predecessor, Joe Biden, had abandoned. He added that the US has more coal than any other country.

Trump’s executive orders reverse decades of American environmental policy, which closed coal-fired power plants and replaced them with gas-fired generation and renewables.

Coal currently accounts for only around 15% of all power generated in the United States, down from more than 50% in 2000.

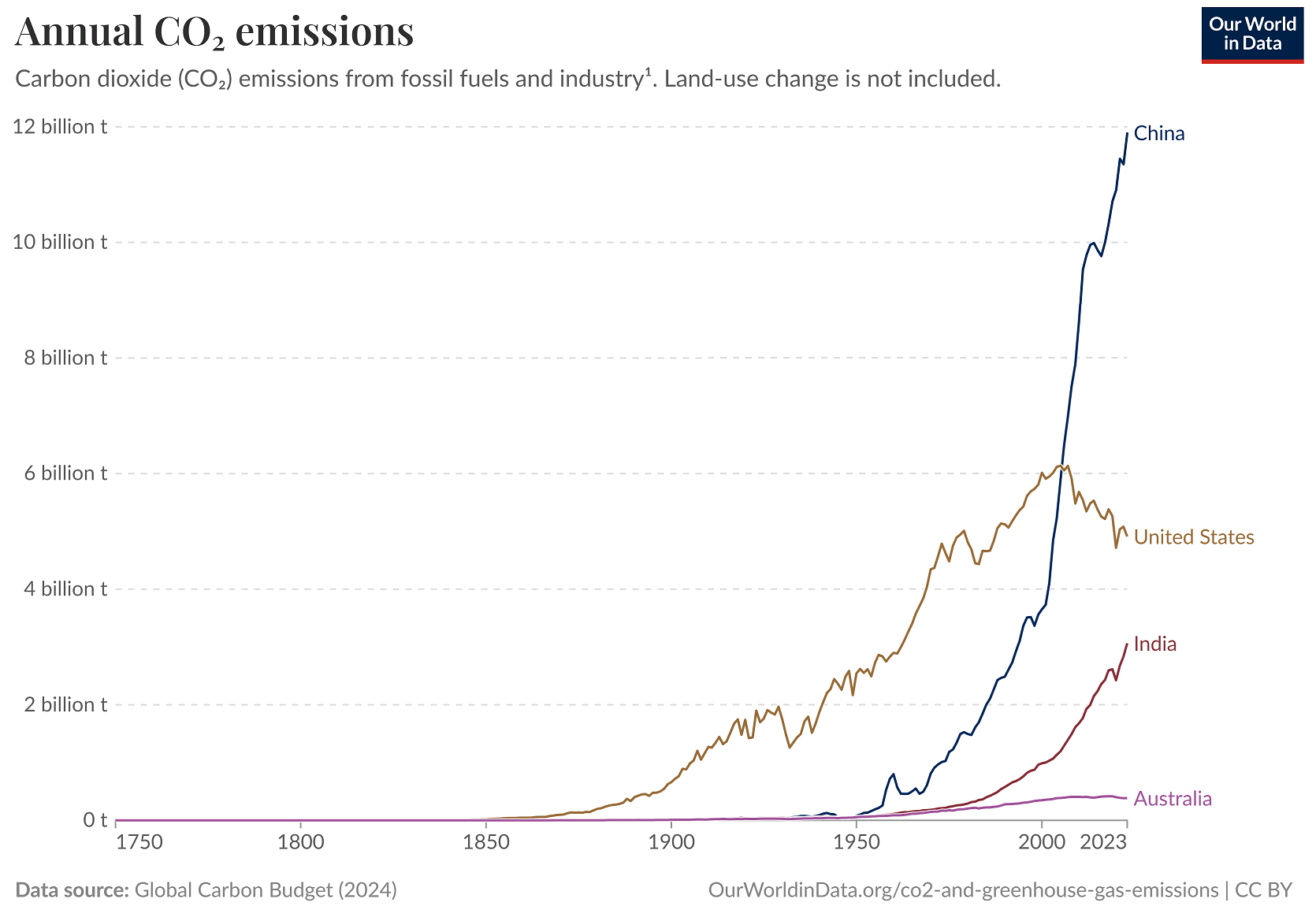

The US is currently the world’s second-largest carbon emitter (13.0% share), and the nation’s coal use and emissions will inevitably rise following President Trump’s announcements.

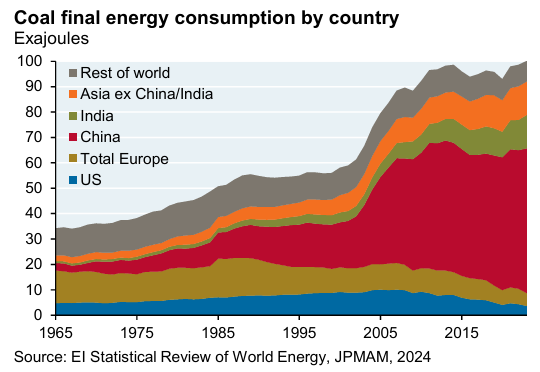

The world’s largest and third-largest emitters, China (31.5% share) and India (8.1% share), are also expanding their coal consumption.

China is the world’s largest coal producer, importer, and user, burning 30% more coal than the rest of the world combined.

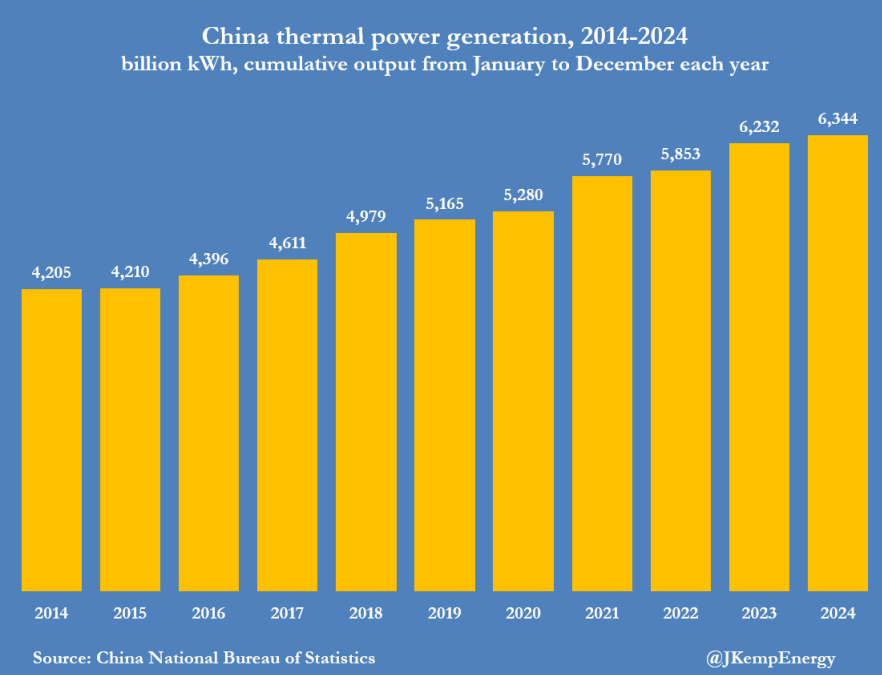

In the decade to 2024, China’s thermal coal electricity generation increased by 51%. Chinese coal production, imports, and consumption are at record highs.

Every quarter, the Chinese government grants construction permits for new coal-fired power plants and mines.

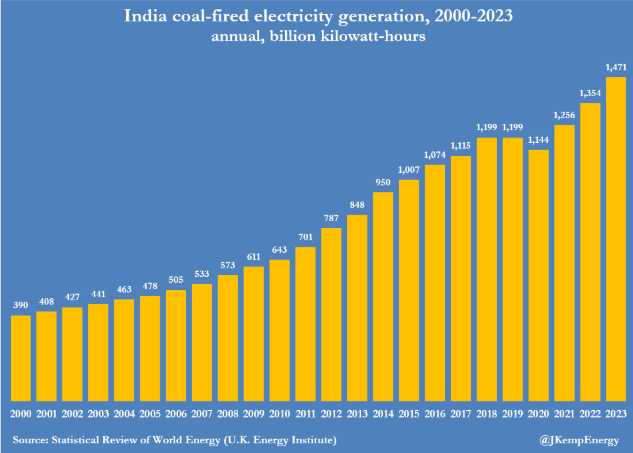

India’s coal consumption also increased by more than 70% over the past decade to a record high.

The Indian government has directed coal generators to accelerate capacity increases, postpone planned retirements, and purchase more equipment to maintain and enhance capacity until at least 2030.

Therefore, we have the three largest carbon emitters, who collectively account for more than half (52.6%) of global carbon emissions, planning to increase coal use.

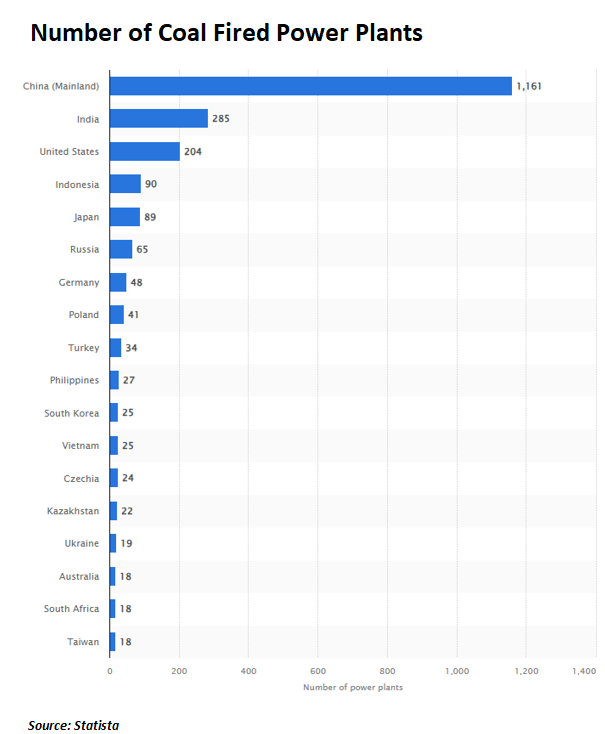

According to Statista, China (1,161), India (285), and the United States (204) had a combined 1,650 coal-fired power plants in operation in 2024, compared to Australia’s 18 coal-fired generators.

Implications for Australia:

The planned expansion of coal use by the world’s three largest emitters poses significant questions for Australia.

Australia exports around six times more coal than it uses domestically. Australia also exports more than four times more gas than it consumes domestically.

Why shouldn’t Australia abandon its net zero target and give itself cheap and reliable energy by consuming more coal and gas at home and exporting a bit less?

Under current ‘net zero’ settings, Australia is exporting energy security to Asia while denying itself energy security at home.

Why should Australia sacrifice its economy for ‘net zero’ when the three largest emitters won’t follow suit?

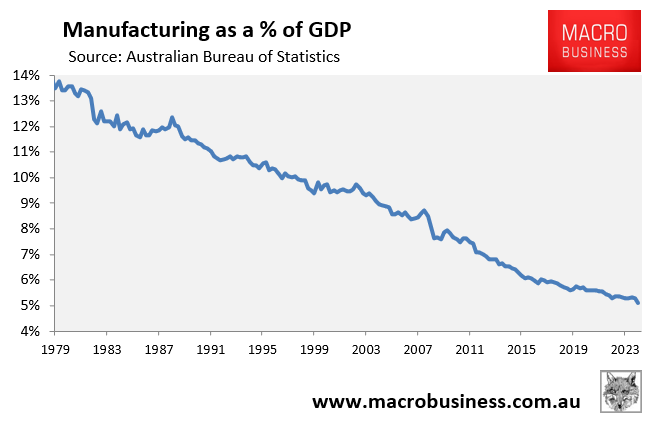

Australia denying itself cheap and reliable energy will merely drive up inflation and the cost of living and force manufacturing to close and move to China, making Australia a less diversified and self-sufficient economy.

Burning more hydrocarbon energy at home, rather than exporting it, will also make no difference to global emissions.

In the case of gas, it is more environmentally friendly to burn gas domestically, as it avoids the energy-intensive process of freezing gas to -162°C (liquefaction) and transporting it halfway across the world.

Australia’s pursuit of ‘net zero’ emissions is futile and economically self-destructive without participation from the world’s largest emitters: China, India, and the US.

Reliable and affordable energy is the bedrock of a modern economy. Australia shouldn’t strive to be a ‘net zero’ hero.

We cannot save the world. But we can save ourselves.

I discussed these issues in last weekend’s Treasury of Common Sense on Radio 2GB/4BC.