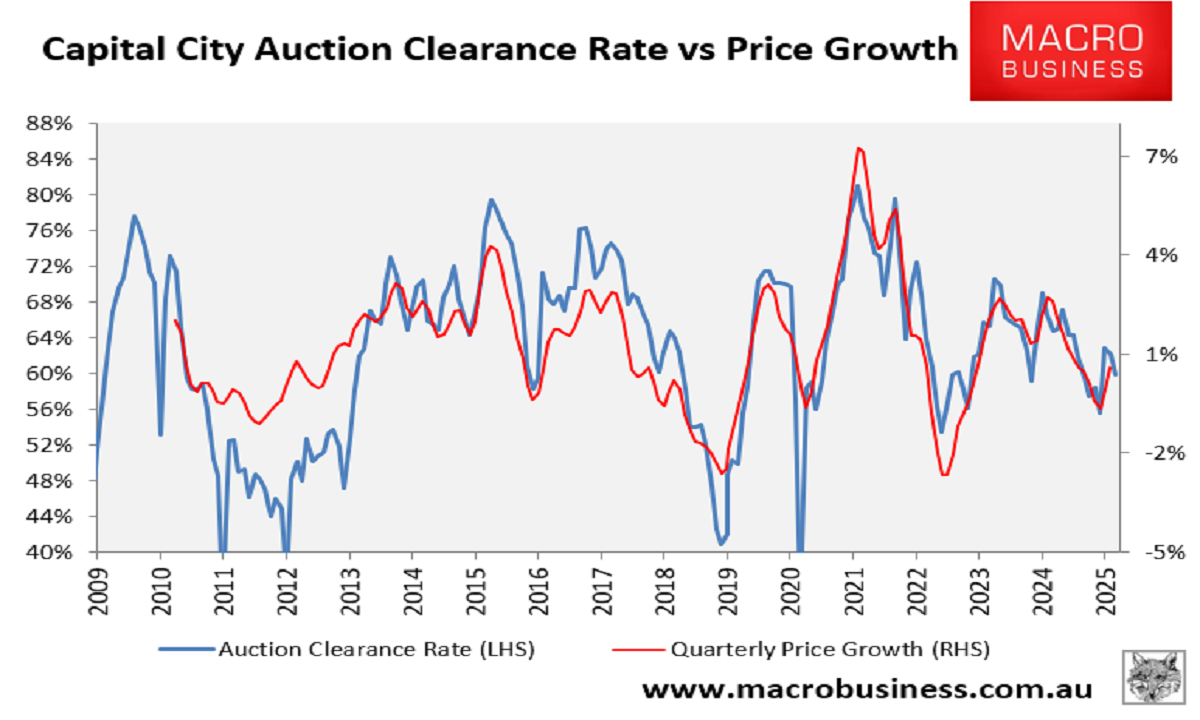

After bouncing following February’s 0.25% interest rate cut from the Reserve Bank of Australia (RBA), momentum in Australia’s housing market has stalled.

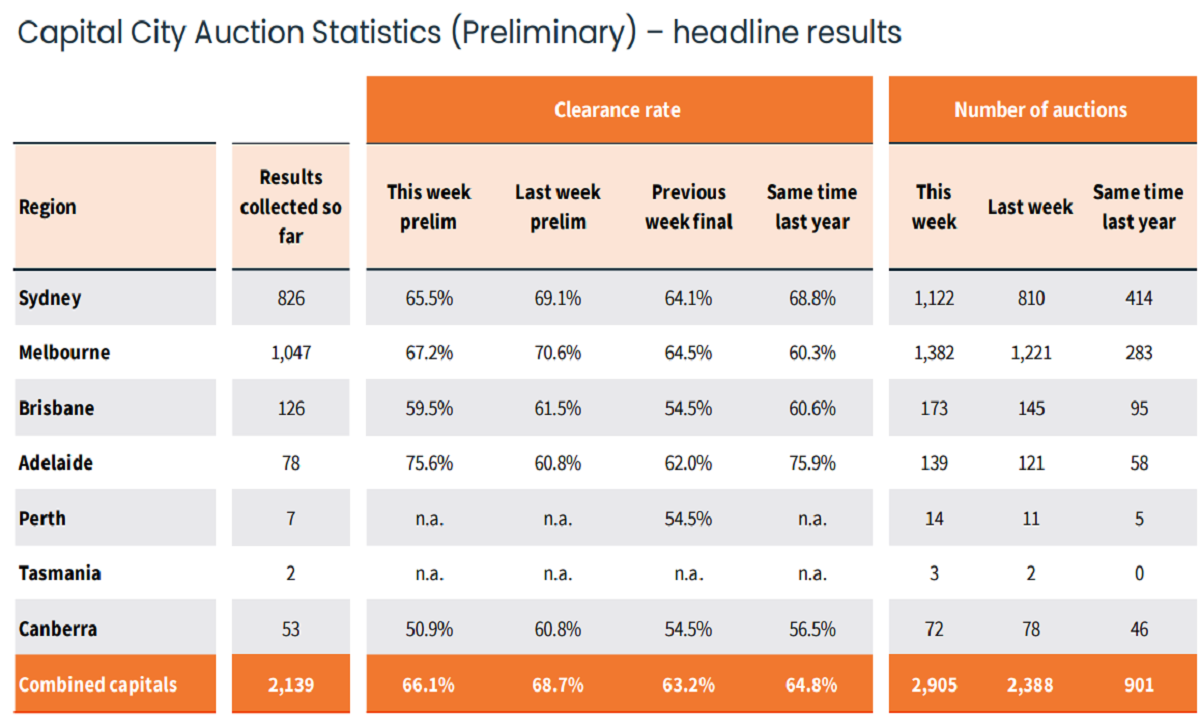

The Easter long weekend recorded the softest final auction clearance rate since January, with only 57.6% of auctions selling across the combined capital cities.

This weekend’s results softened further, recording a preliminary clearance rate of only 66.1% across the combined capital cities, the lowest preliminary clearance rate since mid-December 2024.

Source: CoreLogic

“The trend in auction clearance rates has been gradually easing since the week ending Feb 23rd, when the preliminary clearance rate reached 72.1% following the 25-basis point rate cut on February 19th”, noted CoreLogic.

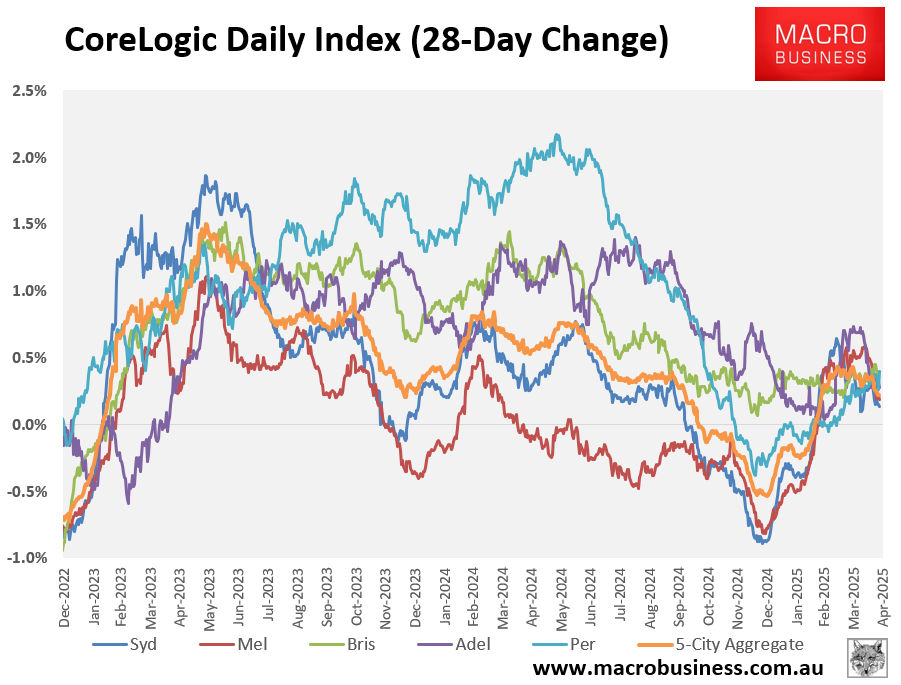

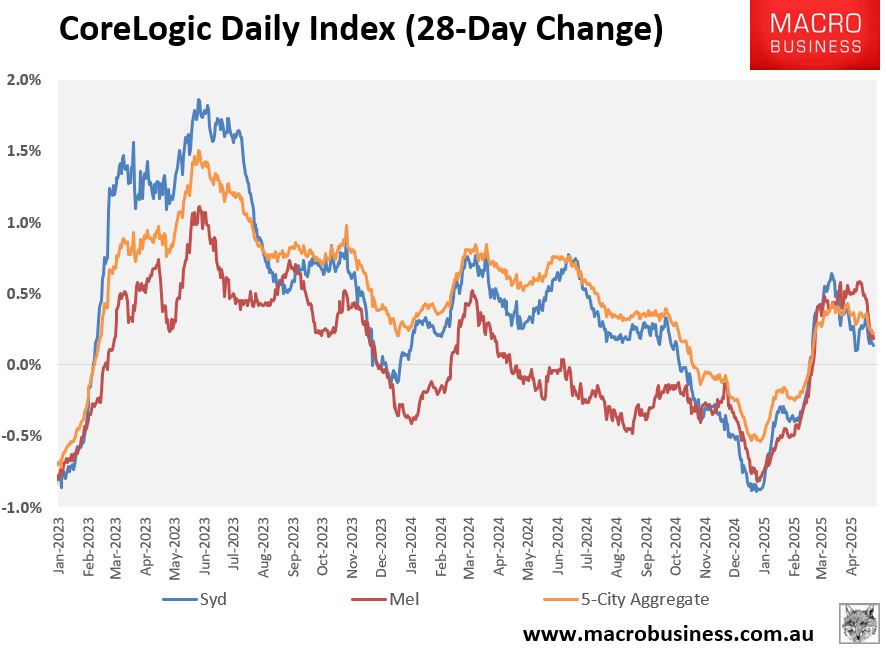

Home prices are reflecting the decline in buyer demand, with CoreLogic’s daily dwelling value index stalling in recent months.

After dwelling growth accelerated following February’s 0.25% interest rate cut, growth has stalled, with values increasing by only 0.2% over the past 28 days.

Sydney and Melbourne have led the slowdown in growth at the 5-city aggregate level.

It is clear that buyers are sitting on the sidelines awaiting further interest rate cuts from the RBA.

First home buyers may also be waiting for the outcome of the upcoming federal election, with both Labor and the Coalition offering juicy incentives for first-time buyers.

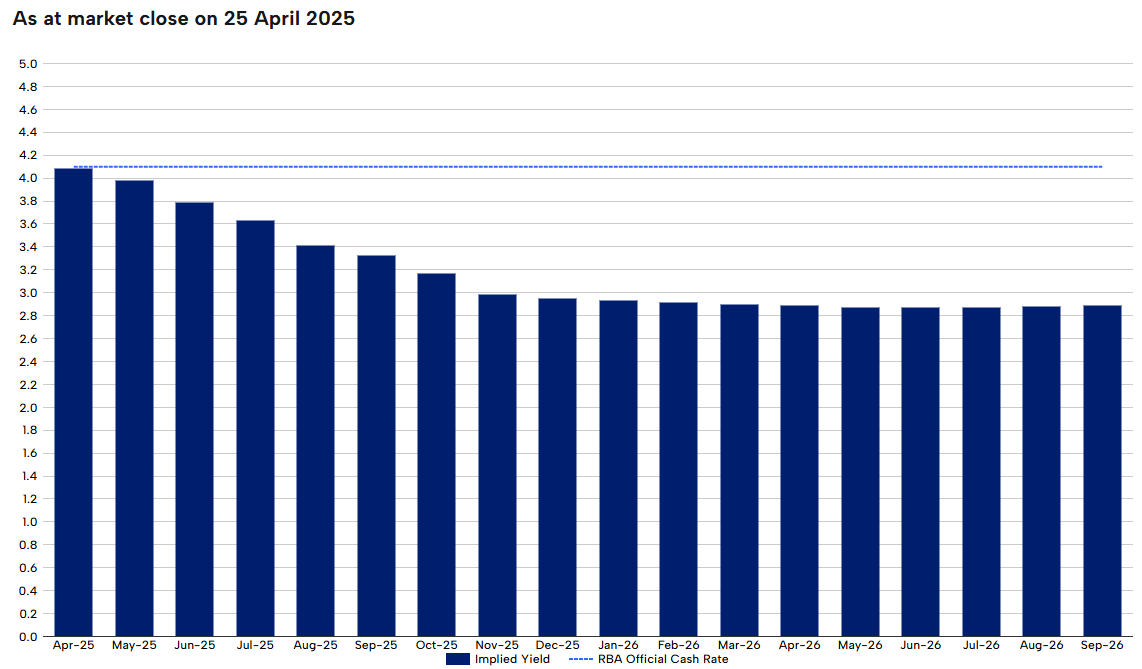

The latest interest rate forecasts from financial markets suggest that the RBA will almost certainly deliver another interest rate cut at its May monetary policy meeting.

Markets are then predicting a further three to four rate cuts this calendar year.

If these forecasts come to fruition, they will certainly bring buyers out of hibernation and usher in another price upswing.

Labor’s first home buyer incentives, which come into effect on 1 January 2026, will add further fuel to the housing bonfire.