Regardless of which party wins the upcoming federal election, a match will be lit under Australian house prices.

Labor Treasurer Jim Chalmers announced in February that Australia’s financial regulators will be required to loosen home lending rules for millions of Australians with student loans.

The changes will mean that a borrower’s student debts will be excluded from mortgage serviceability calculations if the bank believes the borrower will repay them in the near term.

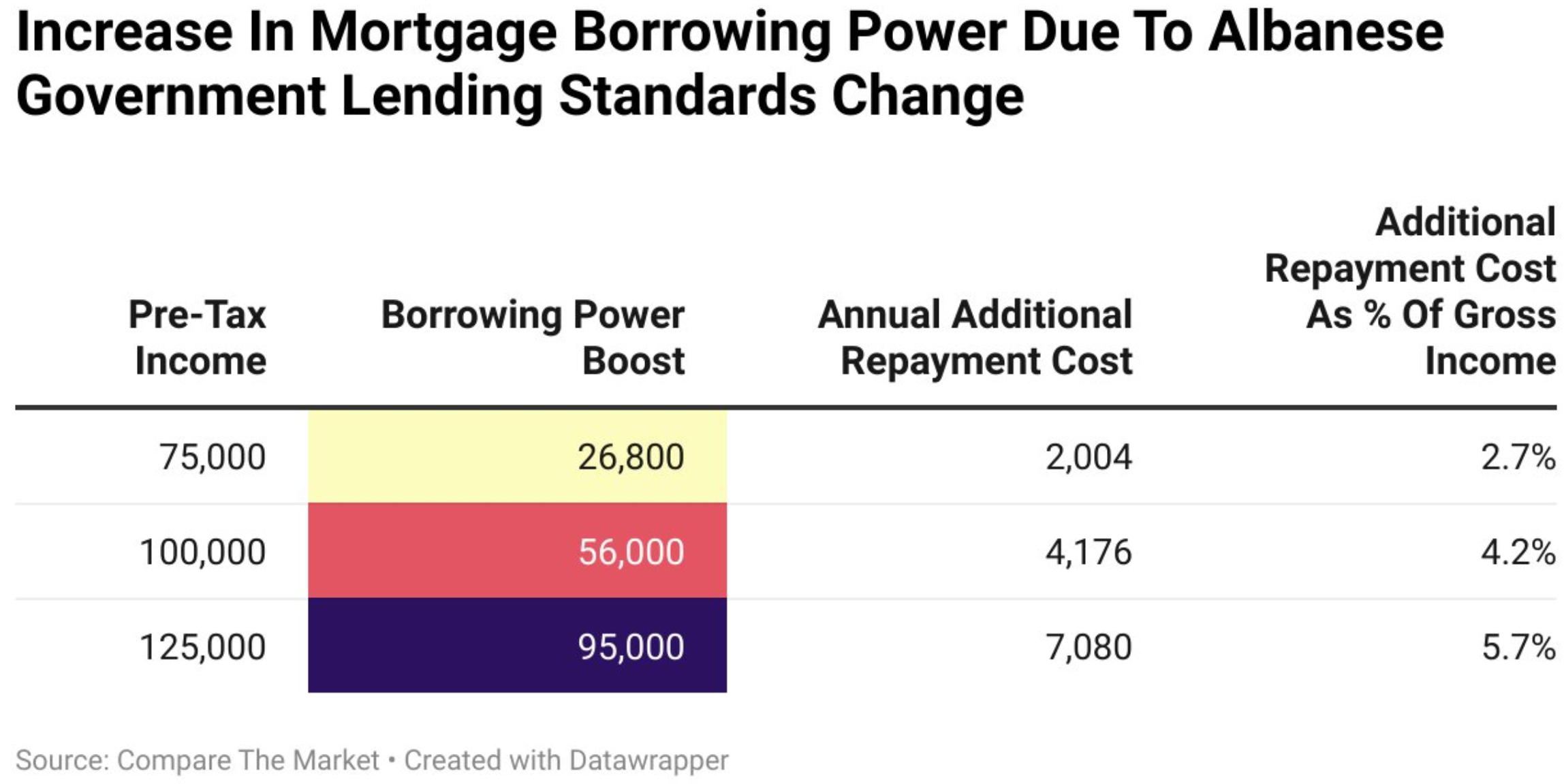

Compare the Market estimated that a tertiary-educated single professional earning $125,000 would be able to borrow an additional $95,900 under the new policy.

Someone earning $100,000 would have an increased borrowing capacity of $56,000, while someone earning $75,000 could borrow an additional $26,800.

Labor also announced that it would expand its ‘Help to Buy’ policy by increasing the income and price caps on the properties that can be purchased.

The Help to Buy shared equity program provides first-time homebuyers with 30% of the purchase price of an existing property or 40% of the purchase price for a new home.

The buyer must provide a deposit of at least 2%, with the scheme limited to 10,000 places each year, totaling 40,000 places over four years.

Under the announced changes, income caps will be lifted as follows:

- $100,000 for individuals.

- $160,000 for couples and single parents.

Property price caps will also be adjusted to reflect the average prices in each state and territory.

The federal government will also provide an extra $800 million in equity investments.

Not to be outdone, the Dutton-led Coalition has promised to allow qualifying first-time buyers immediate access to $50,000 of their superannuation savings if they win the election.

According to modelling by the Australian Super Members Council (SMC), the super-for-housing policy could increase Australian home values by an average of $75,000 (9%) in the five major capital cities.

The Coalition has also pledged to water down responsible lending rules to make it easier for first-time home buyers to borrow.

“The Coalition would, as one of its first tasks in government, direct the Australian Prudential Regulation Authority to lower the current serviceability buffer that requires lenders to assess a home loan applicant’s ability to repay a loan”, the Australian reported.

“The Coalition would direct the regulator to adjust the capital treatment of loans backed by mortgage insurance as set by a lender’s loan-to-value ratio, which artificially raised interest rates for some borrowers who didn’t have access to parents’ financial assistance. This would be done by rewriting the regulator’s Statement of Expectations”.

“Right now, Australians without access to the ‘bank of mum and dad’ are punished by higher borrowing costs – even when the actual risk is the same or lower”, Coalition housing spokesman Michael Sukkar said to a property conference in Melbourne on Tuesday.

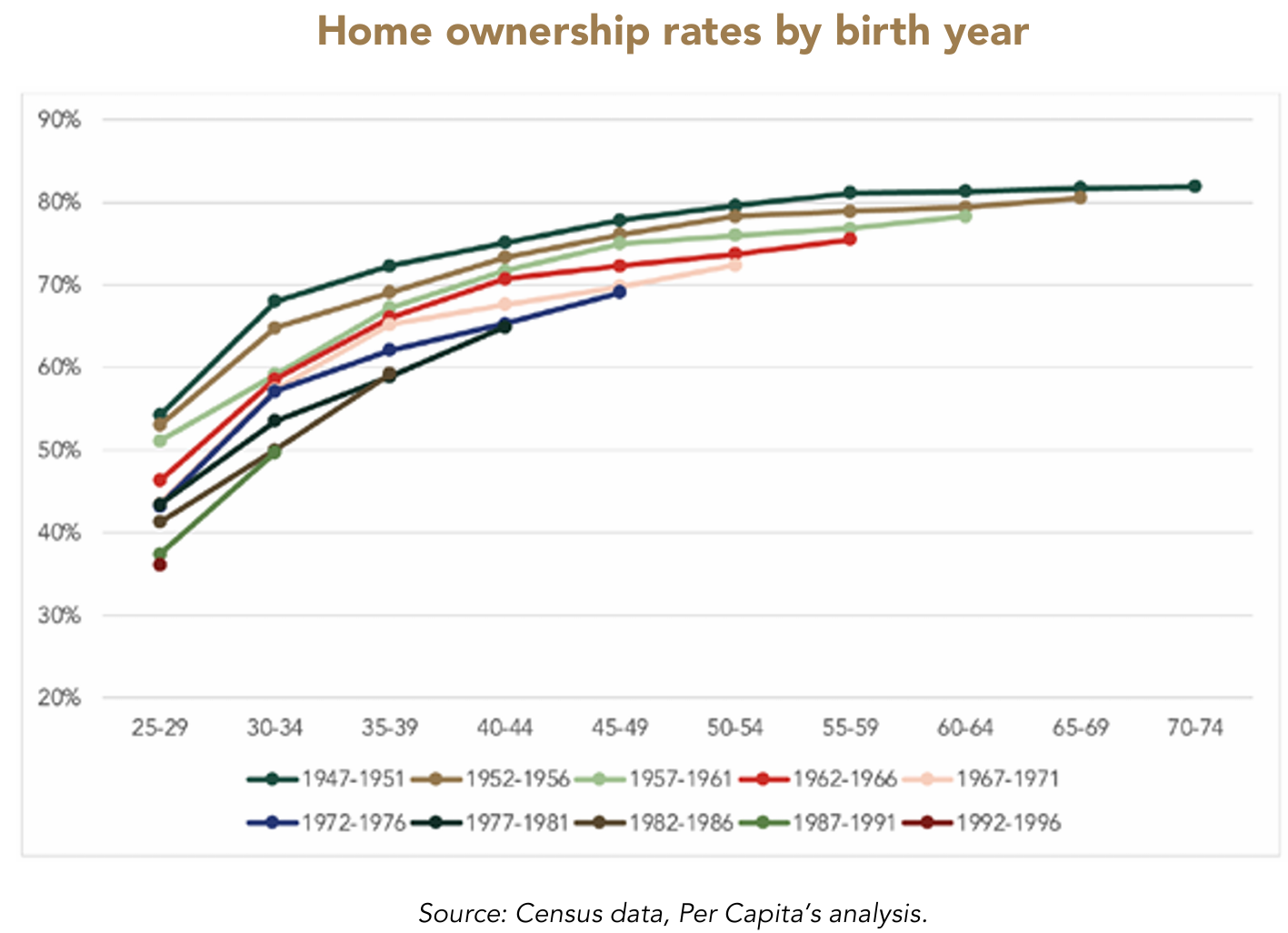

“That’s a systemic bias in favour of inherited wealth. We will remove it. The Coalition will not accept a situation where a generation of Australians do not have the same opportunities for home ownership that previous generations have enjoyed”, he said.

Demand-side policies, such as those promised by Labor and the Coalition, will inevitably boost borrowing capacity and demand, further inflating home values.

A quarter of a century of demand-side policies, such as first-home buyer grants, shows them to be self-defeating from an affordability perspective.

First-time buyers are being excluded from the market because prices are too high in comparison to earnings.

The first solution should be to restrict immigration, which is incredibly destructive to first-time home buyers for two reasons.

- Excessive immigration increases the costs of renting, making it more challenging for prospective first-home buyers to save a deposit.

- Excessive immigration puts upward pressure on home prices, pushing ownership further out of reach.

The federal government should also limit investment property concessions, preferably as part of a more significant tax reform that shifts the burden away from workers through income taxes and towards other forms of taxation, such as resource, consumption, and wealth taxes.

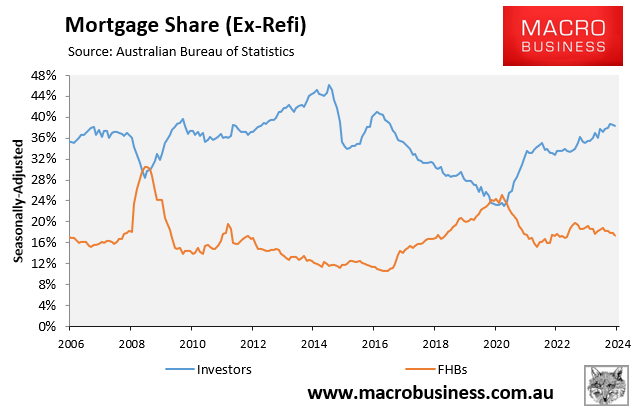

The Australian Bureau of Statistics’ housing financing data clearly indicates that investors are outbidding first-home buyers.

As a result, reducing investor demand through less favourable tax policies would boost first home buyer demand and the national home ownership rate.

Unfortunately, neither side is genuinely interested in “solving” the housing crisis.

Both Labor and the Coalition pretend to care by providing phony remedies while progressively raising home prices with stimulatory demand-side policies such as Help to Buy, access to superannuation, and eroded lending standards.