As was widely expected, the Reserve Bank of Australia (RBA) chose to keep the official cash rate on hold at 4.10% at Tuesday’s monetary policy meeting.

However, the decision could be considered a dovish hold and suggests that the RBA has laid the groundwork for a rate cut at the next meeting in mid-May, pending a favourable Q1 CPI result (due later this month).

In coming to its decision, the RBA noted that “underlying inflation is moderating” and “has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance”.

“Recent information suggests that underlying inflation continues to ease in line with the most recent forecasts published in the February Statement on Monetary Policy”.

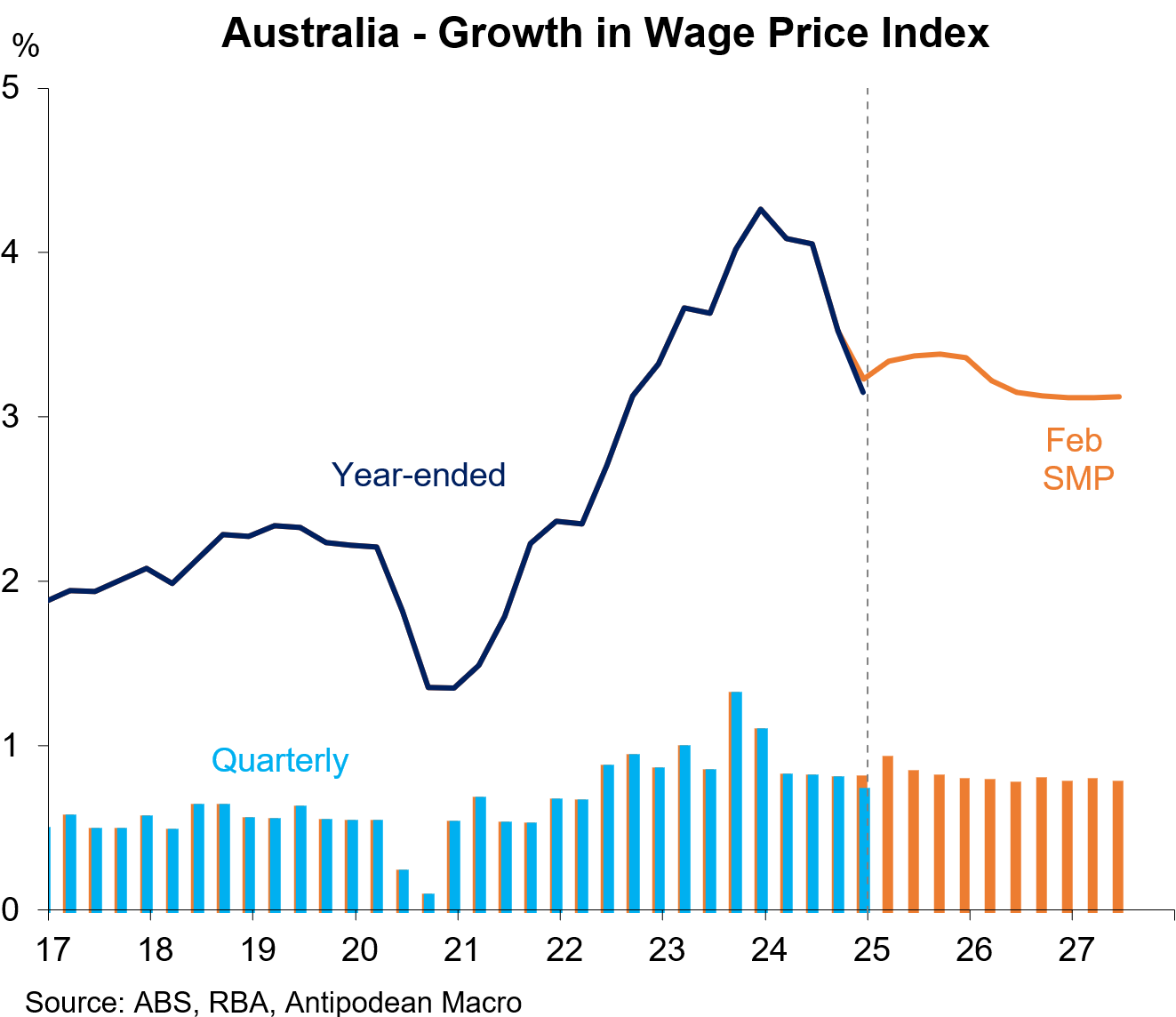

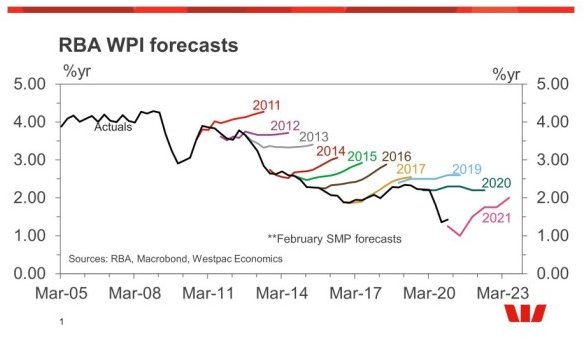

Importantly, the RBA noted that “wage pressures have eased a little more than expected” but cautioned that “productivity growth has not picked up and growth in unit labour costs remains high”.

The RBA has been notoriously bullish on wage growth. Therefore, it should not come as a surprise that wages are growing by less than expected.

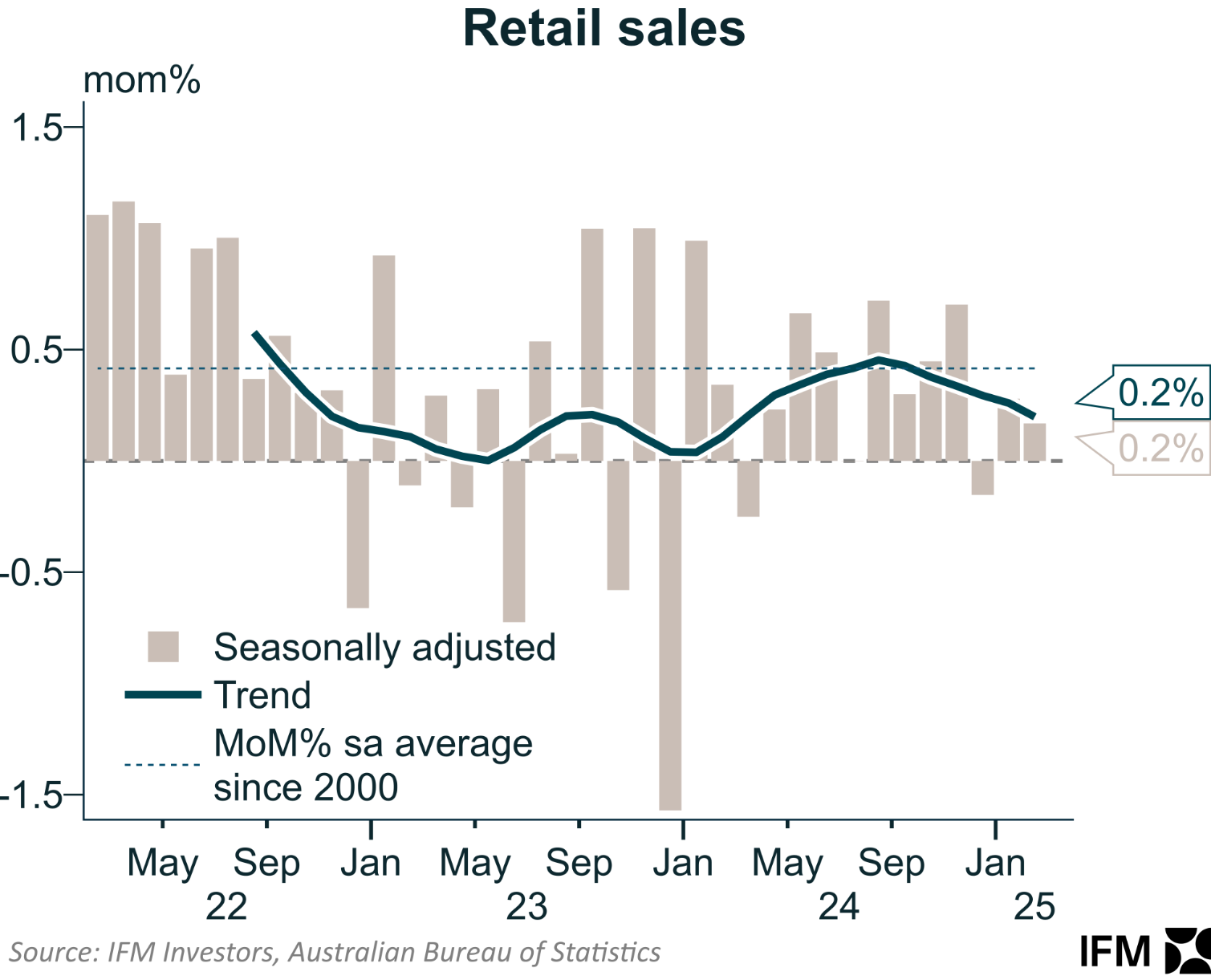

The RBA statement also cautioned that “there is a risk that any pick-up in consumption is slower than expected, resulting in continued subdued output growth and a sharper deterioration in the labour market than currently expected”.

Indeed, Tuesday’s soft retail sales data for February showed that the weakness in consumer spending has persisted into the new year.

The RBA concluded by stating that “monetary policy remains restrictive” and that “the continued decline in underlying inflation is welcome”, although the outlook is uncertain.

“The Board will rely upon the data and the evolving assessment of risks to guide its decisions”.

In other words, it continues to have an easing bias contingent on the data flow.

The next vital data point is the Q1 CPI, which is due to be released on 30 April.

CBA forecasts Q1 2025 trimmed mean inflation of only 0.6%—i.e., below the RBA’s latest forecast. Westpac is more dovish, forecasting a trimmed mean inflation rate of only 0.5% for Q1 2025.

Either result would likely see the RBA cut the cash rate at its next board meeting in mid-May.