Westpac chief economist Luci Ellis published a note on the bank’s outlook for interest rates.

Westpac believes that the Reserve Bank is certain to cut the official cash rate by 0.25% at its next monetary meeting on 20 May.

Ellis notes that “uncertainty has escalated to a whole new level” following the Trump Administration’s trade war. Global growth—and especially US growth—will also be slower, and China’s response will lead to disinflation globally, including for Australia.

Ellis does not believe the RBA will deliver a 0.50% “double-cut” in May.

“Australia is relatively less affected by US tariffs than some economies, and the hit to domestic growth is expected to be moderate”, noted Ellis.

“While the risks have clearly shifted to the dovish side, we do not expect the RBA’s thinking to pivot directly from cutting reluctantly if at all, to going hard in May and signalling more”.

“To do so would look panicky and is contrary to the limited RBA communication since the ‘Liberation Day’ tariff announcements, which was much more circumspect”, Ellis wrote.

Ellis also believes a midway 0.35% cut is a “very outside” possibility to “round quarter-point levels of the cash rate”.

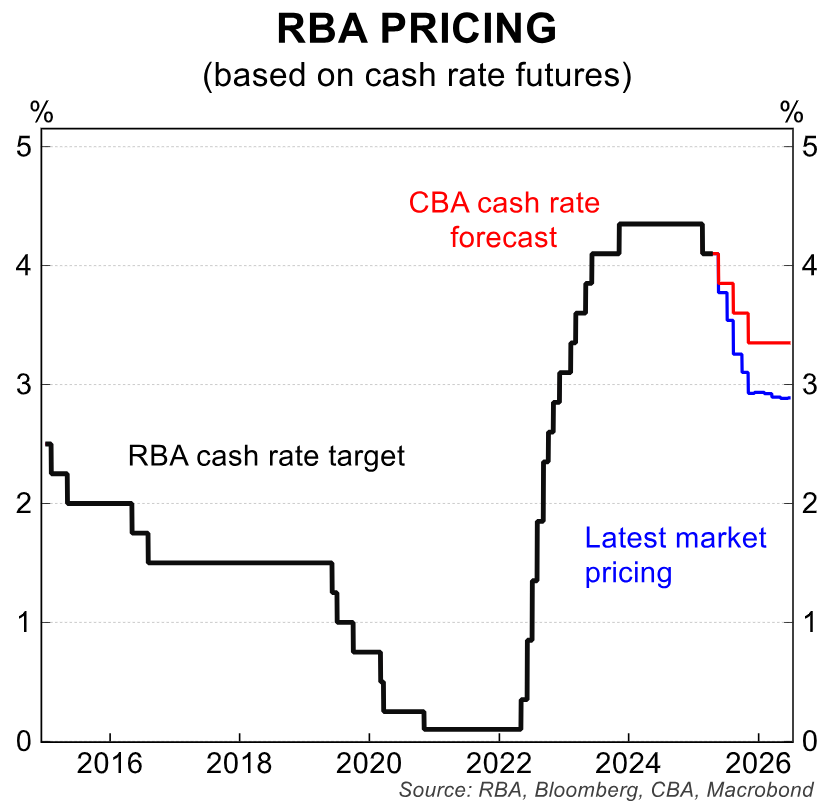

Westpac forecasts “a total of three further cuts (75bps in total), including the cut in May, with August and November pencilled in for the other two cuts”.

“However, the risks on timing and extent are now skewed to the RBA moving faster than this and/or going further”.

CBA’s head of Australian economics, Gareth Aird, has a similar forecast, tipping the RBA to cut by 0.25% in May, followed by two additional cuts in 2025 and a year-end cash rate of 3.35%.

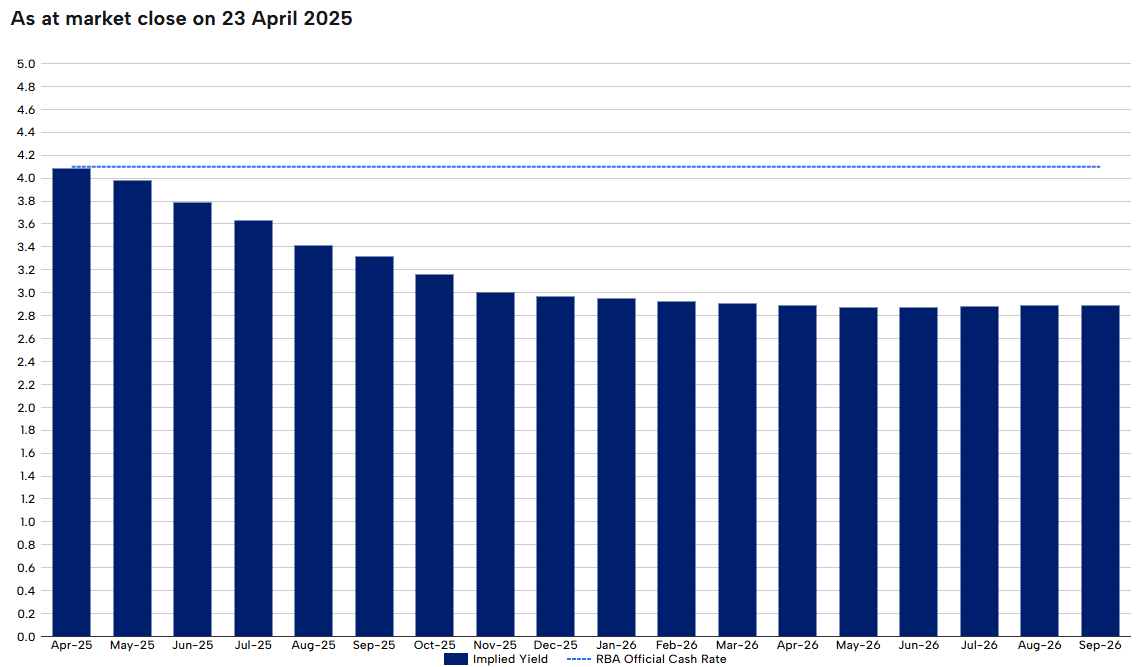

Both banks’ forecasts are less dovish than financial markets, which tip between four and five rate cuts this year and an end-of-year cash rate of 3.0%.