The panic is on.

“Economists” are backflipping on interest rates. Hoocoodanode?

The poll found 29 out of 40 economists forecast the cash rate to fall by a quarter of a percentage point to 3.85 per cent in May.

ANZ, Barrenjoey, and HSBC brought forward their timing after the US president unveiled aggressive tariffs on trading partners last week, triggering a global rout in equities.

Such was the mood that ANZ’s head of Australian economics, Adam Boyton, refused to rule a 50 basis point cut next month, while other economists predicted the Reserve Bank of Australia would cut rates faster than previously thought.

“It was a game changer and the direction is clear,” said Jonathan Kearns, chief economist at Challenger and a former executive of the RBA. “This is both contractionary for growth and reduces inflation as more goods will be directed to Australia at cheaper prices.”

…But not everyone agreed. Warren Hogan, chief economist at Judo Bank, said the immediate threat from Trump’s sweeping tariffs was higher inflation, not a global economic downturn. A pick-up in prices, he warned, could force central banks to raise interest rates.

Yada, yada, yada.

The only two economists who deserve a pat on the back are Andrew Boak at Goldman and Gareth Aird at CBA, who have been calling four cuts this year for ages.

The AFR itself has been a hawkish disaster. What would you expect from a rotten fish head?

Moreover, next year will be the same again as the terms of trade crash accelerates in bulk commodities and gas.

Will the RBA go 50bps in May? Sure, if the market meltdown continues into a global economic shock. Which is the base case.

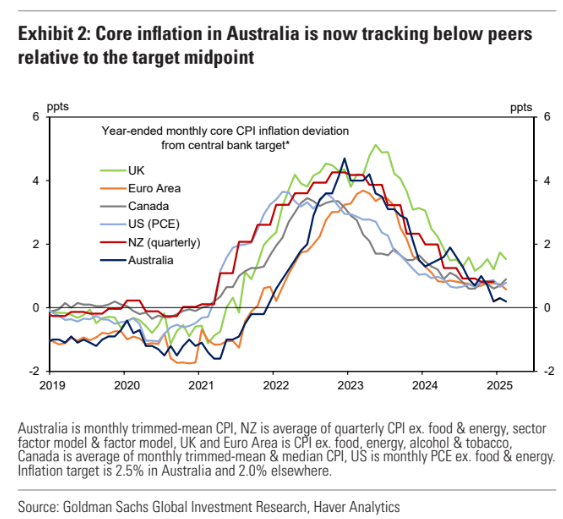

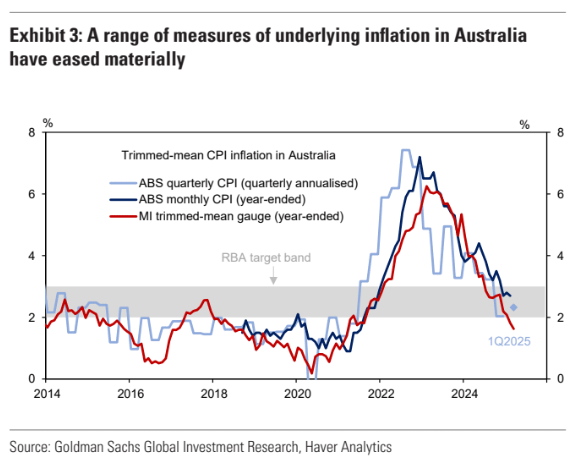

The Lunatic RBA has overshot its target and stupidly starved the pig before market day.

Australia’s immigration-led, labour market expansion economic model does not do inflation.

Since the RBA cannot mention “immigration,” it is always too hawkish, leading to rates being lower for longer.

Followed by a new and improved governor.

Rinse and repeat.