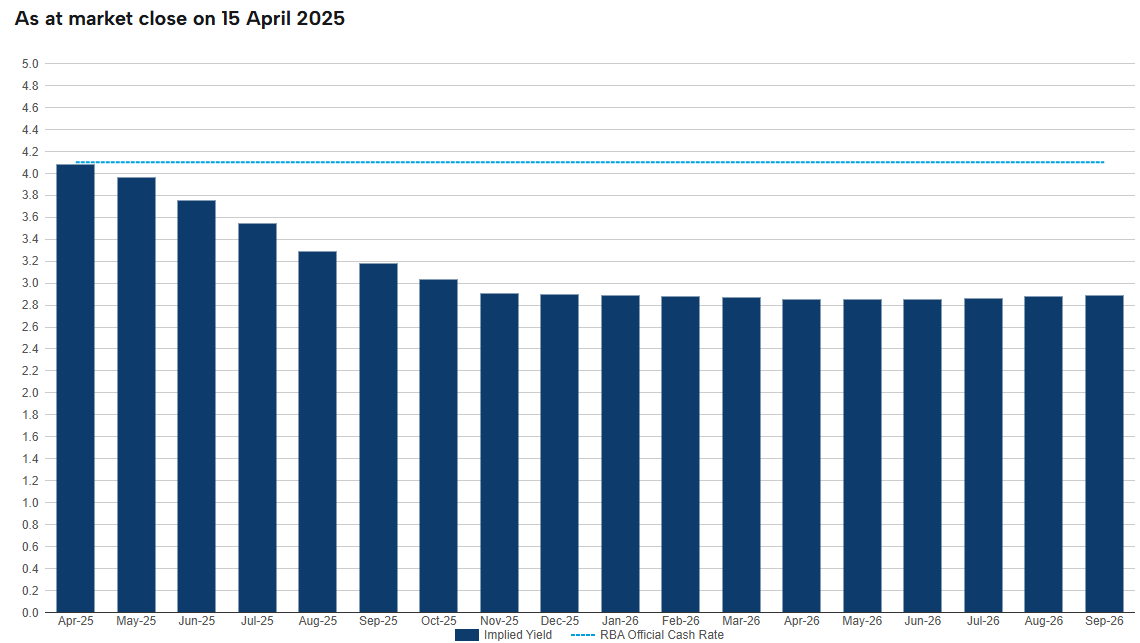

The latest pricing from the interest rate futures market has the official cash rate falling to 2.9% by year’s end, suggesting another five 0.25% rate cuts this calendar year.

The minutes from the latest Reserve Bank of Australia (RBA) board meeting cautioned that Australia’s $11.3 trillion housing market could be at risk if a series of rate cuts results in households taking on excessive debt, higher home prices, and weaker lending standards.

“Historical experience both in Australia and abroad suggested that periods of lower interest rates can coincide with riskier borrowing activity, a rapid increase in house prices and, at times, a relaxation of lending standards”, the minutes read.

“Members noted that the RBA and other regulators were attentive to vulnerabilities that might build in the financial system if households responded to an actual or anticipated easing in financial conditions by taking on excessive debt”.

“Historically, borrowing by investors had been particularly sensitive to changes in conditions in the mortgage market. The potential for this activity to amplify the credit and housing market cycle would be monitored closely”, the RBA minutes warned.

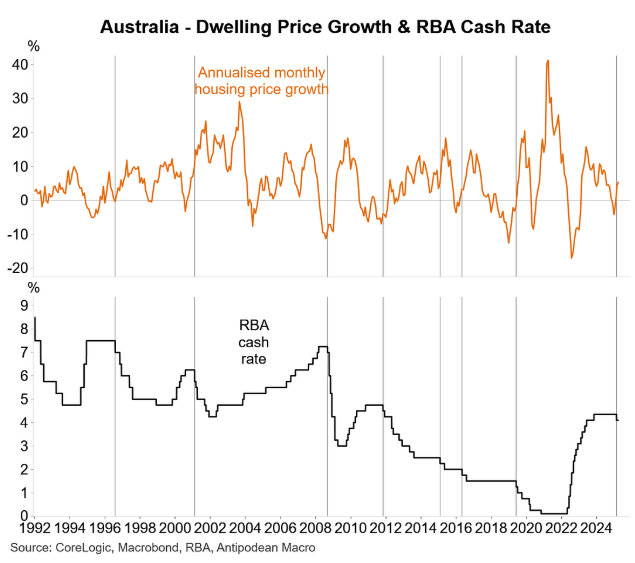

The following chart from Justin Fabo from Antipodean Macro shows that home values typically rise whenever interest rates are cut.

This reflects the increased borrowing capacity and lower repayments that arise from rate cuts.

The situation is especially concerning this time around.

The Albanese government has promised two measures that risk further turbo-charging borrowing capacity, buyer demand, and home prices.

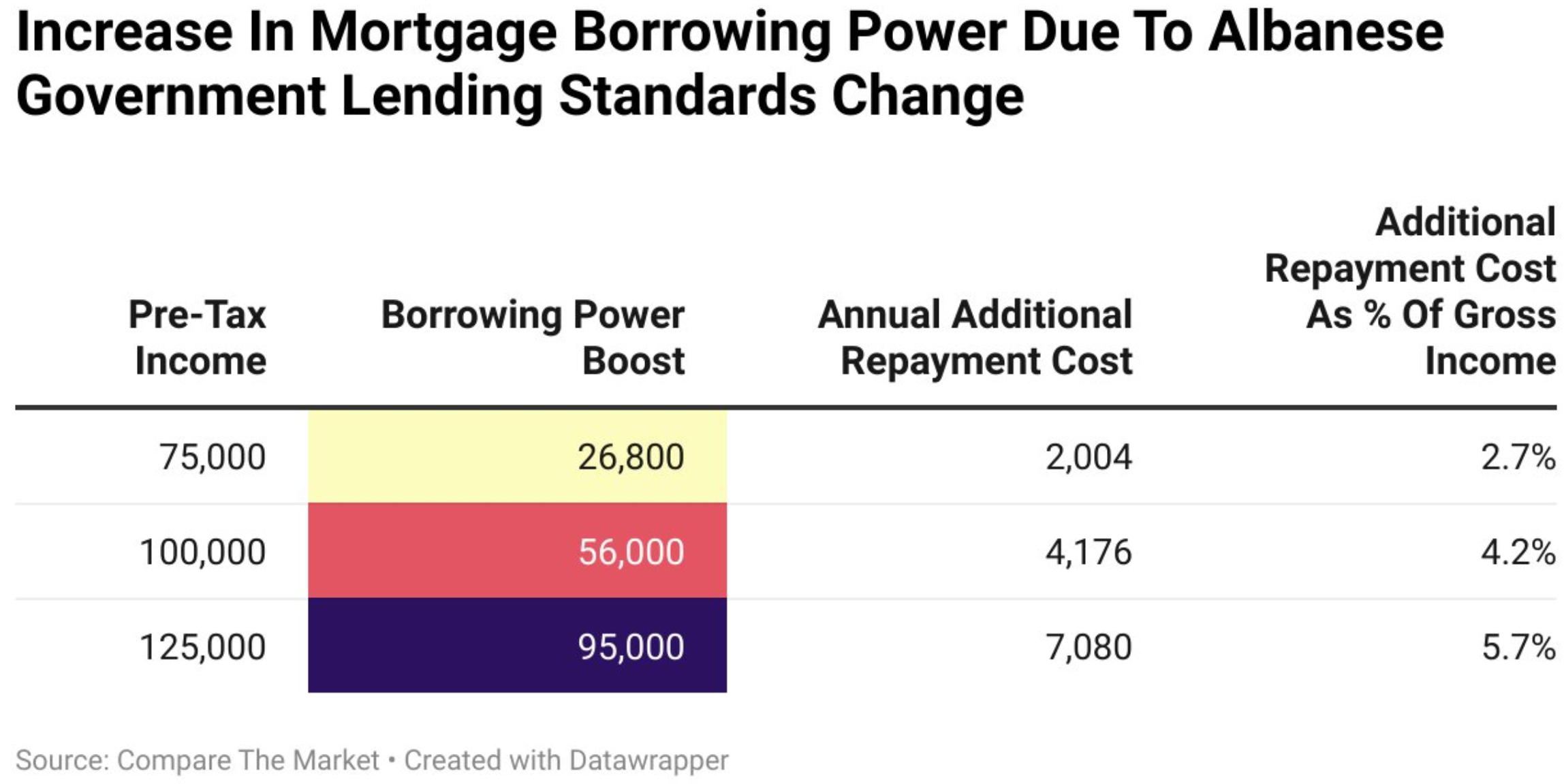

First, Labor announced that mortgage lenders would no longer need to consider student debts in mortgage serviceability calculations.

As illustrated below, Compare the Market estimated that a graduate homebuyer with a pre-tax income of $75,000 would be able to borrow $26,800 more under the lending standards change, whereas a homebuyer with a $125,000 pre-tax income would be able to borrow $95,000 extra.

Second, Labor announced last weekend that all first home buyers would be able to purchase a home with only a 5% deposit, with the government (taxpayers) guaranteeing 15% of the borrowers’ mortgage.

This announcement will dramatically increase borrowing capacity and pull more buyers into the market.

Combined with the projected lower official cash rate, Labor’s announced changes risk dramatically increasing household mortgage debt and home prices.

The RBA should be very concerned about housing market and financial stability risks.