The Australian Energy Market Operator (AEMO) does not mince words.

GPG plays a critical function in supporting the reliable and secure operation of the power system. When coal generation and/or renewable generation output is low, it is often the role of gas-powered facilities to increase output to firm available electricity supplies. Analysis from the 2024 Integrated System Plan (ISP) reinforces the important role GPG is forecast to play in the NEM by helping manage extended periods of low variable renewable energy (VRE) generation, providing firming support when other dispatchable sources are unavailable, and continuing to support grid security and stability as the coal generation fleet retires in the NEM.

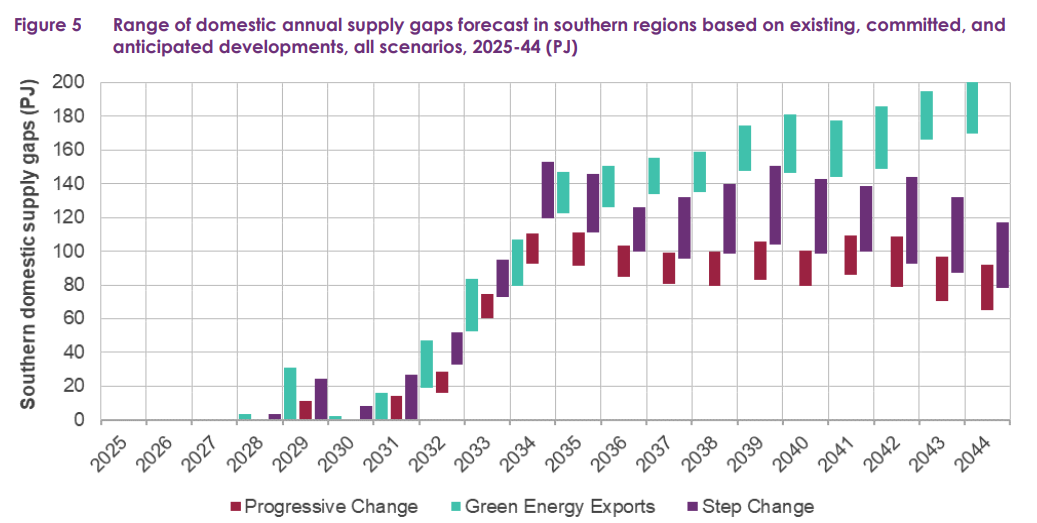

The amount of gas needed will decline over time, but it remains the critical backup generation to renewables for many years, perhaps forever.

So, we need gas for the energy transition. Sure, it is a fossil fuel, but it is cleaner than coal, and because it burns so intermittently, it has low carbon output.

Eventually, there may be enough power storage to dispense with it entirely, but this prospect is distant.

Even The Greens acknowledge this is their embrace of gas reservation. Their resistance to LNG exports is based upon the carbon impacts of shipping gas (fugitive emissions).

So, if we are to electrify everything to decarbonise, for several generations at least, Australia will still need gas, which, thankfully, we have heaps of.

We always knew this. This was the plan. To use gas as the “transitional fuel” to back up renewables while storage technology is developed.

All that went wrong with the plan is that a group of greedy oil executives decided to steal East Coast reserves on behalf of China and Japan.

That is what Peter Dutton’s gas reservation plan aims to reverse. The plan to force an extra percentage above domestic demand into the local market using massive fines looks workable to me.

Unless you are sponsored by the gas cartel. In that event, anything that damages its future looks troubled to you. Enter the Grattan Institute’s Tony Wood, granddaddy of gas cartel destruction. The Guardian.

The current market mechanisms, notably the Australian domestic gas security mechanism, introduced in July 2017 by the then prime minister, Malcom Turnbull, have ensured that the east coast has not run out of gas. If producers do not voluntarily provide sufficient gas to meet any shortfall, the federal minister for resources can limit or prohibit exports. So far this has not been necessary.

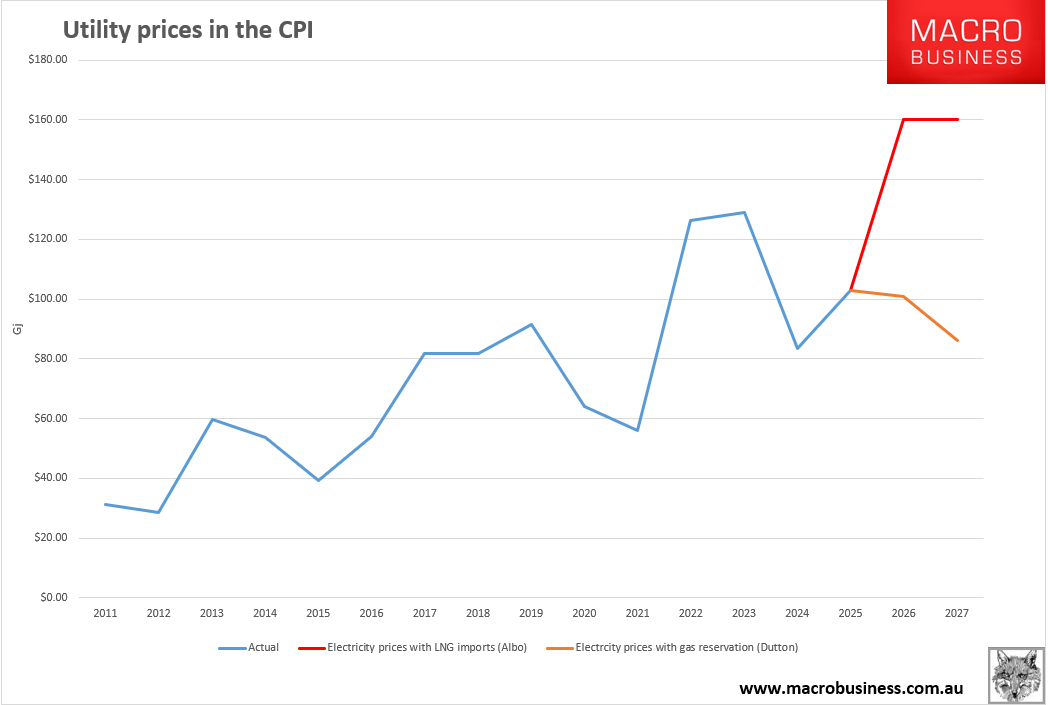

The depletion of gas resources on the east coast was always going to lead to higher prices. The war in Ukraine then dramatically lifted global LNG prices, with domestic wholesale prices reaching almost $30 a gigajoule. The Albanese government introduced a $12 price cap in December 2022. The impact has been limited by the way the price cap is managed, with the result that average producer prices in late 2024 were about $14 a gigajoule.

If the ADGSM has worked so well, why have prices gone from $3Gj to $14Gj, skyrocketing electricity prices and triggering demand destruction? Especially in industry?

This is not a good thing. It is the export of Australian manufacturing to China. No emissions reduction, just a nation more vulnerable.

Nor were gas prices “always going to rise”. That was a choice, recommended by Tony Wood at The Grattan Institute when he told us all how bad gas reservation was in 2013:

“With more than $160 billion forecast to be invested in LNG production, the export industry is good for the economy. Governments should therefore resist self-interested calls from some industries to reserve gas or cap prices for the domestic market”.

“One reason that reserving gas is a bad idea is that there is no shortage of gas. The challenge is to ensure that the gas gets delivered to where it is required, and this means commercial buyers and sellers need to reach commercial terms on new arrangements”.

“Capping prices for the domestic gas market is a very bad idea. It amounts to a tax on producers and a subsidy for domestic gas users. Protectionism of this sort may provide some short-term price relief for targeted industries, but it tends to mean inefficient businesses and less investment”.

“Ultimately it leads to higher prices and damages the economy for us all”.

Wood also demanded the removal of WA’s wildly successful gas reservation scheme, which, thankfully, it ignored and has been laughing ever since.

Now he wants LNG imports, even though they will be catastrophic for energy prices as energy rebates are pulled off.

Following the Grattan Institute’s advice has so far cost Australia hundreds of billions in extra energy costs, plunging living standards, five prime ministers and a constantly troubled energy transition.

We are going to need gas to transition our energy grid. The question is, how much do you want to pay for it?