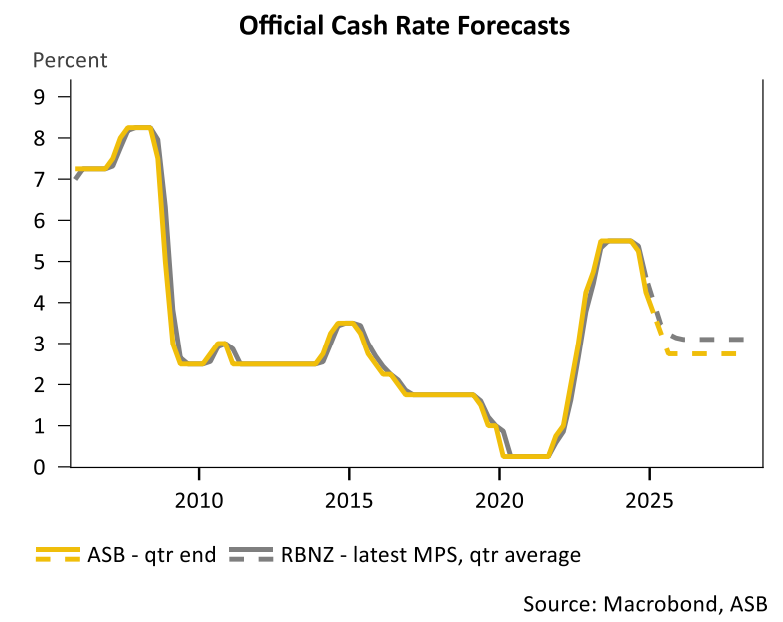

This week saw the Reserve Bank of New Zealand cut the official cash rate (OCR) by 0.25% to 3.50%, as widely expected. The reduction means the OCR has now fallen by 2.0% from its peak of 5.50%.

Curiously, the Reserve Bank’s commentary attached to its decision was not as dovish as expected.

“Most members” saw the balance of risks being lower inflation, while others saw higher uncertainty but still thought the risks were still “balanced”.

Trade war aside, the Reserve Bank board saw domestic events evolving largely in line with its February forecasts, although the mix of growth has changed.

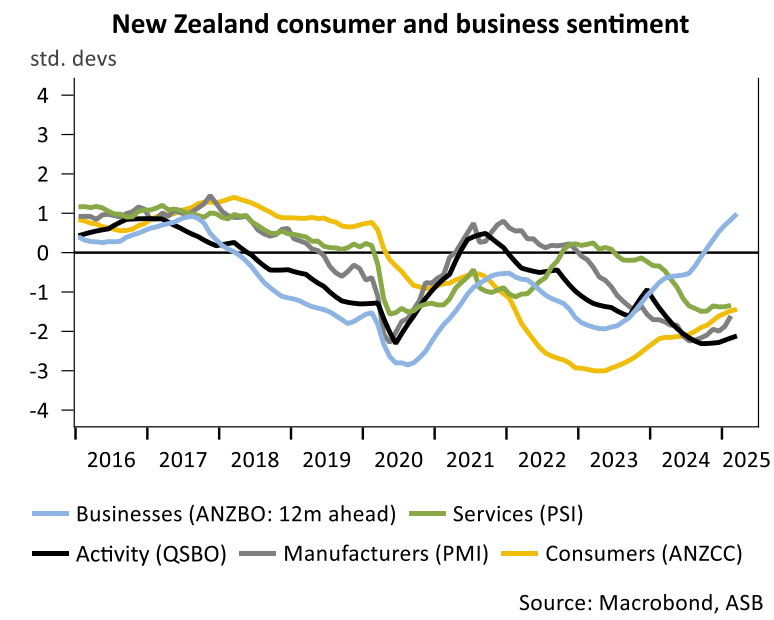

Q4 2024 GDP showed strong export growth but weaker-than-expected domestic demand. The latter suggests that interest rate reductions may not be as stimulatory as expected.

Inflation pressures also remain muted, which facilitates further OCR reductions.

Major bank ASB believes that the trade war has tilted risks to the downside, necessitating deeper OCR cuts from the Reserve Bank.

Of most concern, China and the US have imposed substantially higher tariffs on each other, significantly increasing the levels of economic pain they will inflict on each other if these tariffs remain.

Source: DFAT

China is New Zealand’s largest export market (26.6% share in 2023), whereas the US is its third biggest export destination (12.2% share).

As a result, there is now the potential for larger impacts on New Zealand’s economy.

ASB, therefore, has lowered its OCR projection for New Zealand from 3.25% to 2.75%, with the risk that rates go lower.

“The balance of risks around the medium-term inflation outlook has tilted more noticeably down this week”, ASB wrote. “The key risk is the fast-developing tariff war, in which NZ’s two biggest export markets are escalating their battle”.

“We expect the RBNZ’s assessment will tilt to a greater degree of downward pressure on inflation over the medium term, leading to more monetary easing”.

“We expect the RBNZ will cut by 25bp moves over the May, July and August policy meetings at which the OCR hits 2.75%. Exactly how far the OCR eventually falls will be heavily influenced by the global outlook (which continues to deteriorate) and the eventual impacts on NZ”.

“The bigger the hit to NZ inflation pressures, the further the RBNZ will potentially cut the OCR. We can see scenarios in which the OCR ends the year even lower than 2.75%, ASB wrote.