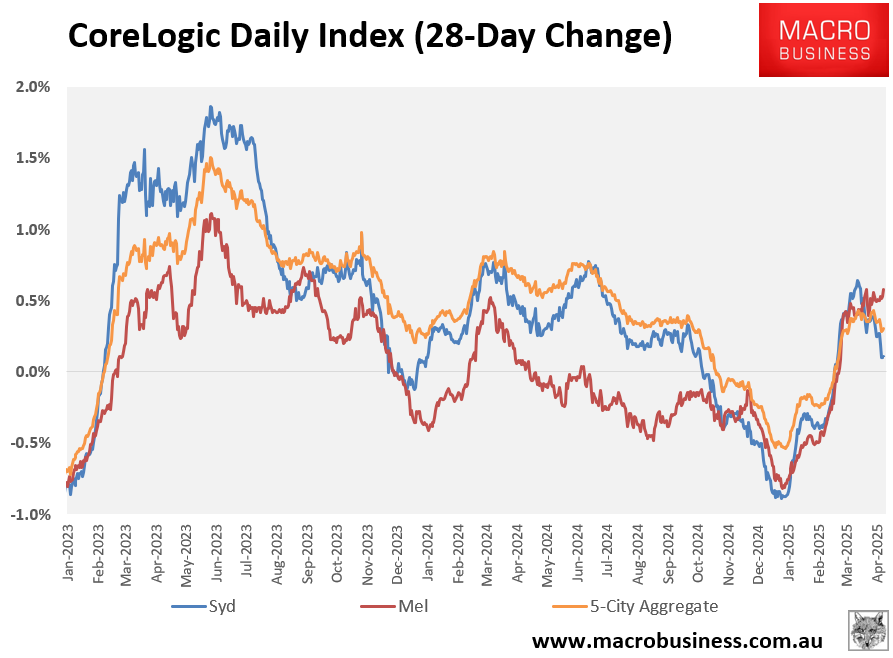

Sydney’s housing market is losing momentum.

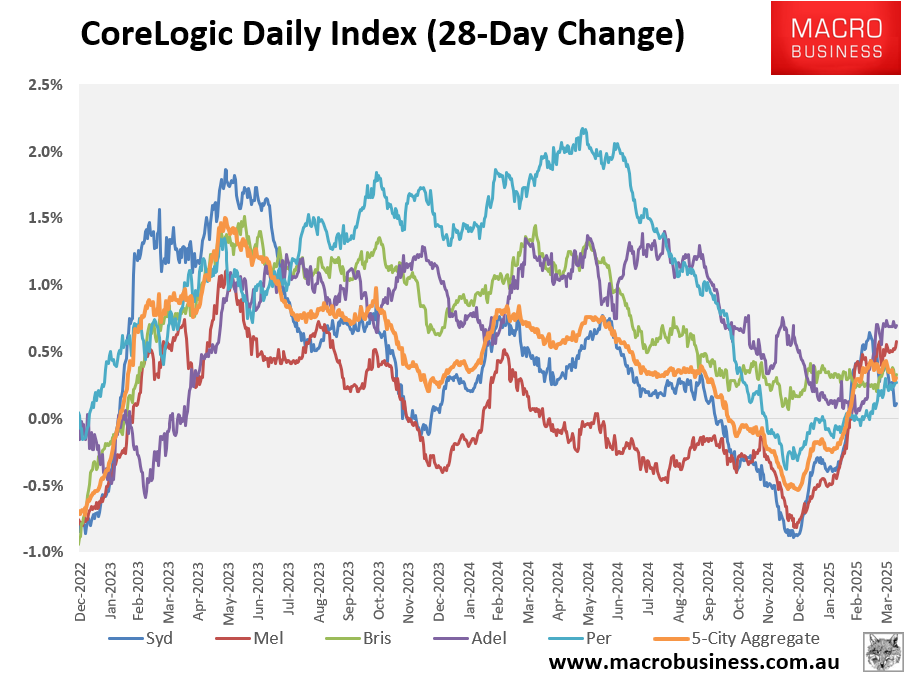

CoreLogic’s daily dwelling values index shows that Sydney recorded only a 0.1% rise in the past 28 days, the softest result across the five main capital city markets.

Sydney’s 0.1% rise in values compares to 0.6% growth in Melbourne, 0.3% in Brisbane, 0.7% in Adelaide, 0.3% in Perth, and 0.3% at the combined 5-city aggregate level.

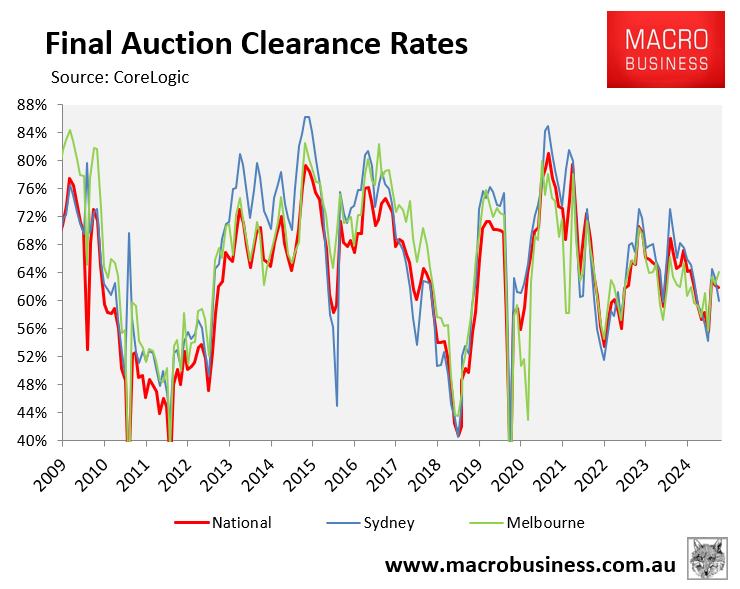

Sydney’s auction market has also stalled.

At 59.9% last week, Sydney’s final auction clearance rate remained below 60% for the second consecutive week and was well below Melbourne’s (64.1%) and the combined capital cities (61.8%).

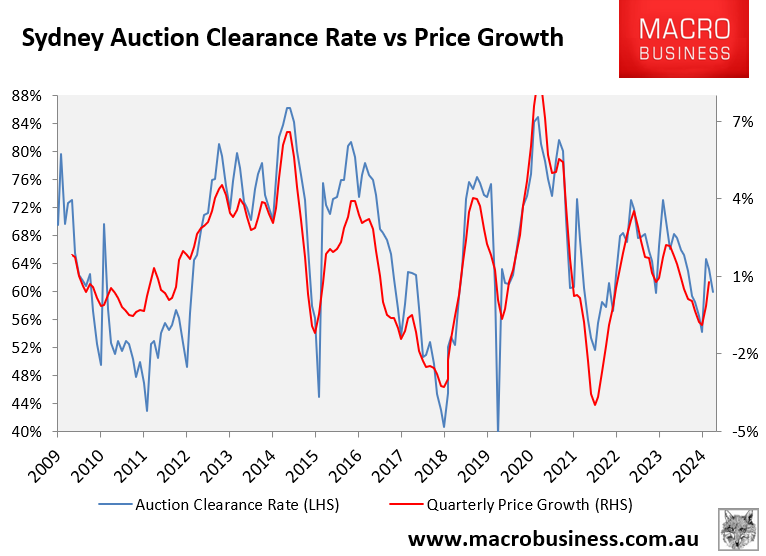

As illustrated in the next chart, the decline in the auction clearance rates portends further price softness.

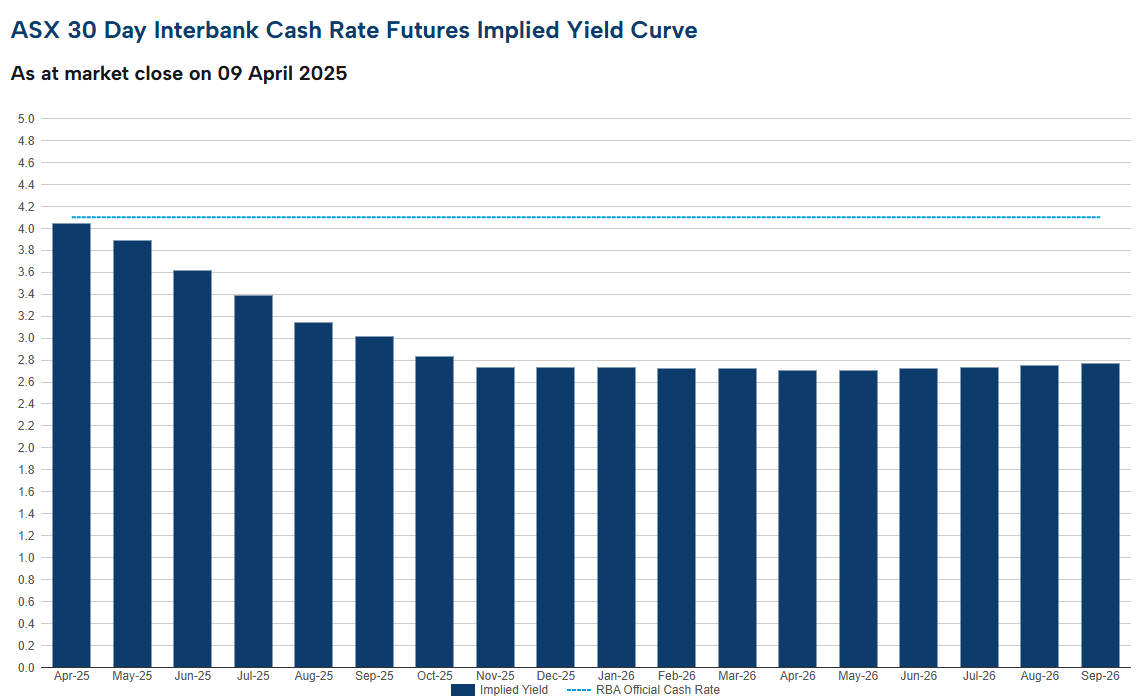

The weakness could be short-lived, however, with financial markets tipping five interest rate cuts from the RBA over the remainder of the year.

If the market’s prediction came to fruition, the official cash rate would fall to 2.85% by year’s end versus 4.10% currently.

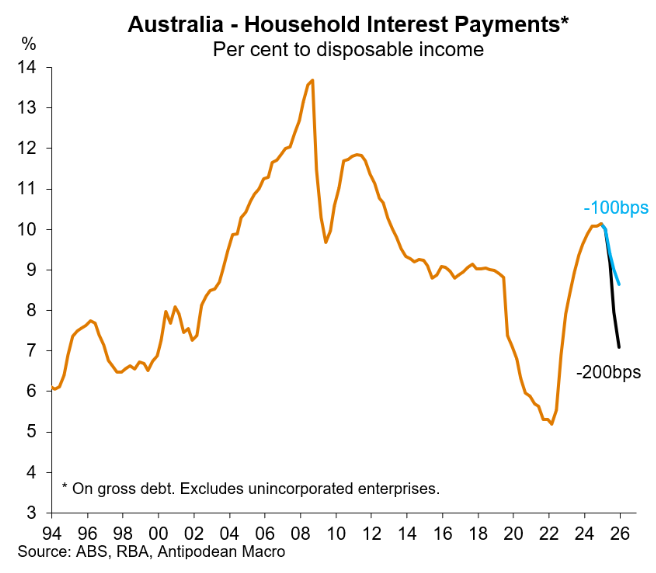

Such deep interest rate cuts would significantly improve mortgage affordability and borrowing capacity and would be bullish for house prices.