JPM kicks us off.

- Country-Level: we look at Australia, Japan, and the UK as being relative safety havens. China may work, too, given the potential to add fiscal stimulus but that is a lower conviction long.

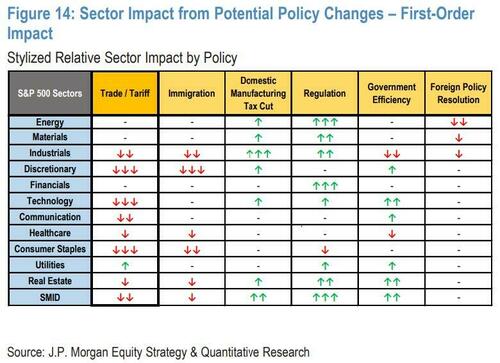

- US Sector Level: Energy and Utilities (ex-AI plays) are the two best longs and look for Lower-Income Discretionary and higher beta TMT plays as being among the more consensus shorts. Separately, parts of Fins (GSIBs, Insurance, Payment Processors) could be safety havens.

- FICC: Look for Credit to outperform Equities on the move lower. We like precious metals, crude, and natgas as longs.

CLIENT Q&A: The following includes Q&A from recent conversations between JPMorgan’s Andrew Tyler and their US and International clients as the world is focused on the April 2nd tariff announcement.

Advertisement