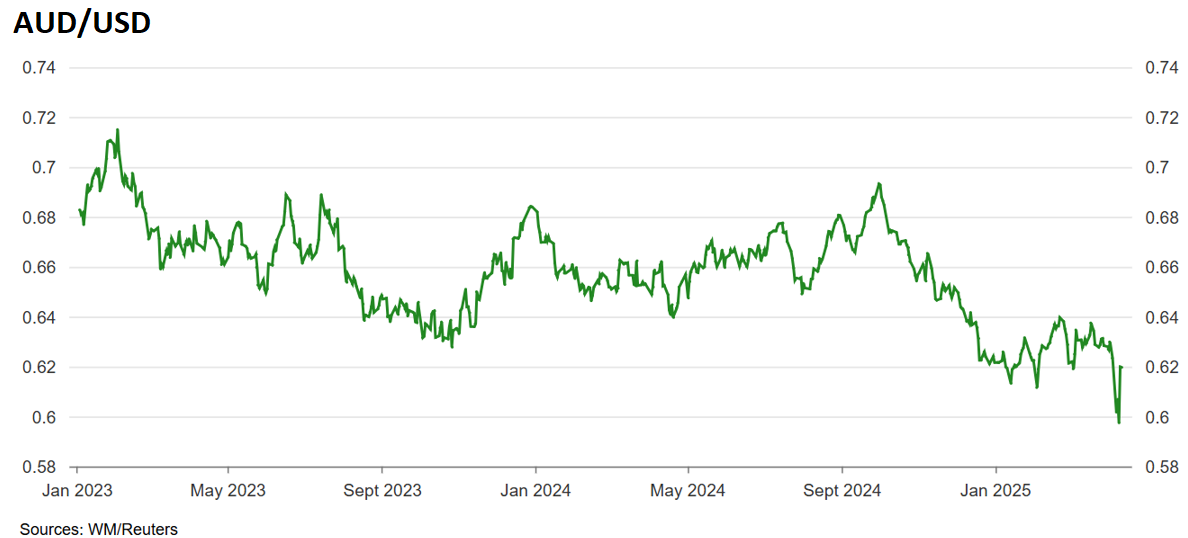

The Trump administration’s “Liberation Day” tariffs have inflicted pain on the Australian dollar.

At the close of business Friday, the Australian dollar was trading at just under 62 US cents, up from its multi-year low of 59.75 cents.

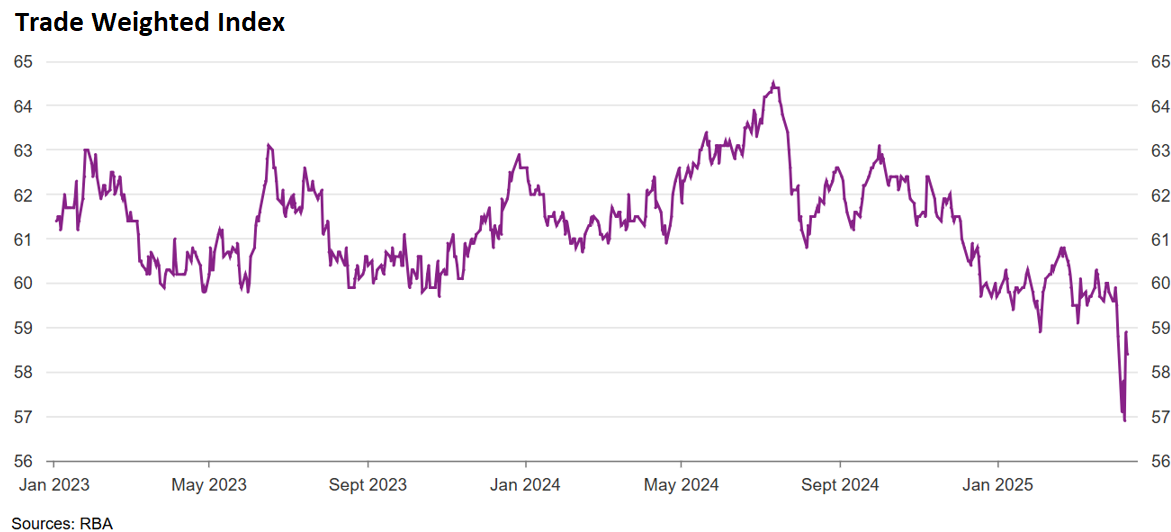

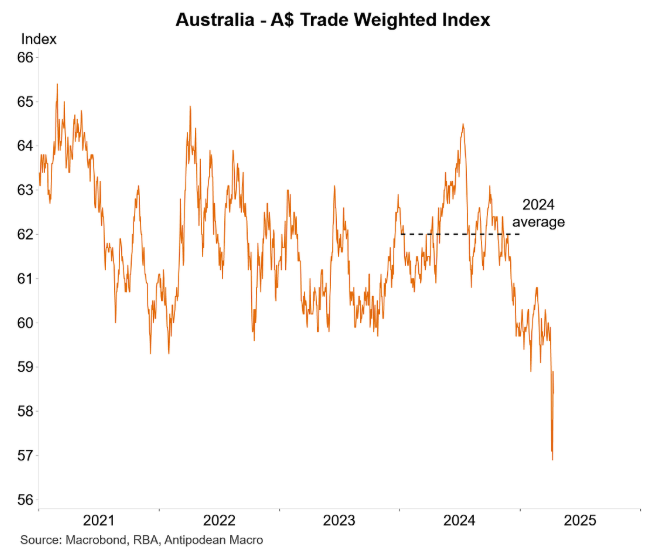

The trade-weighted index (TWI), which measures the value of the Australian dollar relative to its most important trading partners, sunk even lower.

As illustrated below by Justin Fabo from Antipodean Macro, at the close of business on Friday, the Australian dollar trade-weighted index was 5.8% below the 2024 average.

The Australian dollar TWI is heavily impacted by China, with the Chinese renminbi comprising a 29.5% share of the TWI, well above the second-placed US dollar (11.3%) and the third-placed Japanese Yen (10.1%).

As a result, the Trump administration’s brutal 145% tariffs levied on China (with the exception of electronics such as smartphones and computers) have had an oversized impact on the Australian dollar.

The slump in the Australian dollar is particularly troubling news for Australians hoping to travel abroad, who will now have significantly less purchasing power.

For example, the Australian Bureau of Statistics reported on Friday that short-term trips to Japan were up 35% year over year in February 2025.

However, the Australian dollar has depreciated by around 7% against the Japanese yen since the Trump administration’s Liberation Day tariffs were announced on 2 April.

If you are like me and have booked your first overseas trip in 13 years to Japan, it is a painful blow.