The Trump administration’s “Liberation Day” retaliatory tariffs have slapped tariffs of 10% to 48% on US trading partners.

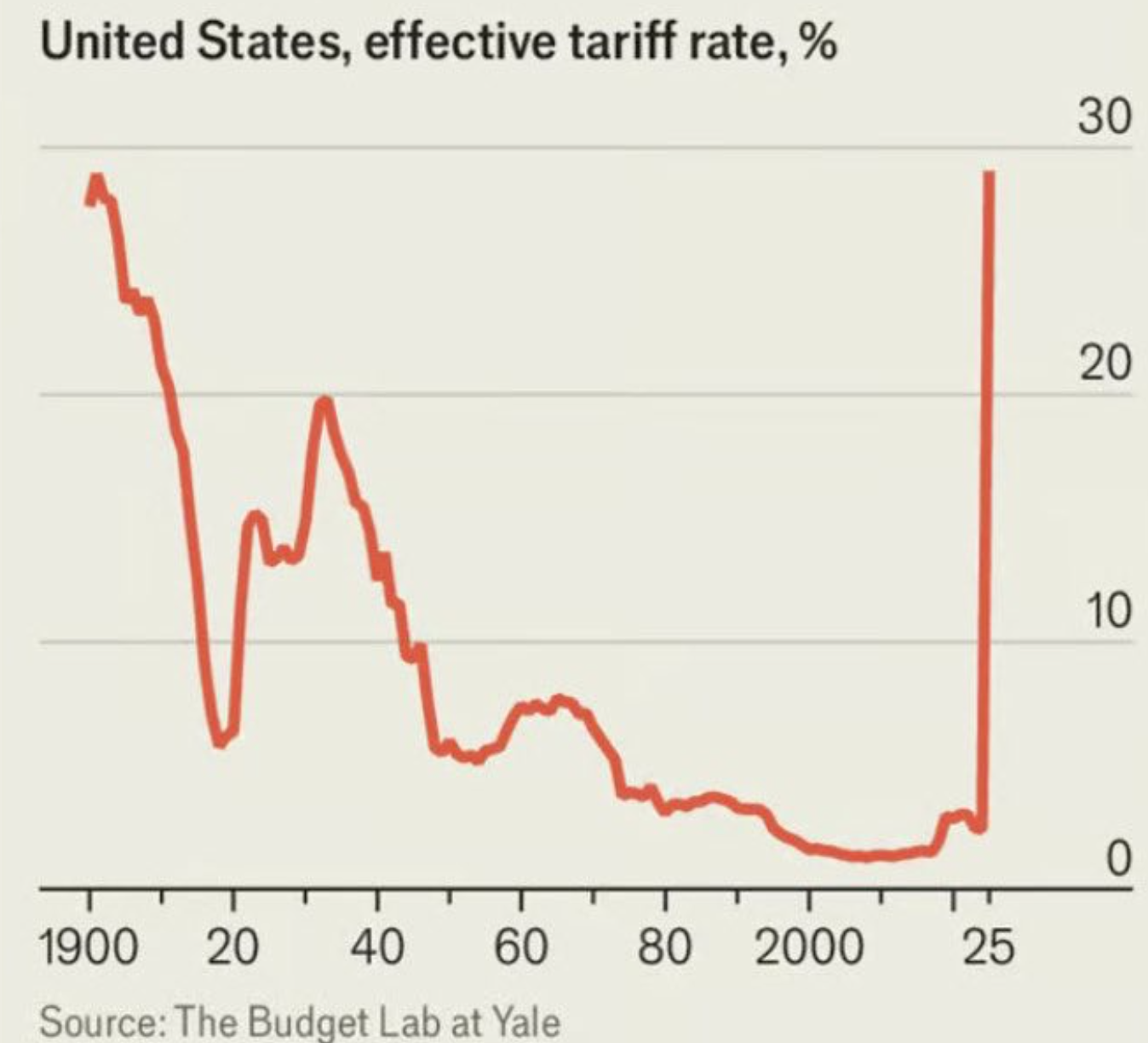

The tariffs are expected to drive the US’ effective tariff rate to its highest level in more than a century.

Global stock markets fell sharply following the announcement of tariffs on Wednesday, US time.

The US markets suffered significant losses, with the S&P 500 losing an astonishing $5 trillion in two days. This was worse than the loss at the beginning of the COVID-19 pandemic in March 2020.

Locally, the ASX 200 fell 0.9% on Thursday and 2.4% on Friday. Over the week, the ASX 200 fell by 3.9%—the largest decline in two years.

Australians are said to have lost an estimated $90 billion from their superannuation funds in the share market rout.

“Markets have delivered their verdict, and it is a brutal one”, said Jonathan Pain, a global markets commentator, who runs JP Consulting.

“The effect of the global shock is also already impacting local household wealth through a high exposure to global equities via households’ superannuation savings”, said HSBC chief economist Paul Bloxham.

Following Friday’s sharp drop on Wall Street, the Australian share market is expected to tumble further today.

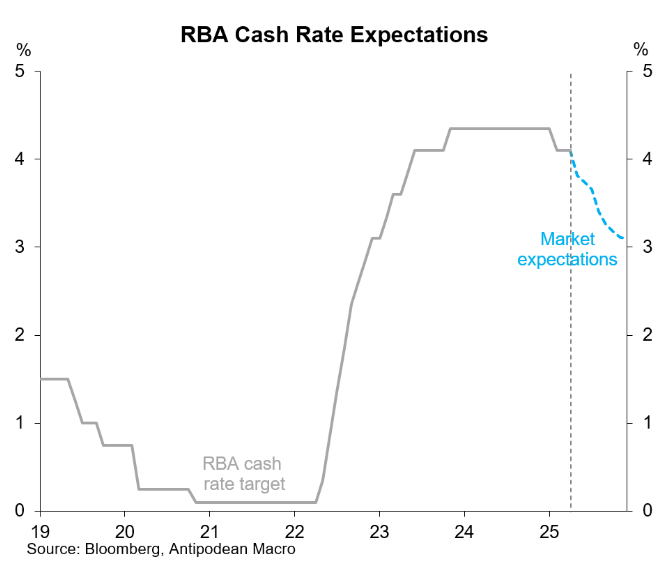

The Trump administration’s tariffs have already resulted in futures markets downgrading their interest rate forecasts for Australia, with another 100 basis points of cuts now expected by the end of this year.

The Reserve Bank of Australia (RBA) is expected to cut for three main reasons.

First, global economic growth is expected to slow, although the extent of slowing will depend on whether countries respond with retaliatory tariffs.

Second, trillions in wealth have been wiped out by the financial market meltdown.

“On the information we have to hand, the market reaction and past RBA responses to global shocks, more aggressive RBA easing now seems more likely than not”, the ANZ economics team said.

“Indeed, we would not rule out a 50 basis point cut in May, if sentiment sours and the global growth outlook deteriorates sufficiently”.

Finally, Australia is expected to be dumped with cheaper goods from Asia amid less consumer demand in the US, which will lower imported goods inflation.

On this last point, HSBC chief economist Paul Bloxham noted the following:

“A key mechanism is trade diversion, as rising trade barriers to manufactured exports from Asia to the US could lead to more cheap goods exported to Australia, which is likely to put downward pressure on imported goods inflation in Australia”, Bloxham said.

“We see the RBA cutting by 25 basis points at its next meeting in May and following this up with three more cuts over subsequent quarters, taking the cash rate to 3.1% by early 2026”.

Goldman Sachs chief economist Andrew Boak agrees.

“We expect downward revisions to both growth and inflation will catalyse a materially dovish pivot at the RBA over the coming weeks”, Boak said.

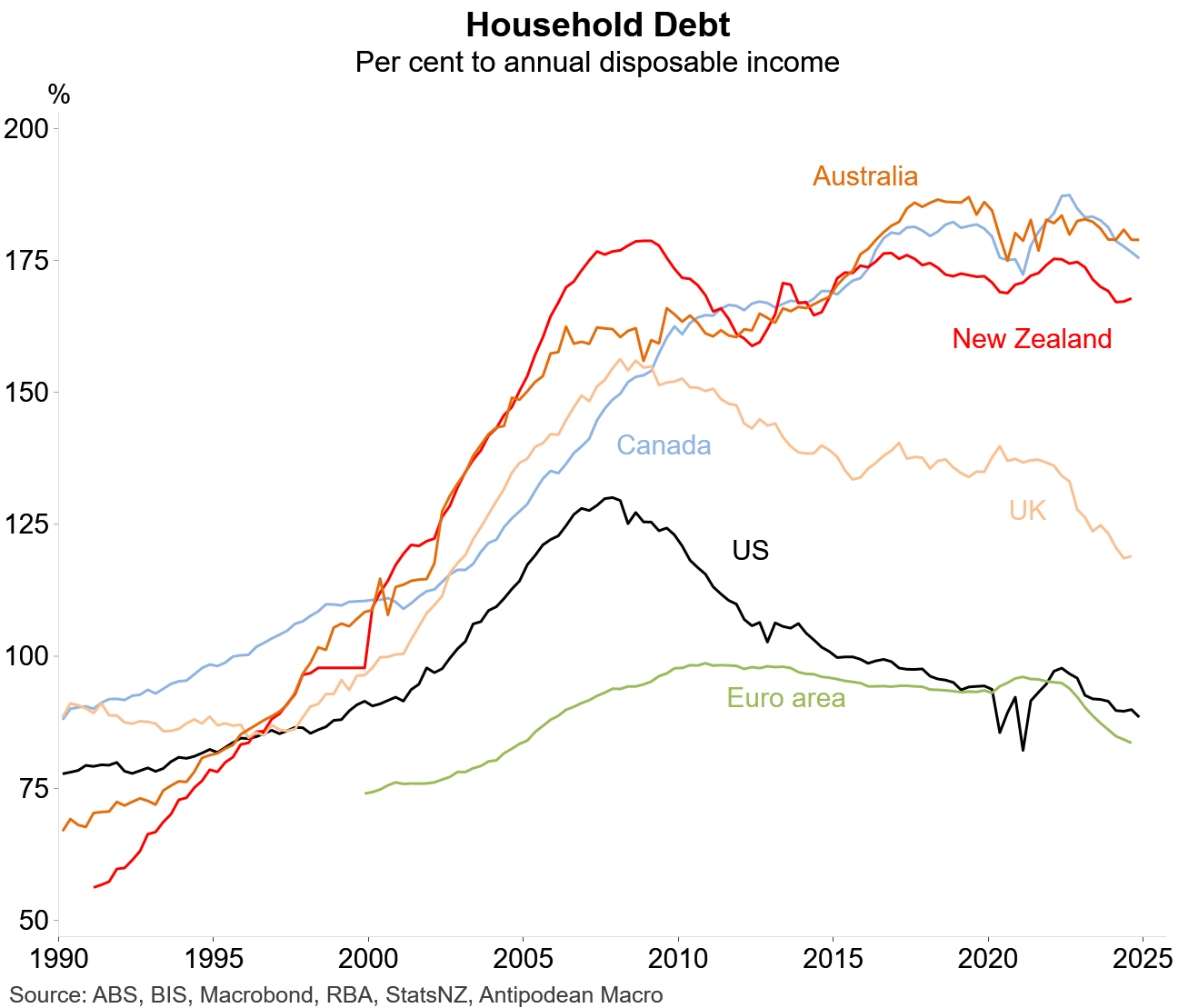

The prospect of deeper interest rate cuts would be music to the ears of Australians carrying large mortgages.

However, lower interest rates and share market volatility are also likely to see a ‘flight to property’, which would drive another house price boom.

Such an outcome would be detrimental for structural housing affordability, which is already tracking near record low levels.