An oft-repeated mantra from the Trump regime is that tariffs in Trump’s first term barely affected inflation. Which is true.

But the inflation environment was very different. The latest inflation data was out at the end of last week, and while it may have beaten expectations, it is not the type of inflation numbers that you would want to see before one of the largest tariff increases ever.

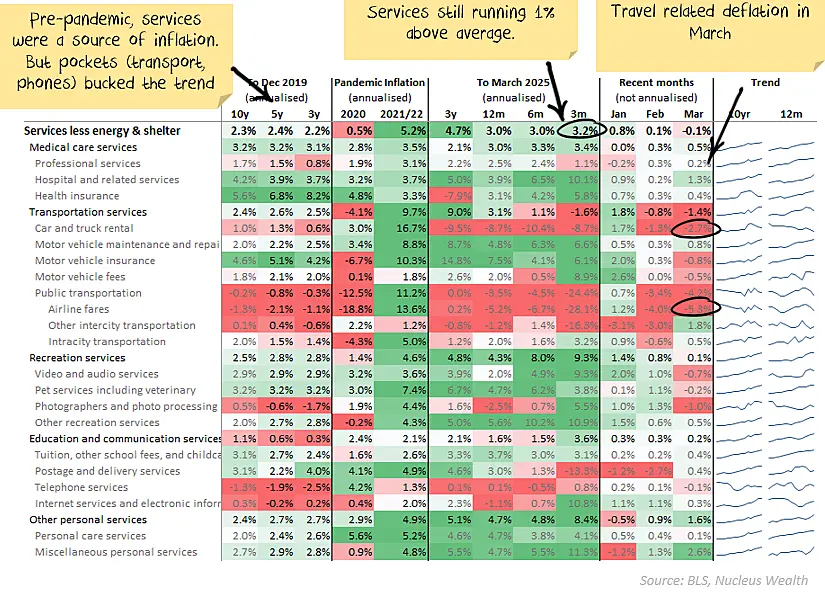

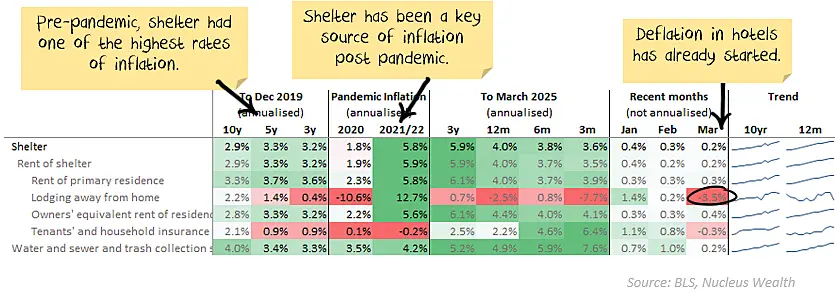

The other highlight: the below-expected services inflation was largely driven by a large decline in travel-related services. Airlines, hotels and car rentals all saw big price falls over the month.

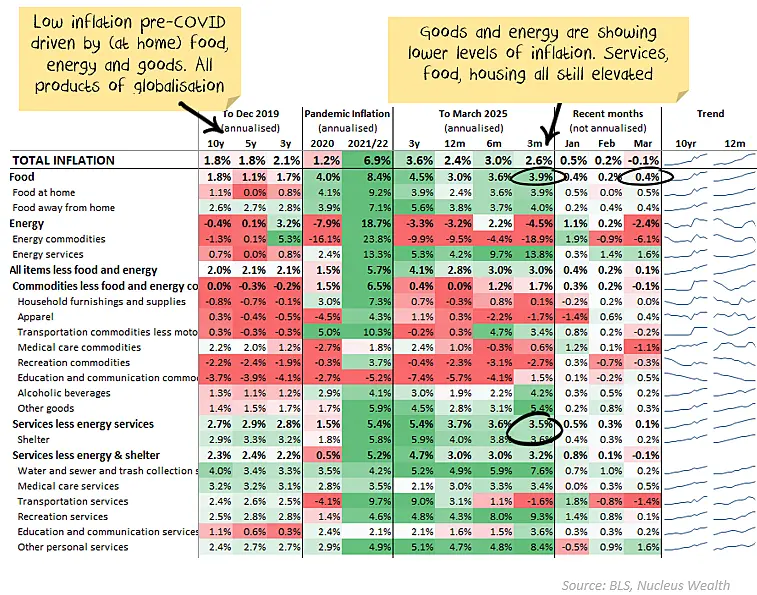

2010 – 2020 US Inflation

Central banks spent most of the 2010-2020 period cutting rates to stimulate inflation and failing.

Now, not only are we (probably) looking at higher levels of tariffs, but the US inflation environment is considerably different.

The US has an inflation target of 2%. For the decade before the pandemic, it achieved this roughly from:

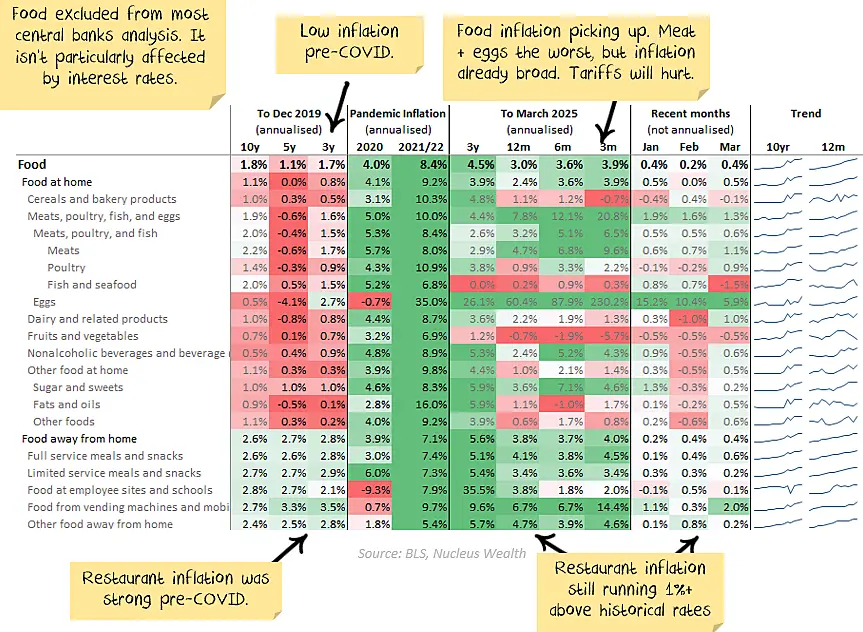

- 2% food inflation split between 1% food cost inflation and 3% inflation on packaged food and restaurants.

- 0% energy inflation

- 0% goods inflation

- 3% housing inflation

- 2.5% services inflation

Basically, anything that benefitted from more trade and globalisation (food, energy, goods) had 0-1% inflation. Anything related to services had 2.5-3% inflation.

Latest US Inflation: high level

Broadly we are looking at:

- 3-4% food inflation, similarly split between food cost inflation and packaged food/restaurants.

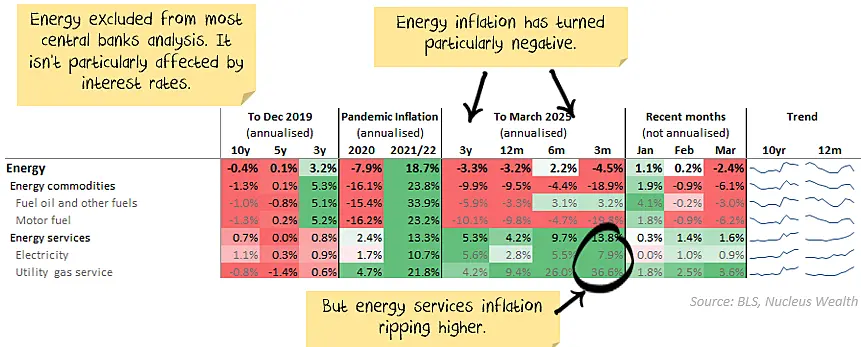

- Rampant deflation in energy commodities, rampant inflation in energy services

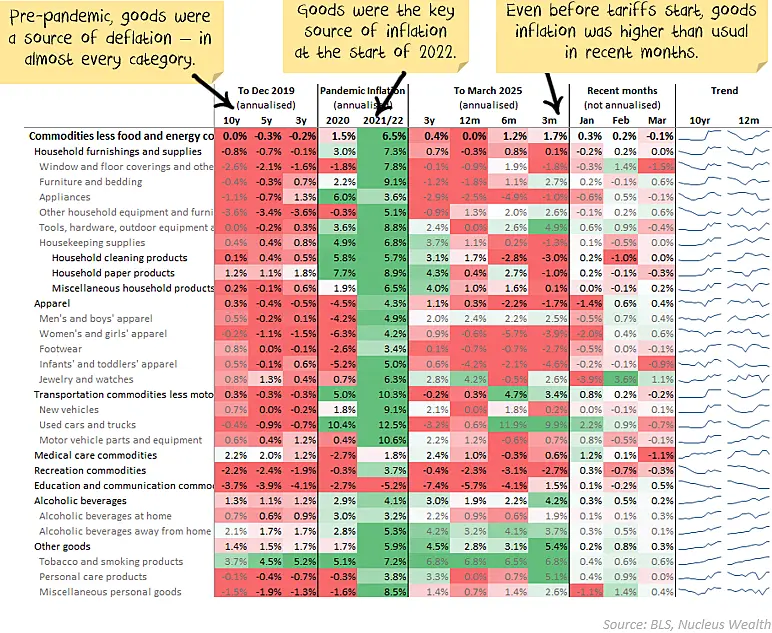

- 0% goods inflation over 12 months, but 1.7% annualised over the last 3 months

- 3-4% housing inflation, continuing to fall

- 3% services inflation, mostly higher in recent months except for a crash in travel-related prices

Latest US Inflation: detailed

————————————————-

Damien Klassen is Chief Investment Officer at the Macrobusiness Fund, which is powered by Nucleus Wealth.

Follow @DamienKlassen on Twitter or Linked In

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an Authorised Representative of Nucleus Advice Pty Limited, Australian Financial Services Licensee 515796. And Nucleus Wealth is a Corporate Authorised Representative of Nucleus Advice Pty Ltd.